After a brutal yr in 2022, the S&P 500 (SPY) ripped increased to start out the year-only to provide a lot of the features again. Utilizing a gradual hand to steer via the day by day volatility continues to be a really viable technique. 2023 is shaping up as a inventory pickers market. A easy system of taking worthwhile bullish positions in good shares AND on the identical time taking bearish positions in unhealthy shares makes extra sense than ever. One of these balanced method will doubtless proceed to outperform in what appears to be like more likely to be a tough 2023. Learn on under to seek out out extra.

Choices. Implied Volatility. Many merchants’ eyes glaze over trying to grasp what’s regarded as one thing manner too tough to ever perceive.

In actuality, although, the ideas that comprise choice buying and selling are simpler to grasp than you assume.

A stroll via of what I take into account crucial idea, implied volatility (IV), will assist show this to you.

Probably the most broadly adopted measure of implied volatility is the CBOE Volatility Index (VIX). It measures a 30-day implied volatility for the S&P 500 Index.

A lot of you might be doubtless conversant in the VIX from listening to it mentioned on the most important monetary information networks. In reality, I discuss concerning the VIX on a weekly foundation on CBOE-TV “Vol 411”.

Individuals take a look at the S&P 500 as a benchmark for a way inventory costs are typically doing. In an identical vein, choice merchants take a look at the VIX as a benchmark of how choice costs are doing.

The next VIX means costlier choices. A decrease VIX means choice costs are cheaper. So implied volatility is only a fancy method to say ”the value of the choice”.

Implied volatility will be considered the identical manner we consider insurance coverage premiums:

- Protected and regular drivers have decrease automobile insurance coverage premiums. Protected, regular, and decrease volatility shares have decrease choice premiums.

- Loopy and reckless drivers have a lot increased premiums. Wilder, increased volatility shares carry a lot increased choice premiums.

So it’s no shock that choice costs are known as choice premiums and that many portfolio managers will purchase draw back places as insurance coverage to guard their portfolios from decrease costs.

There are six elements which might be used to cost choices:

- Inventory Worth

- Strike Worth

- Expiration date

- Present Curiosity Price

- Dividends (if any)

- Implied Volatility (IV)

The primary 5 are identified. You possibly can take a look at your buying and selling display screen and see the inventory worth, strike worth, days to expiration.

Rates of interest and dividends are simply discovered by doing a google search. The one unknown is implied volatility.

As stated earlier, implied volatility is just the value of an choice. No have to do the flamboyant math or the calculations proven under to grasp IV.

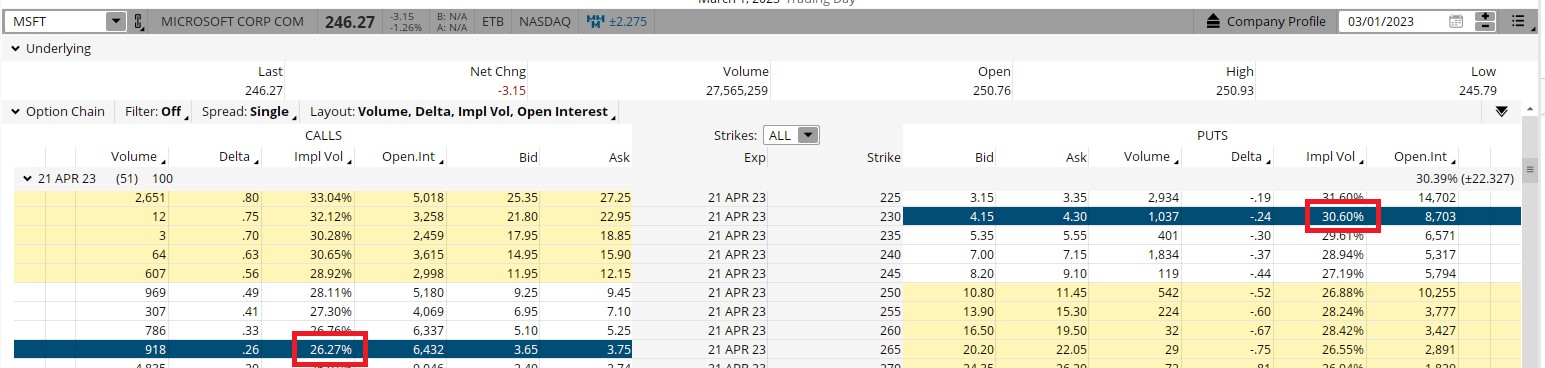

Implied volatility known as implied as a result of it’s the volatility enter wanted to match the value of the choice to the value it’s at the moment buying and selling. A take a look at Microsoft (MSFT) choices exhibits the implied volatility for the completely different strike costs.

