I spend a lot of my time learning and evaluating cash-back bank cards, so it takes loads for a brand new bank card to shock me. I virtually hate to confess it, however the brand new Fifth Third 1.67% Money/Again Card threw me for a loop.

Not as a result of 1.67% Money/Again has a revolutionary rewards program or gorgeous advantages lineup. That’s why I hate to confess it: the novelty is principally a gimmick, and proper there within the title of the cardboard.

You simply don’t see bank cards with a flat 1.67% cash-back price fairly often. 1.5%, positive. 2%, undoubtedly. However 1.67%? Simply what is Fifth Third considering?

I had no concept till somebody a lot better at math jogged my memory that 5 divided by 3 equals 1.67. 5/3…Fifth Third…1.67.

You get it now. Seems it’s proper there within the brand too. (And the “Money/Again” bit is in step with the slash-in-the-name factor too.) Hats off to Fifth Third’s advertising and marketing division for this one, you’re smarter than I’m.

What Is the Fifth Third 1.67% Money/Again Card?

This may shock you, however the Fifth Third 1.67% Money/Again Card is a cash-back bank card that earns limitless 1.67% money again on all eligible purchases. Gasoline, groceries, takeout, journey — all of it earns on the identical price.

You have to have a Fifth Third Momentum® Checking account to use for the 1.67% Money/Again Card. That is an inconvenience when you don’t need or want one other checking account, however Momentum Banking is fee-free and straightforward to open on-line, so it may not be a dealbreaker. If and while you improve to Fifth Third Most well-liked Banking, which has harder-to-avoid charges, you might qualify for the two% cash-back Fifth Third Most well-liked Money/Again Card.

In any other case, the 1.67% Money/Again Card is a fairly customary Mastercard. Right here’s what else it is best to know earlier than you apply.

What Units the Fifth Third 1.67% Money/Again Card Aside

The Fifth Third 1.67% Money/Again Card isn’t a revolutionary bank card, but it surely does have three uncommon or distinctive options value noting:

- Limitless 1.67% Money Again. Novelty, gimmick, no matter you need to name it — the 1.67% Money/Again Card goes the place few if any cash-back bank cards have gone earlier than it.

- Tied to a Particular Fifth Third Financial institution Account. This isn’t a superb factor in my e-book, until you’re already a Fifth Third Momentum Checking buyer. Widespread no-annual-fee cash-back bank cards typically don’t require you to have a selected checking account earlier than you apply.

- Strong Introductory Stability Switch Promotion. The 1.67% Money/Again Card has a 0% APR introductory promotion on steadiness transfers for 12 months from account opening. That’s one of many higher steadiness switch gives within the class.

Key Options of the Fifth Third 1.67% Money/Again Card

Let’s discover a very powerful options of the Fifth Third 1.67% Money/Again Card in additional element.

Incomes Money Again

The 1.67% Card’s rewards program couldn’t be easier. All eligible purchases earn 1.67% money again, with no caps on incomes potential and no bonus rewards classes or tiers to complicate issues. Rewards don’t expire so long as your account stays open and in good standing.

As flat cash-back charges go, 1.67% occupies a center floor between the comparatively low 1% to 1.5% price provided by many entry-level playing cards and the two% to 2.5% provided by extra beneficiant playing cards. It’s nothing particular, however not insultingly low.

Redeeming Money Again

You’ll be able to redeem money again in any quantity, at any time. One of the simplest ways to do that is by establishing automated redemptions, zeroing out your rewards steadiness every month and decreasing the time funding of redeeming to zero as effectively.

Intro Stability Switch Provide

The 1.67% Card has a 0% APR introductory supply on steadiness transfers made through the first 12 months of account opening.

You received’t pay curiosity on these transfers till the thirteenth billing cycle after your account is open. You should definitely repay any transferred balances in full through the interval although, otherwise you’ll need to pay deferred curiosity on any unpaid portion after the introductory interval ends.

There’s no corresponding promotion for purchases, so this isn’t the correct card when you’re planning to make a giant buy early on within the hopes that you simply received’t need to pay curiosity on it.

Cell Cellphone Safety

This card’s signature value-added profit is a comparatively beneficiant cellphone safety plan value as much as $1,000 per yr. The utmost per declare is $800, much less a $50 deductible, and also you’re restricted to 2 claims per yr.

The catch: It’s important to pay your cellphone invoice in full together with your 1.67% Card every month for the profit to stay in impact. If a month goes by with no cellphone invoice fee showing in your assertion, protection not applies.

Contactless Funds

Hyperlink your 1.67% Card to your cell pockets to make contactless tap-to-payments together with your cellphone wherever it’s doable. The cardboard is appropriate with Google Pay, Apple Pay, and Samsung Pay.

Vital Charges

There’s no annual payment or overseas transaction payment. The latter isn’t customary for a fundamental cash-back card, so it counts as a strong perk, particularly when you plan to journey exterior the USA.

