The transient’s key findings are:

- Investing a part of Social Safety’s reserves in equities has apparent attraction: a better return means much less tax hikes or profit cuts.

- However critics concern that fairness funding might intrude with personal markets or sign that buying and selling bonds for shares creates magic cash.

- The proof from the U.S. and Canada exhibits that such investing by authorities retirement funds is possible, secure, and efficient.

- Whereas expertise means that equities might work for Social Safety, the time could have handed.

- Social Safety’s belief fund is careening in the direction of zero, and rebuilding the fund might not be clever or possible.

Introduction

Investing among the Social Safety belief fund’s belongings in equities has apparent attraction. Fairness funding has increased anticipated returns relative to safer belongings, so Social Safety may want much less in tax will increase or profit cuts to attain long-term solvency. However, fairness investments contain higher danger and lift issues about interference in personal markets and about deceptive accounting that means the federal government can get wealthy just by issuing bonds and shopping for equities.

The actual world offers a convincing case that governments can spend money on equities in a wise method. Canada has a big actively managed fund, follows fiduciary requirements, and makes use of conservative return assumptions. In america, the Railroad Retirement system has additionally invested in a broad array of belongings with out interfering within the personal market, as has the Federal Thrift Financial savings Plan, the place the federal government performs an basically passive position.

However do the demonstrated successes imply that fairness funding must be a part of an answer for Social Safety? The prerequisite for such exercise is a belief fund with important belongings to speculate. The present belief fund is quickly heading to zero; the probability of elevating taxes to rebuild it’s low; and borrowing to take action doesn’t assure any extra assets for Social Safety.

The dialogue proceeds as follows. The primary part offers background on motivation for fairness funding and the issues of the critics. The second part describes investing initiatives by three retirement plans – the Canada Pension Plan, the Railroad Retirement system, and the Federal Thrift Financial savings Plan – and evaluates them in opposition to the critics’ issues. The third part explores whether or not, even when the issues have been addressed, fairness funding may very well be a part of a package deal to revive monetary stability to Social Safety. The ultimate part concludes that whereas the mechanics are completely manageable, the time could have handed for elevating taxes sufficient to build up a big sufficient belief fund to take the time worthwhile.

Background

In america, severe dialogue of fairness investments for Social Safety arose as 75-year deficits reemerged within the wake of the 1983 amendments. President Clinton requested the 1994-1996 Advisory Council on Social Safety to think about choices to attain long-term solvency. The Council couldn’t agree on a single plan, so its members superior three completely different proposals to shut the funding hole. All three included some type of funding in equities. Two concerned fairness funding by particular person accounts, and the third advisable {that a} portion of the belief fund reserves be invested straight in equities.

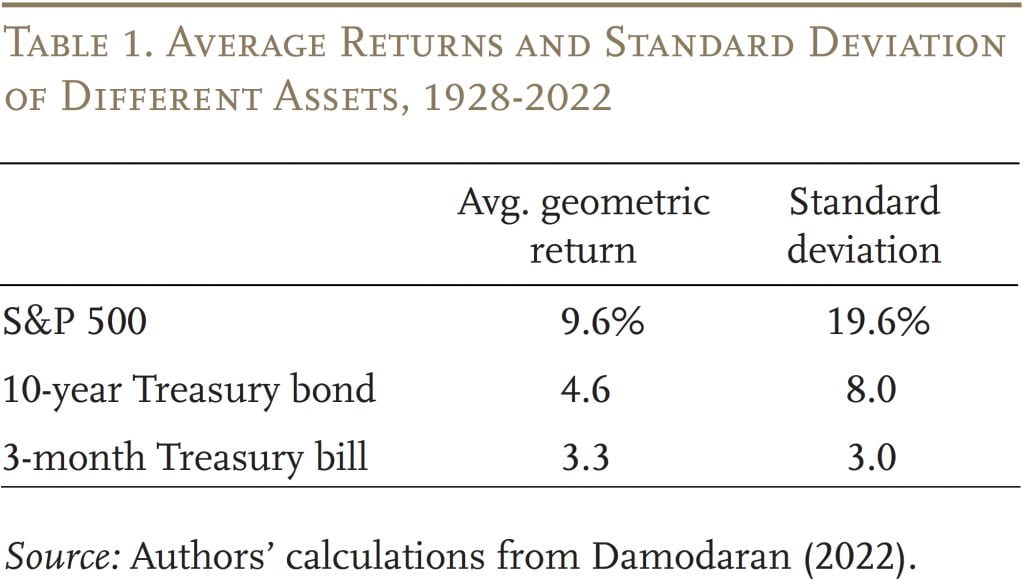

The main attraction of fairness funding is that it has a better anticipated charge of return relative to safer belongings, reminiscent of Treasury bonds or payments, in order that restoring steadiness to Social Safety would require much less in tax will increase or profit cuts (see Desk 1). Economists additionally argue that environment friendly risk-sharing throughout a lifecycle requires people to bear extra monetary danger when younger and fewer when outdated, and for the reason that younger have little in the best way of monetary belongings, investing the belief fund in equities is one option to obtain that objective.

