The transient’s key findings are:

- The 2023 Trustees Report confirmed a slight improve within the 75-year deficit and the depletion of the retirement belief fund moved as much as 2033.

- The prospect of a 23-percent profit reduce solely 10 years away ought to focus our consideration on restoring steadiness to this system.

- The “Lacking Belief Fund,” a results of paying extra advantages to early generations, supplies a robust case for some normal income financing.

- Staff would contribute the quantity required in a funded system, and normal revenues would compensate for the “Lacking Curiosity.”

- Thus, the historic burden can be distributed extra broadly, however the sense that staff pay for their very own advantages would stay.

Introduction

The 2023 Trustees Report barely elevated the 75-year deficit to three.61 p.c of taxable payroll, in comparison with 3.42 p.c in 2022, and moved up depletion of the Previous-Age and Survivors Insurance coverage (OASI) belief fund belongings from 2034 to 2033. Sure, the Incapacity Insurance coverage (DI) belief fund has sufficient to pay advantages for the total 75-year interval and the date of exhaustion for the mixed OASDI belief funds is 2034. However combining the 2 techniques would require a change within the legislation; therefore, underneath present legislation the related date is 2033 – a decade from now.

The truth that in 2033 Social Safety would have the ability to pay solely 77 p.c of scheduled advantages ought to focus our collective minds. Pondering of the way to revive steadiness to this system just isn’t onerous; the Social Safety Actuaries publish an annual booklet with greater than 100 potential advantages cuts or income will increase. Certainly, so much could be mentioned for sustaining a self-financed program. And if the price of at present scheduled advantages merely exceeds what at present’s staff are paying into the system, the standard proposals to scale back advantages or elevate payroll taxes can be most related.

Nonetheless, the reason for the shortfall lies elsewhere. Particularly, this system’s “pay-as-you-go” financing – apart from the latest build-up and spend-down of the present modest belief fund – makes this system look costly. This financing strategy is the results of a coverage determination within the late Nineteen Thirties to pay advantages far in extra of contributions for the early cohorts of staff. The choice basically gave away the belief fund that will have accrued and, importantly, gave away the curiosity on these contributions. The “Lacking Belief Fund” supplies a robust justification for an infusion of normal revenues into this system.

This transient updates the numbers for 2023 and emphasizes the necessity to act to keep away from draconian profit cuts. To that finish, it additionally lays out the case for spreading throughout all taxpayers – not simply at present’s staff – the burden related to making a gift of the belief fund. If policymakers accepted this rationale for a normal income infusion, the pathway to eliminating OASI’s 75-year deficit can be a lot simpler. Fixing Social Safety sooner relatively than later would distribute the burden extra equitably throughout cohorts, restore confidence within the nation’s main retirement program, and provides individuals time to regulate to wanted modifications.

The 2023 Report

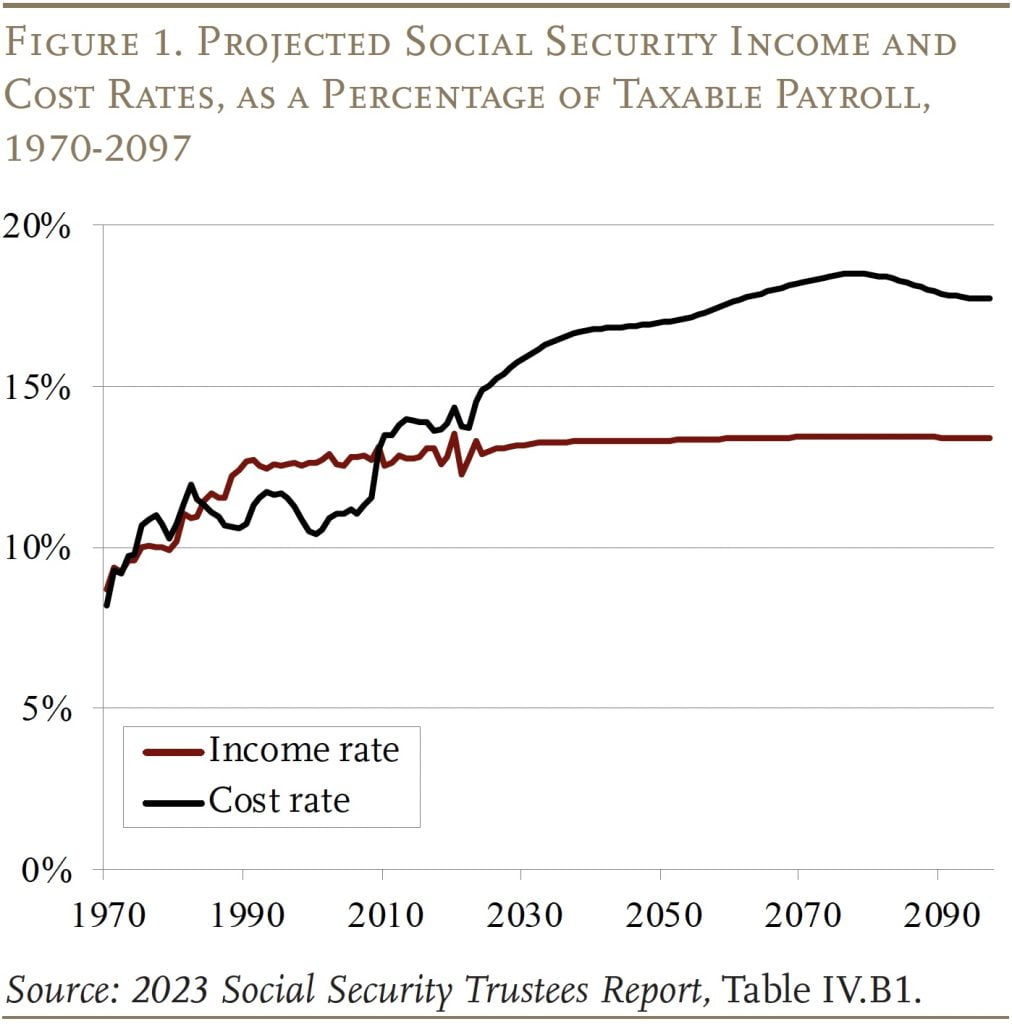

Beneath the Trustees’ intermediate assumptions, the price of the OASDI program rises quickly to about 17 p.c of taxable payrolls in 2040, drifts as much as about 18.5 p.c of taxable payrolls in 2078, after which declines barely (see Determine 1).