Observe how completely different strikes of the identical expiration date – April 21 on this instance- have completely different implied volatilities. That is known as the choice skew.

An necessary takeaway is that out-of-the-money places virtually at all times commerce at the next degree of implied volatility in comparison with comparable out-of-the-money calls.

The MSFT $230 places are priced at a 30.60 IV, whereas the $265 calls are priced a lot decrease at a 26.27 IV as proven in pink.

Each choices closed about $17.50 factors out-of-the cash. Out-of-the cash refers back to the distinction between the place the inventory is buying and selling and the strike worth.

Places are out-of-the cash if the strike worth is under the present inventory worth. Calls are out-of-the cash if the strike worth is above the present inventory worth.

On this occasion, the $230 places have been $17.27 factors under the closing worth of Microsoft ($246.27-$230)-or out-of-the cash by that quantity. The $265 calls have been out-of-the cash by $17.73 factors.

The primary cause for this distinction in IV is the truth that shares are inclined to drop extra rapidly than they rise. So draw back places are extra precious than upside calls.

Implied volatility tends to be a lot increased in entrance of earnings and different company occasions. This is sensible since a probably massive transfer within the inventory worth is looming.

Implied volatility often falls following the earnings launch or firm announcement because the unknown turns into identified.

Having a greater understanding that top implied volatility means increased choice costs will be very important when contemplating potential trades. Paying the next choice worth means you want an even bigger transfer within the inventory to justify the commerce.

In my POWR Choices service I at all times do an in-depth implied volatility evaluation, together with utilizing the POWR Scores and technical evaluation as a part of the concept technology course of.

It’s simply as very important for particular person merchants to at all times take into account ranges of implied volatility when contemplating their trades as properly.

Implied Volatility as a Market Timing Software

Implied volatility can be utilized to establish potential turning factors available in the market. That is very true when implied volatility spikes to extremes.

The charts under exhibits the VIX on the highest and the S&P 500 (SPY) on the underside. Observe how the earlier spikes in VIX (highlighted in blue) in the end signaled vital short-term bottoms within the S&P 500.

Lengthy durations of low ranges within the VIX are an indication of complacency, which often are a dependable indicator of short-term market tops, as seen in purple. The latest promote sign was an indication of that.

The previous Warren Buffett adage, to be “fearful when others are grasping and grasping when others are fearful,” applies completely to this VIX market timing methodology.

Buying and selling, as we all know, is all about chance, not certainty. Understanding and utilizing implied volatility to place these possibilities in your favor generally is a precious addition to your buying and selling toolbox. In POWR Choices it is likely one of the most necessary instruments we use.

What To Do Subsequent?

Should you’re searching for the very best choices trades for right this moment’s market, you need to positively try this key presentation Learn how to Commerce Choices with the POWR Scores. Right here we present you methods to constantly discover the highest choices trades, whereas minimizing danger.

Utilizing this straightforward however highly effective technique I’ve delivered a market beating +55.24% return, since November 2021, whereas most traders have been mired in heavy losses.

If that appeals to you, and also you need to be taught extra about this highly effective new choices technique, then click on under to get entry to this well timed funding presentation now:

Learn how to Commerce Choices with the POWR Scores

Right here’s to good buying and selling!

Tim Biggam

Editor, POWR Choices Publication

SPY shares rose $0.24 (+0.06%) in after-hours buying and selling Friday. Yr-to-date, SPY has gained 5.69%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Creator: Tim Biggam

Tim spent 13 years as Chief Choices Strategist at Man Securities in Chicago, 4 years as Lead Choices Strategist at ThinkorSwim and three years as a Market Maker for First Choices in Chicago. He makes common appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Community “Morning Commerce Stay”. His overriding ardour is to make the advanced world of choices extra comprehensible and subsequently extra helpful to the on a regular basis dealer.

Tim is the editor of the POWR Choices e-newsletter. Be taught extra about Tim’s background, together with hyperlinks to his most up-to-date articles.

The put up #1 Rule for Profitable Choices Buying and selling appeared first on StockNews.com