Critics are involved that Social Safety fairness investing would have hostile results on the inventory market and company decision-making, and create the impression that buying and selling bonds for shares offers magic cash. Any evaluation includes answering the next questions:

- How huge is the fairness funding initiative in comparison with the financial system? If Social Safety had begun investing within the inventory market in 1984 or 1997, in accordance with a 2016 research, it could personal about 4 % of the market. As a degree of comparability, state and native pension plans presently maintain about 5 % of whole equities.

- How do authorities officers select the investments? Proponents of belief fund fairness funding on the 1994-1996 Advisory Council assumed that the federal government would take a really passive position. However, as mentioned under, the Canada Pension Plan and the Railroad Retirement system take a way more energetic strategy.

- Do authorities businesses use anticipated returns or risk-adjusted returns to guage the impression of equities on plan funds? Crediting anticipated returns quantifies the potential contribution of equities to fixing Social Safety’s financing shortfall, however means that the federal government might mint cash just by promoting bonds and shopping for shares. Adjusting for danger avoids the impression that returns are assured, however exhibits no impression of fairness funding on the system’s funds on the time of adoption. Larger returns are booked solely after they’re realized.

The next takes a better take a look at three retirement plans engaged in fairness funding and assesses the extent to which they handle the critics’ issues.

Three Federal Authorities Plans with Fairness Investments

The dialogue begins with the Canada Pension Plan, which has a big actively managed fund engaged in a variety of investments. Whereas the Canadian expertise is spectacular and even enviable, it most definitely includes extra even quasi-government funding exercise than People might tolerate. So, the main focus shifts to 2 U.S. plans – the Railroad Retirement system, a comparatively small plan additionally with a broad funding portfolio, and the Federal Thrift Financial savings Plan, an outlined contribution plan for public staff and army personnel, the place the federal government merely selects the plan’s funding choices.

Canada Pension Plan

The Canada Pension Plan, the key part of Canada’s retirement system, was initially arrange in 1966 as a pay-as-you-go plan with a modest reserve, much like the U.S. Social Safety program. This strategy made sense with a younger inhabitants and quickly rising wages. Nonetheless, inside just a few many years, decrease start charges, longer life expectations, and decrease actual wage progress led to growing plan prices, with the prospect of quickly rising payroll contribution charges going ahead.

A dramatic enhance in contribution charges over time ran counter to Canadian notions of intergenerational fairness. To enhance equity throughout generations and make sure the long-term monetary sustainability of the plan, Canada enacted laws in 1997 that elevated payroll contributions to its projected long-term charge and started investing among the fund accumulations in equities. It additionally required that any modifications to the plan going ahead needed to be absolutely funded.

To implement the funding technique, the 1997 laws created the CPP Funding Board (CPPIB). Whereas it’s a government-owned company, CPPIB is managed independently from the CPP itself and operates at arm’s size from governments. The Board’s mandate is to speculate CPP revenues not wanted to pay present advantages to attain the utmost return, with out incurring undo danger, for the only advantage of CPP contributors and beneficiaries.