The rise in prices is pushed by demographics, particularly the drop within the whole fertility charge after the child increase (these born between 1946 and 1964). Girls of childbearing age in 1964 had a mean of three.2 kids; by 1974 that quantity had dropped to 1.8. The mixed results of the retirement of child boomers and a slow-growing labor power because of the decline in fertility scale back the ratio of staff to retirees from about 3:1 to 2:1 and lift prices commensurately. The growing hole between the revenue and price charges implies that the system is dealing with a 75-year deficit.

The 75-year money stream deficit is mitigated within the brief time period by the existence of a belief fund, with belongings at present equal to about two years of advantages. These belongings are the results of money stream surpluses resulting from reforms enacted in 1983. Since 2010, nonetheless, when Social Safety’s price charge began to exceed the revenue charge, the federal government has been tapping the curiosity on belief fund belongings to cowl advantages. And, in 2021, as taxes and curiosity fell in need of annual advantages, the federal government began to attract down belief fund belongings. These drawdowns will proceed till the OASI belief fund is depleted in 2033.

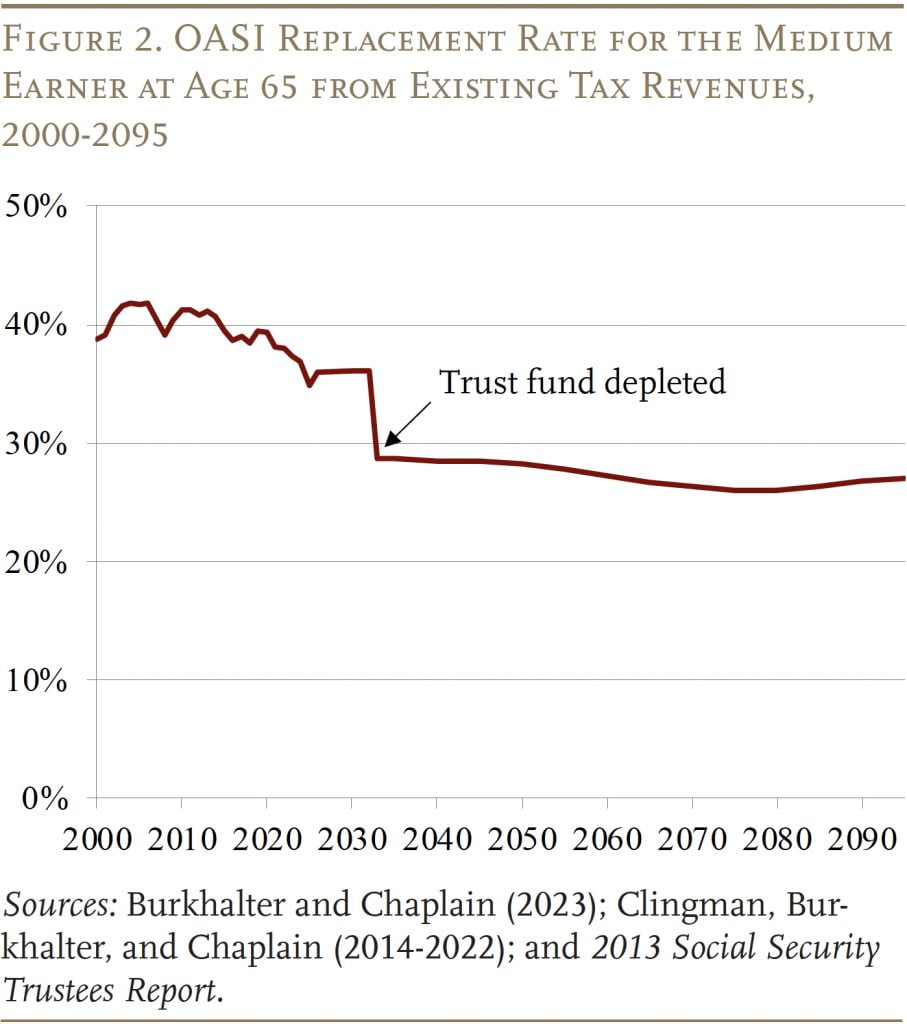

The depletion of the belief fund doesn’t imply that OASI is “bankrupt.” Payroll tax revenues maintain rolling in and may cowl 77 p.c of at present legislated advantages initially, declining to 71 p.c by the top of the projection interval. Relying solely on present tax revenues, nonetheless, implies that the substitute charge – advantages relative to pre-retirement earnings – for the standard age-65 employee would drop from about 36 p.c to about 27 p.c – a degree not seen for the reason that Nineteen Fifties (see Determine 2). (Observe that the substitute charge for these claiming at 65 has already declined because of the rise within the Full Retirement Age from 65 to 67.)

Shifting from money flows to the 75-year deficit requires calculating the distinction between the current discounted worth of scheduled advantages and the current discounted worth of future taxes plus the belongings within the belief fund. This calculation for the OASDI program as a complete exhibits that Social Safety’s long-run deficit is projected to equal 3.61 p.c of coated payroll earnings. That determine implies that if payroll taxes had been raised instantly by 3.61 proportion factors – about 1.8 proportion factors every for the worker and the employer – the federal government may pay scheduled advantages via 2097, with a one-year reserve on the finish.