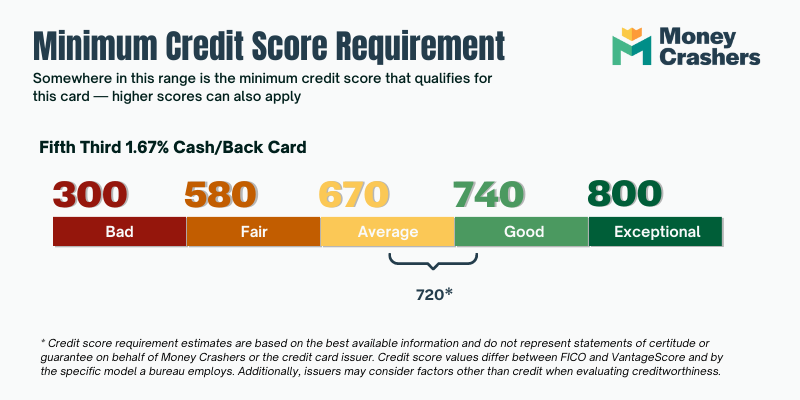

Credit score Required

The 1.67% Money/Again Card requires respectable (or higher) credit score. You’ll have bother qualifying for this card in case your FICO rating is beneath 700.

Benefits of the Fifth Third 1.67% Money/Again Card

The 1.67% Card’s brilliant spots embody its respectable cash-back price, strong steadiness switch promotion, and no annual payment.

- 1.67% on All Eligible Purchases. The title says all of it. Each buy earns 1.67%, each day, with no caps or restrictions on how a lot you’ll be able to earn.

- No Annual Charge. The 1.67% Card doesn’t cost an annual payment. That is par for the course for this kind of cash-back card, however nonetheless value noting as a bonus.

- 0% APR on Stability Transfers for 12 Months. Stability transfers made early inside 12 months of account opening don’t accrue curiosity for the whole interval, making this a strong if not spectacular steadiness switch card. Simply remember to repay transfers in full earlier than the intro interval ends or you might be on the hook for deferred curiosity.

- Simple to Redeem Money Again. You’ll be able to redeem money again in any quantity, at any time. Enroll in automated redemption to set and overlook your month-to-month redemptions.

- No International Transaction Charges. This card doesn’t cost overseas transaction charges, which is good news when you plan to journey exterior the USA or make purchases from abroad retailers.

- Comes With Complimentary Cell Cellphone Safety. Pay your cellphone invoice in full every month together with your 1.67% Money/Again Card and revel in complimentary cellphone safety value as much as $800 per declare and $1,000 per 12-month interval.

Disadvantages of the Fifth Third 1.67% Money/Again Card

The 1.67% Card has some notable drawbacks that might offer you pause. Take into account them fastidiously earlier than you apply.

- Requires a Fifth Third Financial institution Account. You have to open a Fifth Third Momentum Checking account earlier than making use of for this card. Hottest cash-back bank cards don’t require a linked checking account as a situation of approval, so it is a particular downside for individuals who aren’t already Fifth Third clients.

- No Bonus Rewards. 1.67% money again is a advantageous rewards price, however it could be good when you may do higher. And you’ll’t with this card.

- No Signal-up Bonus. This card doesn’t have a sign-up bonus both. The most effective no-annual-fee cash-back bank cards do.

- No 0% APR Buy Promotion. The 1.67% Card’s intro steadiness switch promotion doesn’t pair with a comparable buy promotion, as is commonly the case. A transparent downside when you’re planning a significant buy.

How the Fifth Third 1.67% Money/Again Card Stacks Up

Earlier than you apply for the Fifth Third 1.67% Money/Again Card, see the way it compares to a different widespread cash-back bank card: the Citi Double Money Card.

| Fifth Third 1.67% Card | Citi Double Money Card | |

| Rewards Price | 1.67% on all eligible purchases | 1% again while you make purchases + 1% again on steadiness funds |

| 0% APR Provide | 0% for 12 months on steadiness transfers, then common APR | 0% for 18 months on steadiness transfers, then common APR |

| Signal-up Bonus | None | None |

| Annual Charge | $0 | $0 |

Different Credit score Playing cards to Take into account

The Double Money and 1.67% Money/Again Playing cards aren’t the one fish within the cash-back bank card sea, after all. Take into account these alternate options as effectively.

Closing Phrase

The Fifth Third 1.67% Money/Again Card has an uncommon cash-back price and requires a selected Fifth Third checking account (Momentum Checking) to use. Past these two telltale options, there’s not loads to write down house about right here.

For me, that’s the place the dialog ends. It’s not value my time (or the hit to my credit score rating) to use for a bank card that doesn’t stand out in some ways and certainly requires me to use for a second checking account earlier than I get my fingers on it.

However had been I an current Fifth Third buyer or somebody planning to modify to Fifth Third anyway, I’d be pleased I had the choice. The 1.67% Card isn’t a horrible product — it’s simply not one to exit of your means for.