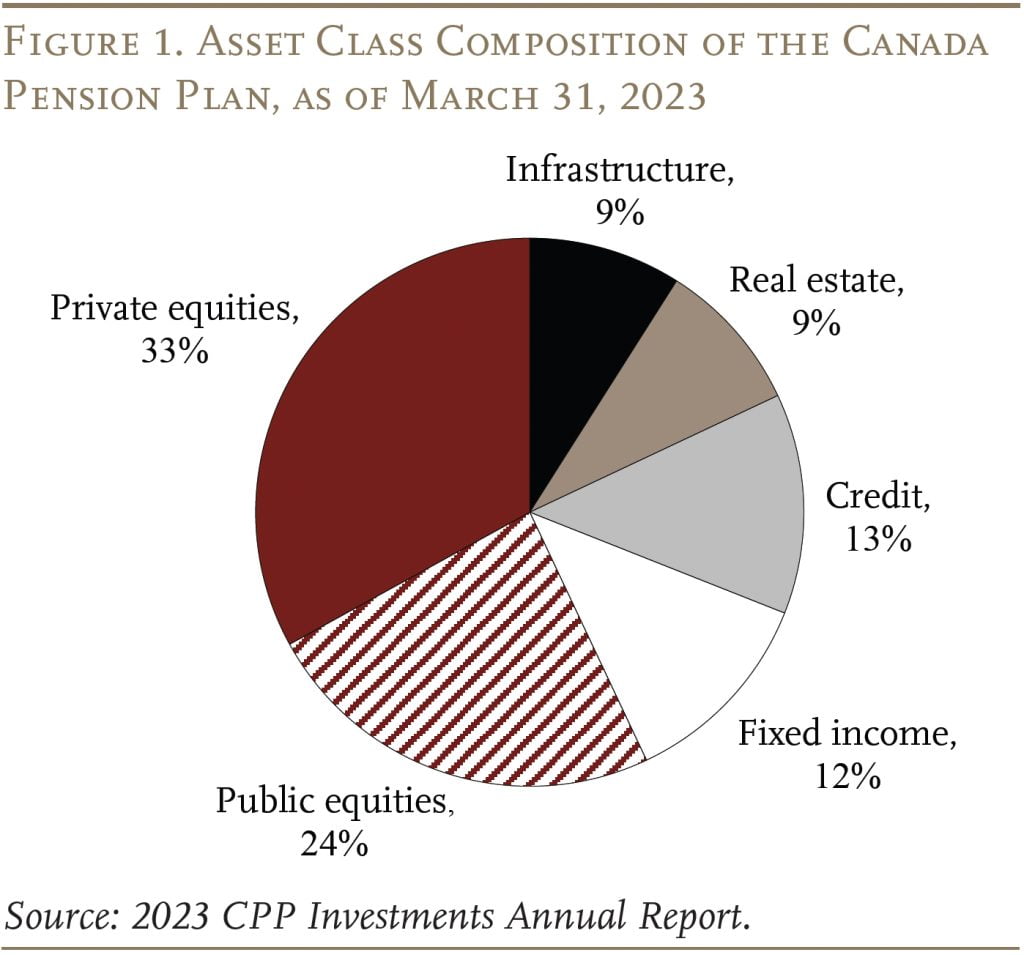

The CPPIB has constructed a broad-based portfolio that features not simply investments in shares and bonds, but additionally actual property, infrastructure tasks, and personal fairness (see Determine 1). Whole belongings quantity to 570 billion CAD in 2023.

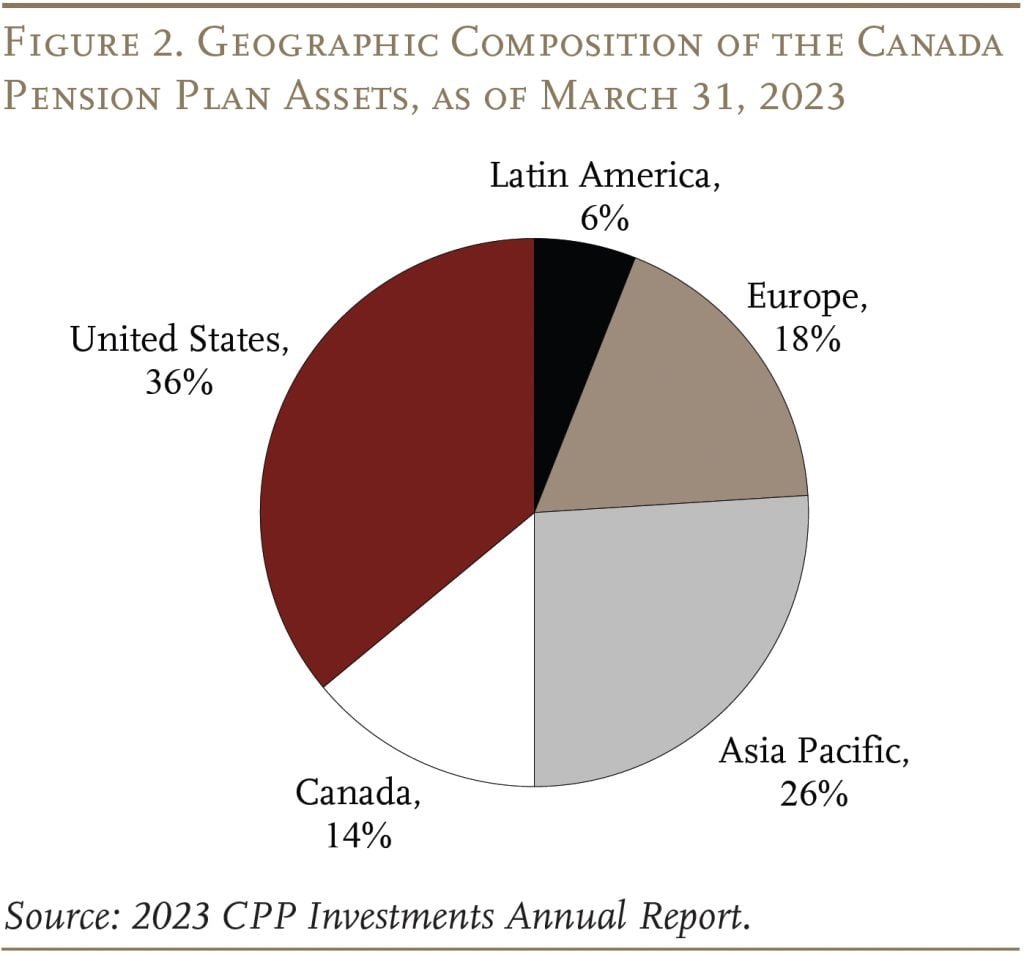

To mitigate publicity of the Fund to dangers associated to future Canadian financial and demographic circumstances, the CPPIB diversifies its investments internationally (see Determine 2). Thus, the Fund’s home investments are small relative to its GDP (2.8 trillion CAD) and its inventory market (3.9 trillion CAD).