At this level, fixing the 75-year funding hole just isn’t the top of the story when it comes to required tax will increase. Sooner or later, as soon as the ratio of retirees to staff stabilizes and prices stay comparatively fixed as a proportion of payroll, any resolution that solves the issue for 75 years will kind of clear up the issue completely. However, throughout this era of transition, any bundle of coverage modifications that restores steadiness just for the following 75 years will present a deficit within the following 12 months because the projection interval picks up a 12 months with a big adverse steadiness. Thus, eliminating the 75-year shortfall ought to be considered as step one towards “sustainable solvency.”

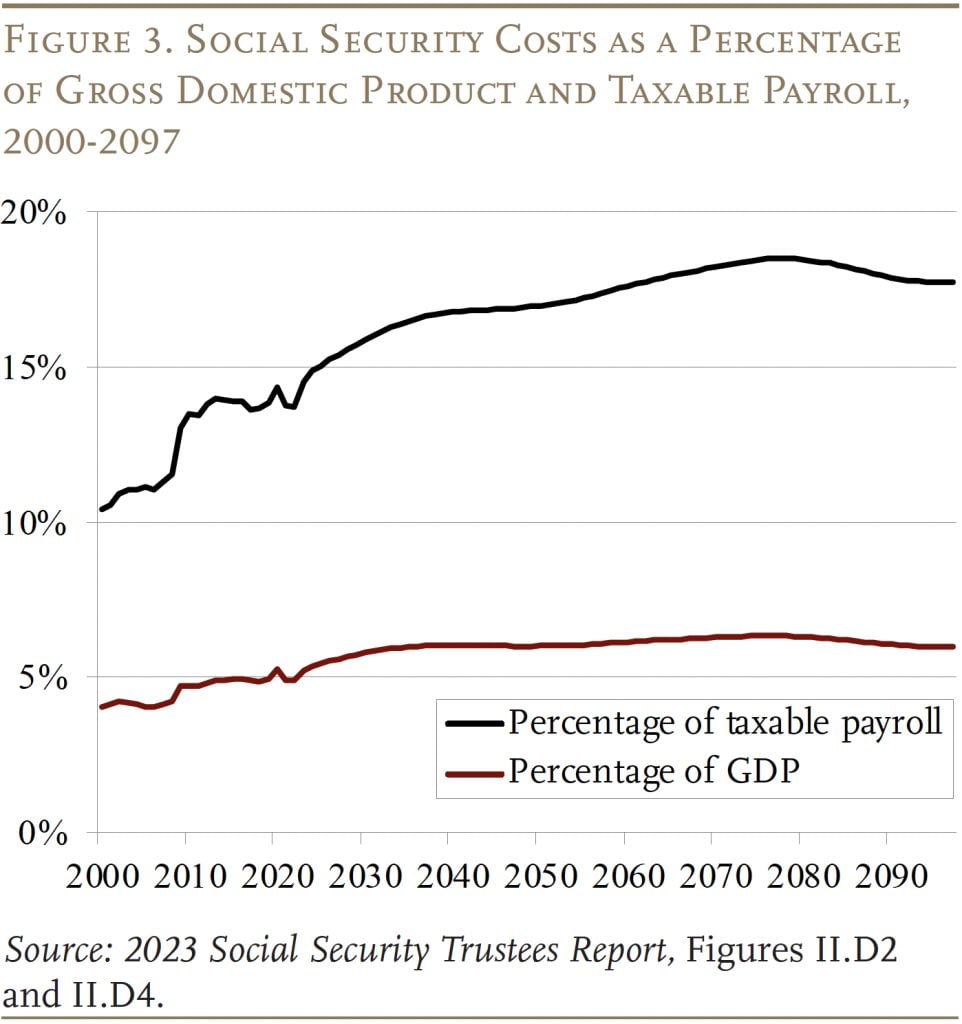

The Trustees additionally report Social Safety’s shortfall as a proportion of GDP. The price of this system is projected to rise from about 5 p.c of GDP at present to about 6 p.c of GDP because the child boomers retire (see Determine 3). The explanation why prices as a proportion of taxable payroll maintain rising – whereas prices as a proportion of GDP kind of stabilize – is that taxable payroll is projected to say no as a share of whole compensation resulting from continued development in well being advantages.