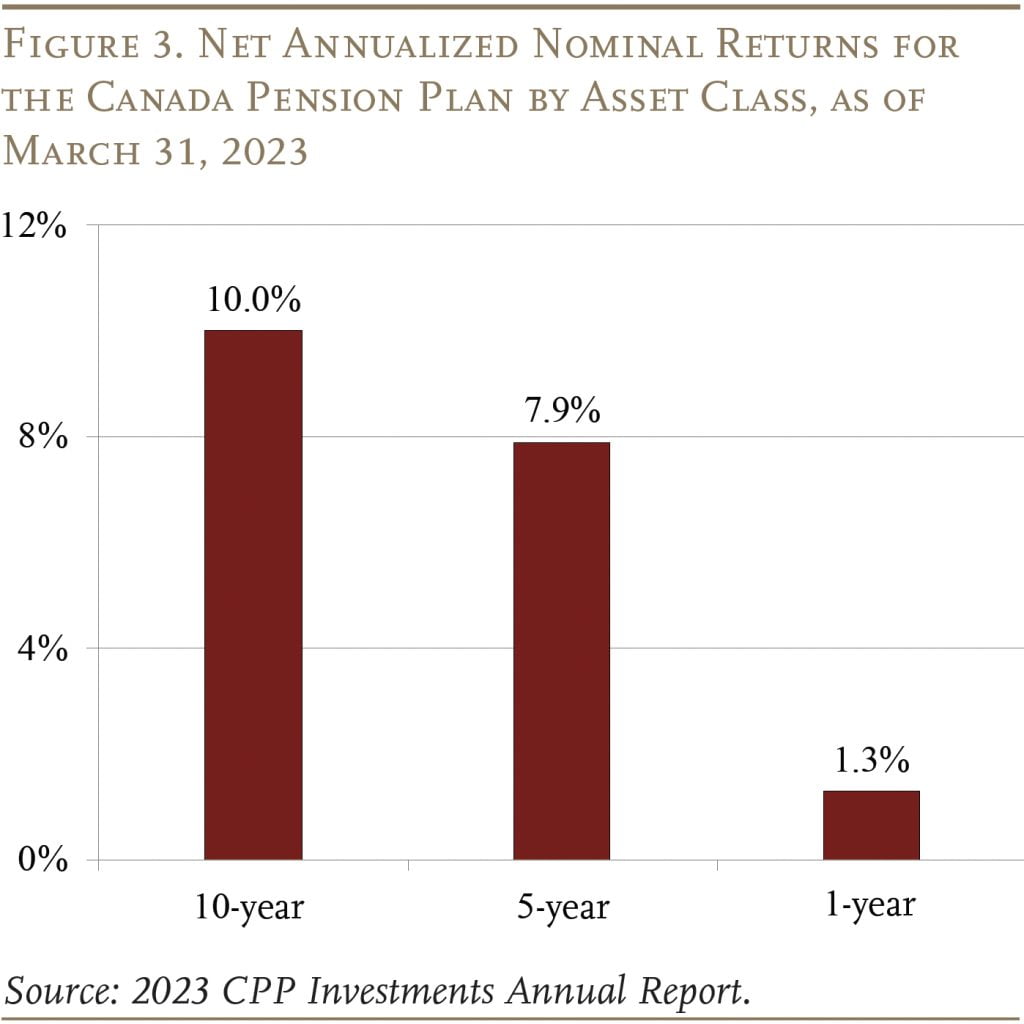

Whereas the CPPIB has one fund, it has six departments that make investments and handle the belongings. The managers are in-house, highly-compensated people. Over the past ten years, the Fund had an annualized internet return of 10 % (see Determine 3).

The CPPIB does embrace financial, social, and governance issues in its funding choices when the managers imagine that addressing such points will generate superior returns in the long term. The Board publicly votes proxies at annual conferences and encourages corporations to think about local weather danger and develop viable transition methods. It doesn’t interact in blanket divestment from corporations in high-emitting sectors as a result of the managers suppose that they’d then lose the flexibility to make use of the CPPIB’s affect constructively.

The Board thinks about danger when it comes to each a minimal and a goal (see Desk 2). The minimal stage of danger for the bottom CPP can be a portfolio of 50-percent Canadian authorities bonds and 50-percent international public equities. In 2016, Canada handed laws that may enhance CPP contributions and advantages. The minimal danger ranges for this extra part are considerably decrease: 60-percent bonds and 40-percent international equities.

The speed of return assumptions used within the actuarial stories have been conservative, as precise funding earnings have routinely exceeded projected earnings. Beneath these cautious assumptions, the bottom CPP and extra CPP parts have each been projected to be sustainable for the 75-year interval. A further safeguard kicks in if the actuaries undertaking that the system’s funds are usually not in steadiness. If policymakers fail to handle the projected imbalance, contribution charges enhance and profit indexation is frozen.

The underside line is that the Canadian funding initiative has paid off, whereas addressing the issues of critics. Investments signify a small share of the Canadian financial system; they’re ruled by strict fiduciary requirements; the Board makes use of its affect within the personal sector solely to reinforce long-run returns; and the assumed funding returns used for evaluating the solvency of the CPP are on the conservative aspect.

U.S. Railroad Retirement System

Congress created the Railroad Retirement system in 1934, when it took over the rail trade’s tottering pension plan. This system was funded on a pay-as-you-go-basis financed by a payroll tax on employees and employers. It had a modest belief fund with belongings invested solely in authorities bonds. Within the Nineties, nonetheless, belongings in this system’s belief fund had grown to 4 occasions annual outlays, a traditionally excessive stage, and the notion was that it might develop even increased with the usage of equities. So, administration and labor negotiated a proposal to speculate the Railroad Retirement belongings in equities. Since Railroad Retirement is a authorities program, administration and labor needed to persuade Congress to enact their plan.

Congress’ main concern was the danger of political affect on funding choices. To deal with this concern, Congress created the Nationwide Retirement Funding Belief (NRRIT) with administration and labor every deciding on three trustees, who, in flip, would then choose a seventh impartial trustee. Congress additionally imposed a private-sector fiduciary mandate on these trustees, requiring them to speculate the federal government’s belongings solely within the curiosity of plan contributors. The trustees initially allotted 65 % of belief fund belongings to equities. Over time, NRRIT has broadened its portfolio past equities to incorporate actual property, personal fairness, and personal debt. In 2023, internet belongings within the belief fund have been $27 billion. The precise investing is delegated to exterior managers.

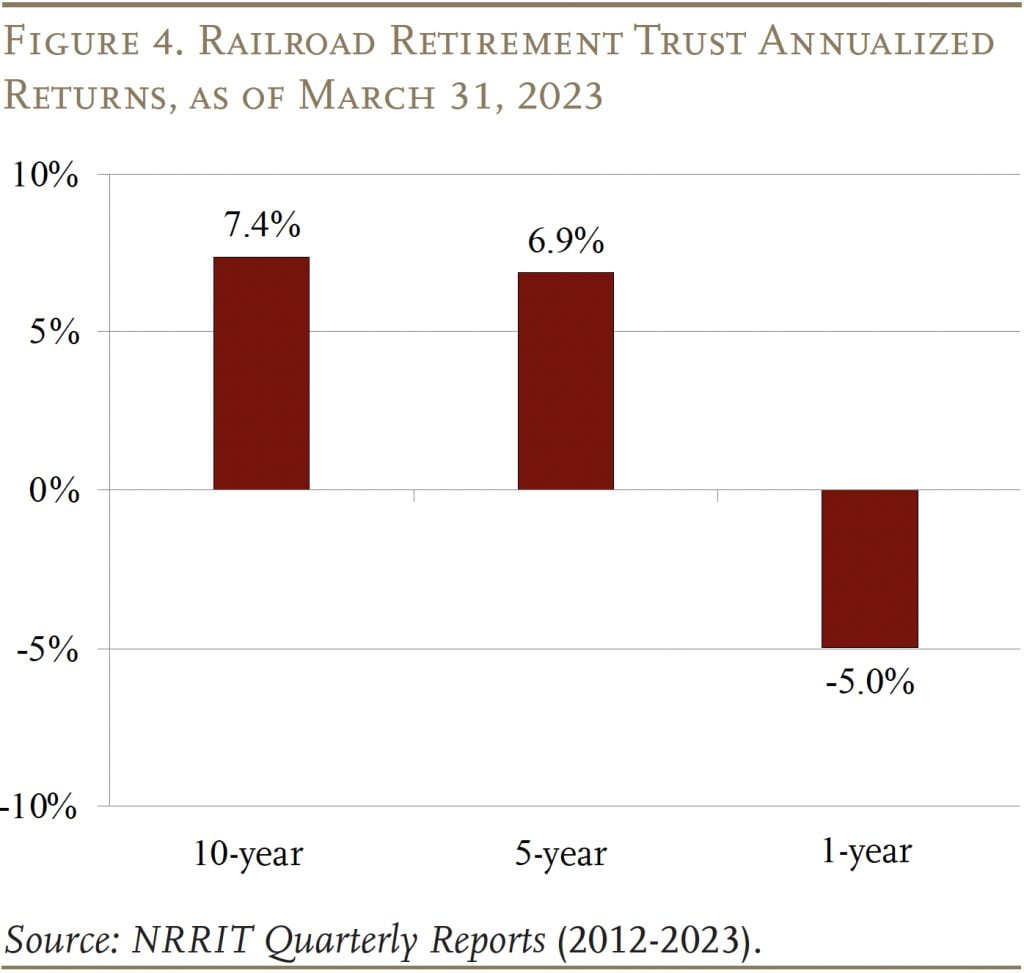

The difficulty arose on easy methods to consider the usage of equities in reform proposals. Whereas the Social Safety actuaries credit score equities with their anticipated charge of return, the Workplace of Administration and Funds, in evaluating the monetary implications of the Railroad Retirement proposal, ignored the upper anticipated return on equities and used a risk-adjusted return – the long-term Treasury charge – to undertaking future Belief Fund balances. Right this moment, the Railroad Retirement actuaries assume a 6.5-percent return, a compromise between the precise returns and a risk-adjusted charge (see Determine 4).