2023 Report in Perspective

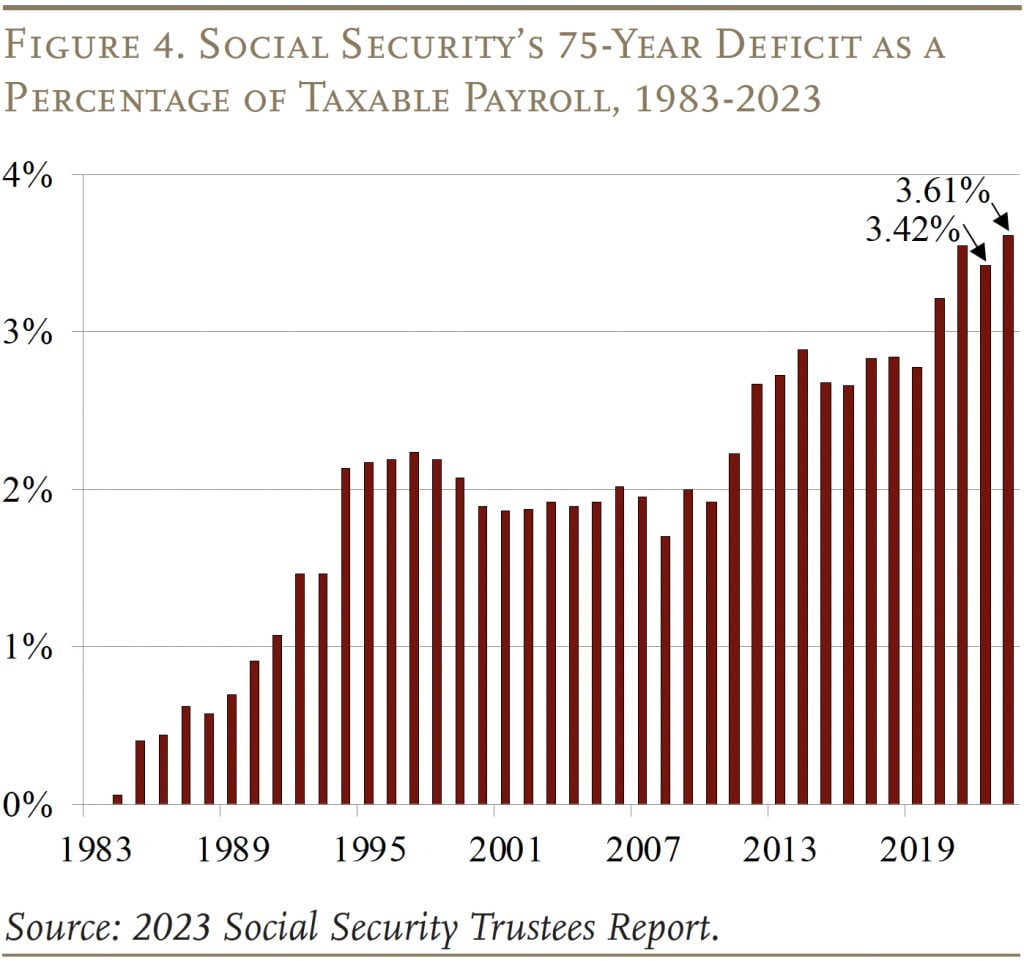

The 75-year deficits within the final three Trustees Studies are the biggest since 1983 when Congress enacted main laws to revive steadiness (see Determine 4). The principle query is why did the deficit develop over the interval 1983-2023, and a secondary query is why did it improve since final 12 months’s Report.

Adjustments in 75-Yr Deficit Since 1983

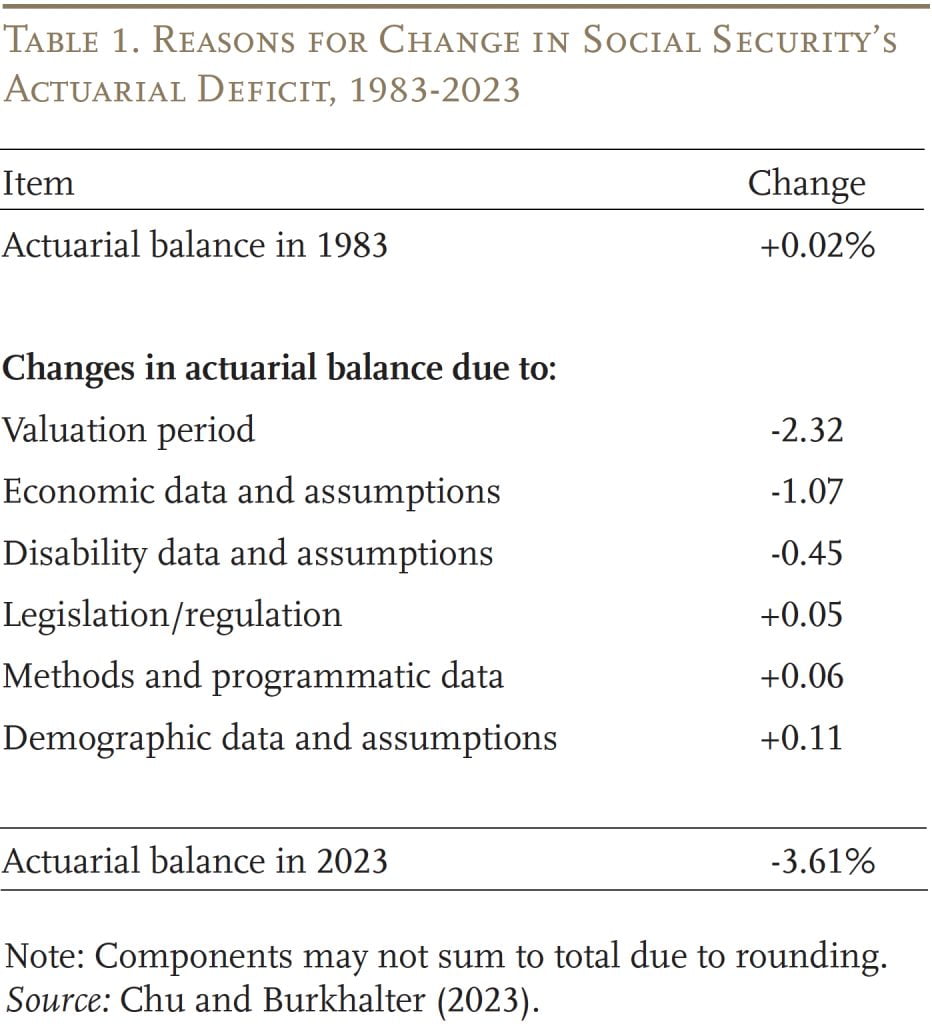

Social Safety moved from a projected 75-year actuarial surplus of 0.02 p.c of taxable payroll within the 1983 Report back to a projected deficit of three.61 p.c within the 2023 Report. As proven in Desk 1, main the checklist of causes is advancing the valuation interval. Every time it strikes out one 12 months, as famous above, it picks up a 12 months with a big adverse steadiness. The cumulative impact during the last 40 years has been to extend the 75-year deficit by 2.32 p.c of taxable payrolls. That’s, nearly two thirds of the 40-year change within the OASDI deficit is attributable to easily shifting the valuation interval ahead.

A worsening of financial assumptions – primarily a decline in assumed productiveness development and the influence of the Nice Recession – have additionally contributed to the rising deficit. One other contributor over the previous 40 years has been will increase in incapacity rolls, though that image has modified dramatically in recent times.

Partially offsetting the adverse elements has been a discount within the actuarial deficit resulting from legislative and regulatory modifications. Methodological enhancements and up to date information have additionally had a optimistic influence on the system’s funds. The largest increase has come from modifications in demographic assumptions, reminiscent of a slower tempo of mortality enchancment general. The online impact in 2023 of all these modifications is a 75-year deficit equal to three.61 p.c of taxable payrolls.

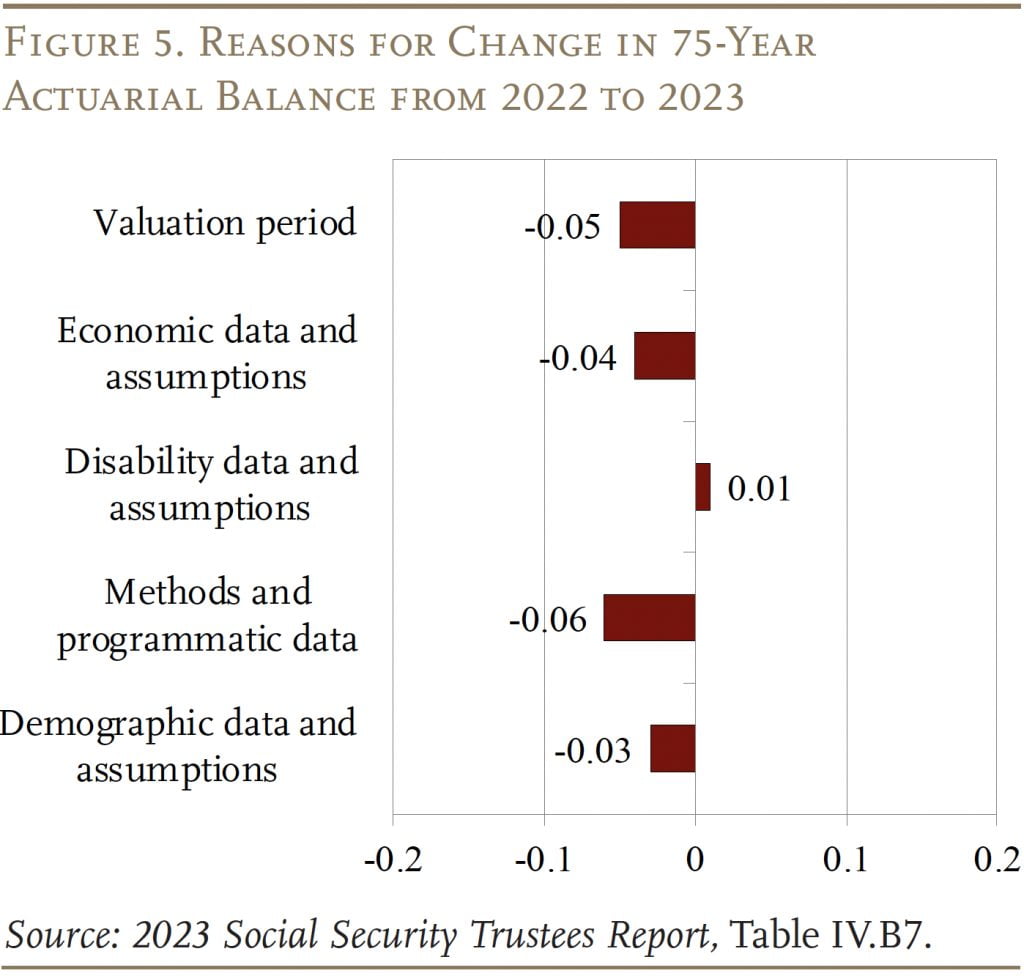

Adjustments from Final Yr’s Report

The three.61 p.c of taxable payrolls within the 2023 Report is barely greater than the three.42 p.c in final 12 months’s Report (see Determine 5). Solely three elements enable simple explanations. First, advancing the valuation interval to incorporate 2097 alone elevated the actuarial deficit by 0.05 p.c. Second, in response to higher-than-expected inflation and lower-than-expected output development, the Trustees revised down the degrees of GDP and labor productiveness by about 3 p.c by 2026 and for all years thereafter. Another elements had offsetting results. Third, a continued discount in assumed DI incidence charges improved the outlook. The remaining two elements – strategies and programmatic information and demographics – are the web results of a bunch of small modifications. The main target right here, nonetheless, just isn’t year-to-year modifications however relatively the upcoming exhaustion of the OASI belief fund.