Federal Thrift Financial savings Plan

The Federal Thrift Financial savings Plan (TSP), established in 1986, presently has 6.5 million contributors and about $800 billion in belongings. From the start, members of Congress have been involved that the Government Department would strain the plan fiduciaries to pick funding choices to additional its personal coverage targets. In response, Congress established elaborate guardrails.

The Federal Retirement Thrift Funding Board, which administers the TSP, has far much less discretion than different plan fiduciaries in setting funding coverage. Whereas different fiduciaries can decide the quantity and forms of funding funds, Congress has established the choices that the Board can provide and should approve any enlargement or change. Furthermore, when selecting benchmark indices for the funding funds, the Board is proscribed to those who are “generally acknowledged” and that are a “moderately full illustration” of your complete market. The Board is prohibited from eradicating any inventory from the index. As well as, the Board is categorically prohibited from utilizing proxy voting energy to affect company decision-making.

Francis Cavanaugh, the primary govt director of the TSP’s Board, reported that it had no difficulties in deciding on an index and acquiring aggressive bids from giant index fund managers. And he encountered no points of presidency interference out there. In brief, a mannequin already exists for structuring Social Safety funding in equities – passive funding by index funds and no proxy voting.

Does Fairness Funding Make Sense in 2023?

In concept the reply is “sure.” These plans which have adopted equities have loved considerably increased returns than bond yields, regardless of the dot-com recession and the monetary disaster. When it comes to critics’ issues, the expertise with the TSP offers a highway map for separating the federal government from precise funding choices, and accounting for returns on a considerably risk-adjusted foundation – just like the Railroad Retirement system – would keep away from the looks of straightforward cash.

However investing belief fund belongings in equities requires having a large belief fund. Social Safety’s belief fund, which emerged from the 1983 amendments, is rapidly heading in the direction of zero. To recreate a belief fund would require a tax hike to cowl each this system’s present prices and to supply an annual surplus to construct up belief fund reserves.