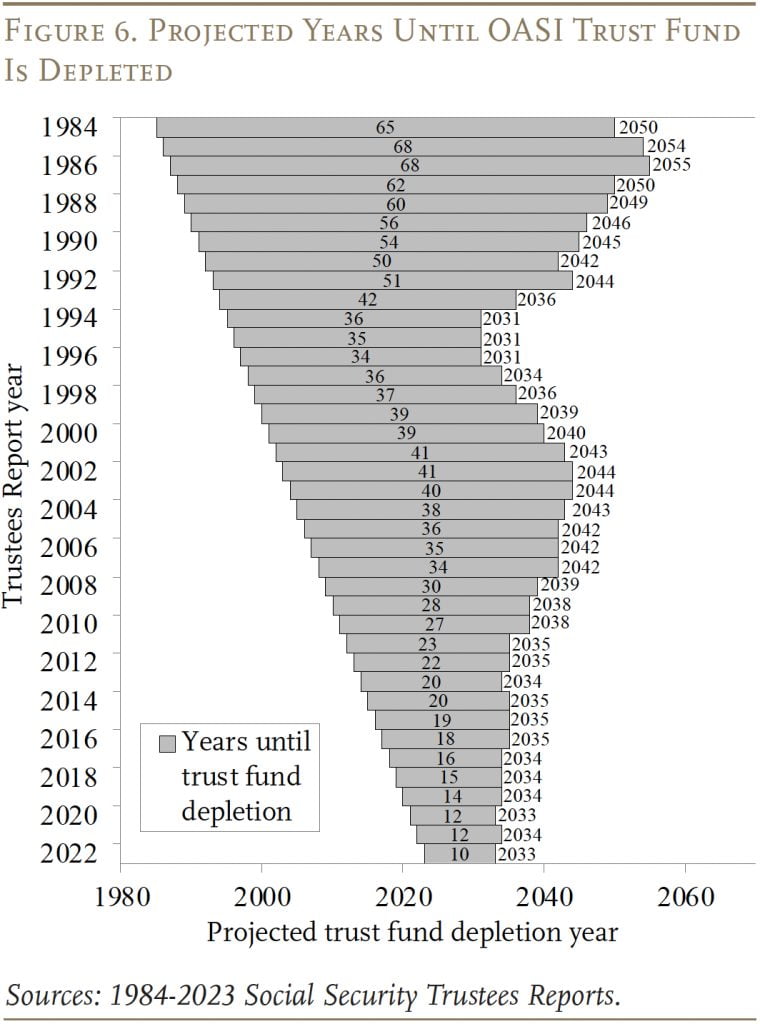

An Motion-Forcing Occasion and the Case for Some Normal Income Financing

The depletion of the OASI belief fund just isn’t information. Just about for the reason that 12 months the belief fund started accumulating belongings, the Trustees have projected its demise. The purpose is that the window of alternative to revive steadiness has narrowed dramatically over time. Whereas we used to have 68 years to determine find out how to keep away from belief fund depletion, that quantity has dropped to 10 years (see Determine 6). If nothing is finished earlier than depletion, advantages for all present and future retirees should be reduce instantly.

The upcoming depletion of belief fund belongings is the best time to rethink this system’s financing construction and to contemplate whether or not a general-revenue element is perhaps applicable. The rationale for normal income is that Social Safety prices are excessive, not as a result of this system is especially beneficiant, however as a result of the belief fund is lacking. If policymakers select to take care of Social Safety advantages at current-law ranges, little rationale exists for putting the whole burden of the Lacking Belief Fund on at present’s staff via greater payroll taxes; that element may very well be financed extra equitably via the revenue tax.

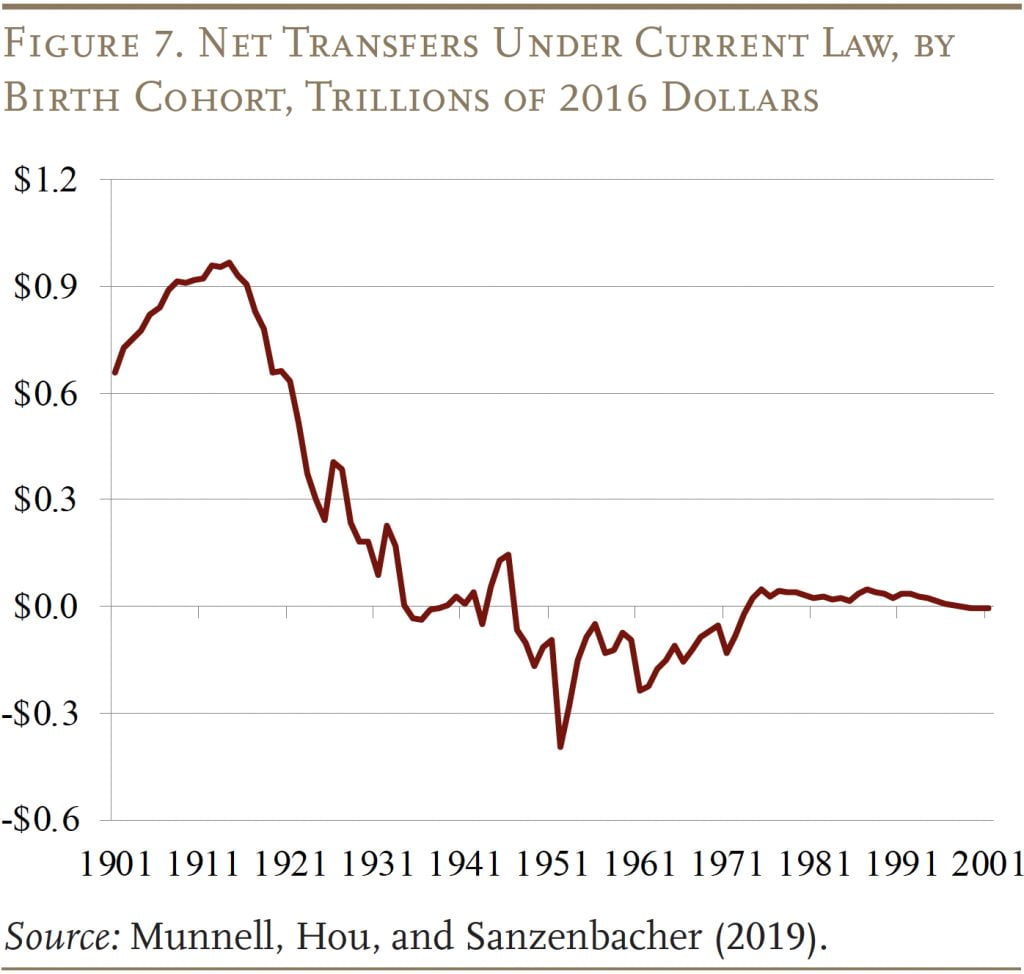

What occurred to the belief fund? The Lacking Belief Fund consists of two elements: 1) advantages paid to early cohorts in extra of their contributions; and a couple of) internet transfers by subsequent beginning cohorts. The primary half is sometimes called the Legacy Debt. It’s not similar to the Lacking Belief Fund, as a result of later beginning cohorts may have changed a few of that lacking fund if they’d contributed extra into this system than they’re projected to obtain, or they might have added to the deficit. Determine 7 illustrates that early beginning cohorts acquired giant optimistic transfers – creating an enormous legacy debt – and that the web adverse transfers skilled by the 1935-2001 beginning cohorts solely barely decreased the Legacy Debt. Thus, the Legacy Debt and Lacking Belief Fund are very shut in worth.