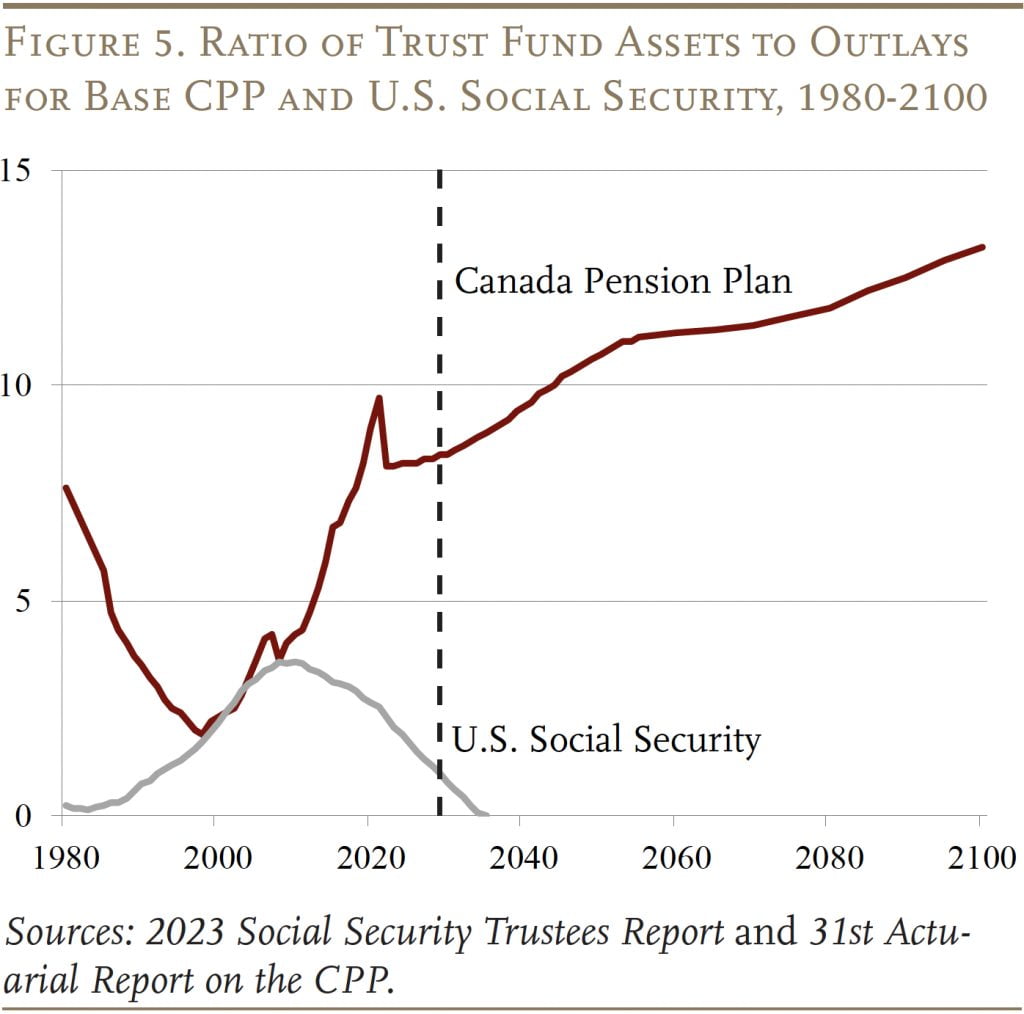

Such an initiative will not be unprecedented; each america in 1983 and, as famous, Canada in 1997 raised payroll contributions above present program prices and collected fund belongings (see Determine 5). Elevating taxes upfront of the retirement of the newborn increase served as a mechanism for equalizing the burden throughout generations.

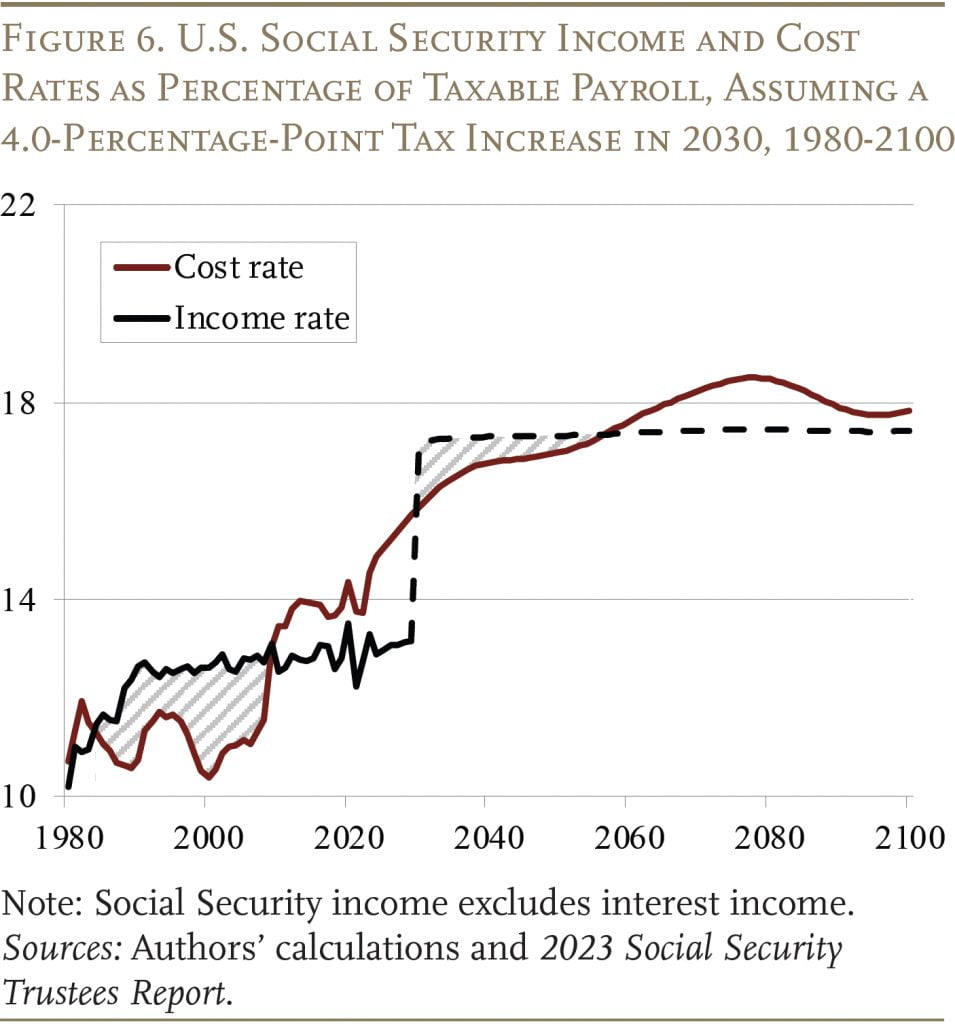

The scenario now’s fairly completely different than it was in 1983. A lot of the value enhance is behind us so even when Congress raised the payroll tax charge by 4 proportion factors beginning in 2030 – roughly the quantity wanted to pay advantages over the subsequent 75 years – it could produce solely small momentary surpluses adopted by cash-flow deficits thereafter. For context, these surpluses can be lower than 40 % of these produced by the 1983 laws (see Determine 6).