The massive switch to early generations was not anticipated within the 1935 laws, which arrange a scheme extra much like a personal retirement plan, with the buildup of a belief fund and the shut alignment of contributions and advantages. The 1939 amendments, nonetheless, essentially modified the character of this system. These amendments tied advantages to common earnings, initially over a minimal interval of protection, and added spousal and survivor advantages that had been successfully unfunded, thus breaking the hyperlink between lifetime contributions and advantages. Because of this, within the early phases of this system, payroll tax receipts had been used to pay advantages to retirees far in extra of their contributions relatively than to construct up a belief fund.

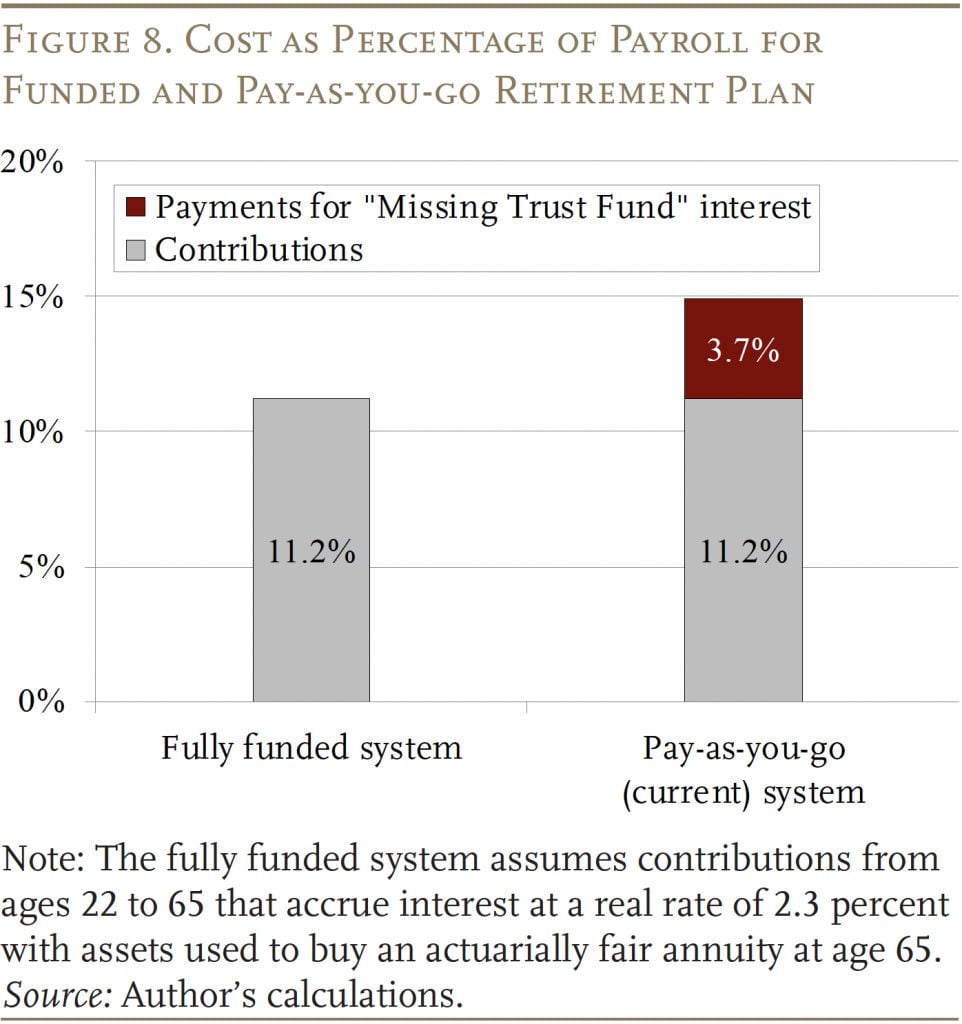

The only strategy to see the implications of Social Safety’s Lacking Belief Fund is to contemplate the contribution charge required to finance this system’s retirement advantages underneath a funded retirement plan in comparison with a pay-as-you-go system. This train makes use of the Social Safety Trustees’ intermediate assumptions on mortality and on the true rate of interest (2.3 p.c) to attain a substitute charge of about 36 p.c (the Social Safety substitute charge at 65 for the common earner). Beneath a funded system, the mixed employer-employee contribution charge for a typical employee can be 11.2 p.c of earnings. Beneath our pay-as-you-go system, the whole price is 14.9 p.c, the sum of the present OASI tax charge of 10.6 p.c and the deficit within the seventy fifth 12 months of the projection interval of 4.3 p.c. The ensuing distinction in price to the employee between the funded and the pay-as-you-go system is 3.7 proportion factors (14.9 p.c minus 11.2 p.c) (see Determine 8). This distinction is because of the presence of a belief fund that may pay curiosity in a totally funded system however is lacking within the pay-as-you-go system.

Apparently, if Social Safety had been a totally funded program, the price of the retirement advantages calculated above – 11.2 p.c – can be very near the present precise tax charge – 10.6 p.c – for the retirement portion of Social Safety. That’s, a lot of the shortfall could be attributed to the truth that this system doesn’t have a belief fund producing curiosity.