In fact, within the unlikely occasion that motion have been taken a lot earlier than 2030, the mix of present belief fund balances and the fast surpluses generated by the tax enhance might result in significant accumulation.

However it’s not clear that the political will exists to make such a transfer, neither is the case for increase a big belief fund compelling. With prices scheduled to stage off, it’s laborious to argue that immediately’s employees ought to pay extra to construct up a belief fund in order that tomorrow’s employees would pay much less.

If Congress is unwilling to boost taxes sufficient to create a significant belief fund, how about borrowing? Certainly, one proposal would have the federal government borrow about $1.5 trillion and make investments these funds in shares, personal fairness, and different devices that supply increased anticipated returns than curiosity on authorities debt. Within the meantime, the federal government would additionally borrow to cowl Social Safety’s shortfall. After 75 years, cash from the belief fund may very well be used to repay the borrowing that went in the direction of paying advantages.

This proposal differs basically from the strategy in Canada, which includes truly contributing more cash to construct up a reserve fund for the long run. In distinction, making a belief fund on borrowed cash, which the federal government should repay with curiosity, implies that the one proceeds are any earnings in extra of the curiosity paid on the bonds. Fixing Social Safety requires actual financial modifications – reducing advantages or growing earnings. This proposal affords nothing besides the likelihood to pocket the return in extra of the bond charge.

Some have likened the proposal to advising a middle-aged couple who understand that they haven’t saved sufficient for retirement to not in the reduction of on their spending, plan to spend much less as soon as they retire, or work longer, however slightly to take out a extremely giant mortgage and put it within the inventory market. No monetary planner would recommend such a technique, and the proposal to borrow is not any extra smart for the nation than borrowing-to-invest is for the couple.

The underside line is that the prerequisite for investing in equities – specifically, having a significant belief fund – will not be more likely to emerge. It could have been a terrific thought in 1983 and even later. However america handed up that chance, and it might be too late for such an initiative.

Conclusion

The notion of governments investing in equities by retirement program belief funds is a viable idea that has been confirmed possible, secure, and efficient in each Canada and america. So, in concept, this concept might work with the U.S. Social Safety program.

However one important part is presently lacking: Social Safety not has a large belief fund to speculate. And rebuilding the belief fund by extra taxes or borrowing might not be both clever or possible. Thus, whereas the mechanics are completely manageable, the time could have handed for elevating taxes sufficient to build up a significant Social Safety belief fund that may make investing in equities worthwhile.

References

Advisory Council on Social Safety. 1997. 1994-1996 Advisory Council on Social Safety: Findings and Suggestions. Volumes I and II. Washington, DC.

Burtless, Gary, Anqi Chen, Wenliang Hou, and Alicia H. Munnell. 2016. “How Would Investing in Equities Have Affected the Social Safety Belief Fund?” Working Paper 2016-6. Chestnut Hill, MA: Middle for Retirement Analysis at Boston Faculty.

Canada Pension Plan Board Act. S.C. 1997, c.40. Ottawa, Canada: Authorities of Canada, Justice Legal guidelines Web site.

Cassidy, Invoice. 2023. “Refusing to Reform Social Safety Is a Plan – and a Unhealthy One.” (Might 9). New York, NY: Nationwide Evaluation.

CPP Investments. 2023. Annual Report. Toronto, Canada.

Damodaran, Aswath. 2022. “Historic Returns on Shares, Bonds, and Payments – United States.” New York, NY: New York College, Stern Faculty of Enterprise.

Federal, Provincial and Territorial Governments of Canada. 1996a. An Info Paper for Consultations on the Canada Pension Plan. Ottawa, Canada.

Federal, Provincial and Territorial Governments of Canada. 1996b. Report on the Canada Pension Plan Consultations. Ottawa, Canada.

Federal Retirement Thrift Funding Board. 2022. Request for Info on Attainable Company Actions to Shield Life Financial savings and Pensions from Threats of Local weather Associated Danger. Washington, DC: U.S. Division of Labor.

Nationwide Railroad Retirement Funding Belief. 2012-2023. Quarterly Updates. Washington, DC.

Workplace of the Chief Actuary, Workplace of the Superintendent of Monetary Establishments Canada. 2022. thirty first Actuarial Report on the Canada Pension Plan as at 31 December 2021. Ottawa, Canada: Minister of Public Works and Authorities Providers.

Pesando, James. 2001. “The Canada Pension Plan: Wanting Again on the Latest Reforms.” In The State of Economics in Canada: Festschrift in Honour of David Slater, edited by Patrick Grady and Andrew Sharpe, 137-150. Ottawa, Canada: Queen’s College, John Deutsch Institute and the Centre for the Examine of Residing Requirements.

U.S. Social Safety Administration. 2023. The Annual Reviews of the Board of Trustees of the Federal Previous-Age and Survivors Insurance coverage and Federal Incapacity Insurance coverage Belief Funds. Washington, DC: U.S. Authorities Printing Workplace.