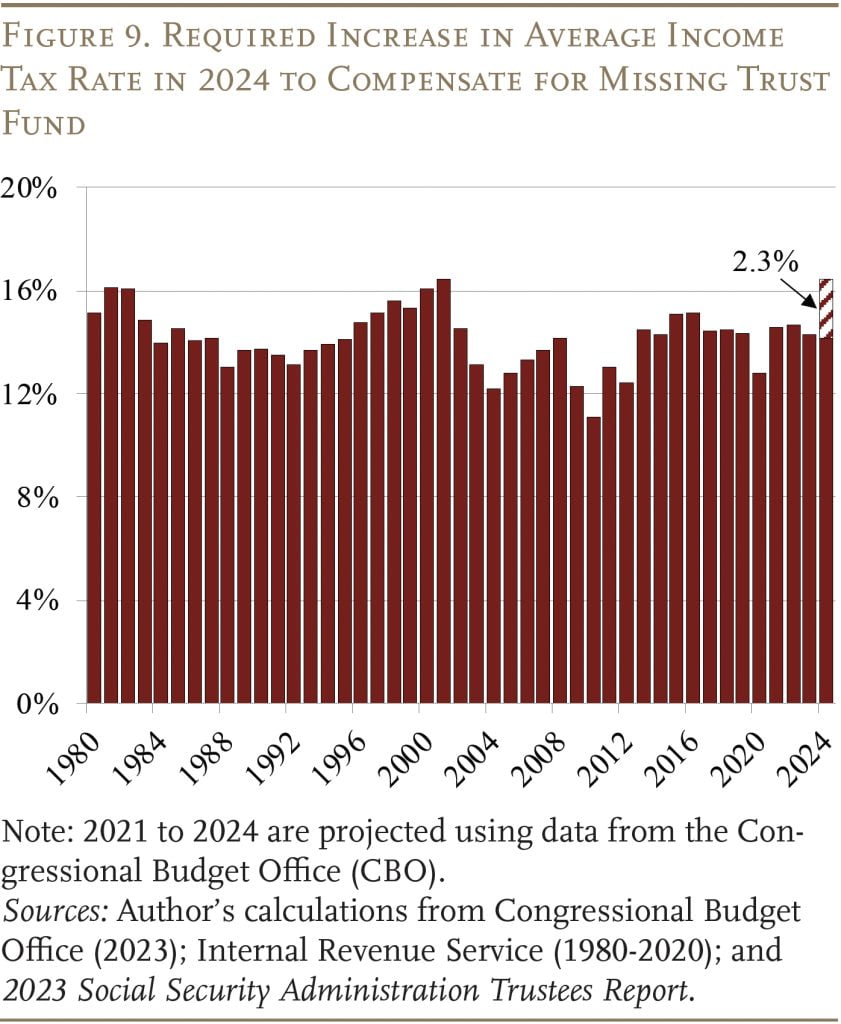

The query is whether or not staff ought to be requested to pay the upper payroll tax ensuing from the choice to present away the belief fund or whether or not they need to pay merely what they must contribute in a funded system. One may argue that the legacy burden ought to be borne by the final inhabitants in proportion to the flexibility to pay – that’s, this a part of the Social Safety financing drawback may very well be transferred to normal revenues. In that case, the common revenue tax charge (revenue taxes/adjusted gross revenue) must improve by 2.3 proportion factors (from 14.1 p.c to 16.4 p.c) in 2024. Even when we had been to go all the way in which and lift taxes by sufficient to cowl all Lacking Belief Fund earnings, the common tax charge would nonetheless be throughout the bounds of historic expertise (see Determine 9).

Conclusion

The 2023 Trustees Report confirms what has been evident for nearly three many years – specifically, Social Safety is dealing with a long-term financing shortfall that equals 1 p.c of GDP. The modifications required to repair the system are effectively throughout the bounds of fluctuations in spending on different applications up to now. Furthermore, motion must be taken earlier than the OASI belief fund is depleted in 2033 to keep away from a precipitous reduce in advantages. People help this program; their representatives ought to repair its funds.

This action-forcing occasion is an efficient time to rethink the financing of the system. An earmarked tax, nonetheless, is important to the political stability of Social Safety, which implies that you will need to determine what ought to and what shouldn’t be paid for by this regressive levy. One may argue that the price of making a gift of the belief fund related to the start-up of this system ought to be borne by society basically consistent with a broad measure of skill to pay. Thus, a robust rationale exists for shifting a portion of Social Safety financing to normal revenues. This isn’t a free lunch – revenue tax charges must improve. However this shift would symbolize a extra equitable sharing of the burden. On the identical time, staff can be paying an quantity for his or her advantages equal to what they might have paid had a belief fund accrued. Thus, the burden can be distributed extra broadly, however the sense that staff pay for and are entitled to their advantages would stay.

References

Burkhalter, Kyle and Chris Chaplain. 2023. “Alternative Charges for Hypothetical Retired Staff.” Actuarial Observe Quantity 2023.9. Baltimore, MD: U.S. Social Safety Administration.

Chu, Sharon and Kyle Burkhalter. 2023. “Disaggregation of Adjustments within the Lengthy-Vary Actuarial Stability for the Previous Age, Survivors, and Incapacity Insurance coverage (OASDI) Program Since 1983.” Actuarial Observe Quantity 2023.8. Baltimore, MD: U.S. Social Safety Administration.

Clingman, Michael, Kyle Burkhalter, and Chris Chaplain. 2014-2022. “Alternative Charges for Hypothetical Retired Staff.” Actuarial Observe Quantity 9. Baltimore, MD: U.S. Social Safety Administration.

Congressional Funds Workplace. 2023. “Lengthy Time period Funds Projections.” Washington, DC.

Inside Income Service. 1980-2020. “Statistics on Earnings Tax Stats – Particular person Earnings Tax Return (1040).” Washington, DC.

Munnell, Alicia H., Wenliang Hou, and Geoffrey Sanzenbacher. 2019. “The Implications of Social Safety’s ‘Lacking Belief Fund.’” Subject in Transient 19-9. Chestnut Hill, MA: Middle for Retirement Analysis at Boston School.

U.S. Social Safety Administration. 1983-2023. The Annual Studies of the Board of Trustees of the Federal Previous-Age and Survivors Insurance coverage and Federal Incapacity Insurance coverage Belief Funds. Washington, DC: U.S. Authorities Printing Workplace.