Everyone ought to have some investments in shares. Though shares present zero utility, some shares present dividend revenue and all shares have the potential for capital appreciation. Since 1926 the S&P 500 has returned about 10% on common a 12 months.

Additional, sooner or later in your life you need to promote some shares to purchase what you need. As soon as you have gathered or made sufficient, exit and revel in a few of your positive aspects. In any other case, there’s actually no level investing in shares.

In contrast to actual property, you may’t sleep in your shares. In contrast to nice artwork, you may’t cling your shares in your wall to get pleasure from. And in contrast to nice wine, you may’t drink your shares.

In different phrases, shares are ineffective in the event you do not promote them every so often. Shares are a method to an finish.

The Major Issues To Purchase After Promoting Shares

There are a lot of explanation why you’d wish to promote shares. However first, let’s remove as a purpose of believing shares are overvalued and also you count on the inventory market to appropriate. Timing the inventory market is tough.

Beneath is a chart that reveals the annual returns and intra-year declines of the S&P 500 since 1980. Regardless of common intra-year drops of 14 p.c, annual returns have been optimistic in 32 of 42 years, or 76% of the years.

Let’s discuss some precise belongings you may wish to purchase together with your inventory proceeds. As an investor, you are manner forward of those that simply spend all their cash now!

1) Promote shares to purchase a automotive

When you’ve been investing in shares for plenty of years, and so they have appreciated to the place you should purchase a automotive in money, then promoting shares may not be a nasty thought. The secret is to observe, or carefully observe, my 1/tenth rule for automotive shopping for.

When you do not, you’ll most likely remorse shopping for an overpriced automotive because the inventory market tends to go increased yearly ~76% of the time. Promoting shares to pay for a automotive is psychologically tougher since you’re buying and selling a possible wealth builder for a assured wealth destroyer.

However in the event you want a automotive for work or to move your children to highschool, then shopping for a automotive is a necessity. Simply attempt to pay as little as potential for the most secure automotive you’ll find.

Instance of promoting shares to purchase a automotive

For instance you wish to purchase a $38,000 automotive and the lease or automotive buy fee is $400 a month. The purpose is to have a minimum of $38,000 in inventory investments in your taxable portfolio. However the choice is to have a minimum of $38,000 in inventory positive aspects. From there, you may resolve to promote inventory to pay for the automotive nonetheless manner you need.

I might fairly pay money for a automotive with my capital positive aspects. Nonetheless, leasing a automotive or borrowing to purchase the automotive so you do not tie up as a lot capital could also be useful. However in the event you go the month-to-month funds route, you need to be capable to pay for the automotive by way of your month-to-month money circulate.

The act of promoting shares to pay money for a automotive nonetheless offers me the shudders. I drove a sub $9,000 automotive from 2003 – 2017 as a result of I could not stand lacking out on potential inventory market and actual property market positive aspects.

2) Promoting shares to pay for faculty tuition

Hopefully, mother and father begin saving for faculty as quickly as their child is born. Some of the tax-efficient methods to take action is by investing in a 529 plan. After-tax cash goes in, however the cash will get to compound tax-free and withdrawals are tax-free to pay for certified academic bills.

One other technique is to pay for faculty with a Roth IRA. The tax implications are comparable, however there are fewer restrictions on what you may spend the Roth IRA cash on.

Promoting shares and bonds, normally within the type of a goal date index fund, to pay for faculty is simple. For a 529 plan, the funds have to be used for faculty and as much as $10,000 a 12 months for personal grade faculty.

As well as, the worth of a school diploma ought to equal to a minimum of the whole tuition price you pay to get a level. In any other case, you should not be keen to pay it if it will not increase your future revenue era energy.

When you promote shares to pay for faculty, you are truly simply shifting property in your internet value.

Is perhaps onerous to make use of all of the 529 funds to pay for faculty

After probably 18 or extra years of saving and investing to your kid’s faculty schooling, you may not wish to use all of the funds. I think about a state of affairs the place I attempt to persuade my youngsters to go to a cheaper public college or a college that gives extra scholarships to save cash, even when the rating is not as excessive.

This manner, leftover 529 funds could be rolled right into a Roth IRA for use for no matter. Alternatively, the 529 plan’s beneficiary could be modified to another person’s identify, together with your grandchild’s identify. Would not that be good?

3) Promoting shares to purchase a home

Shopping for a home is without doubt one of the predominant causes to promote shares. When you plan to reside someplace for a minimum of 5 years, it is best to get impartial actual property by shopping for your major residence.

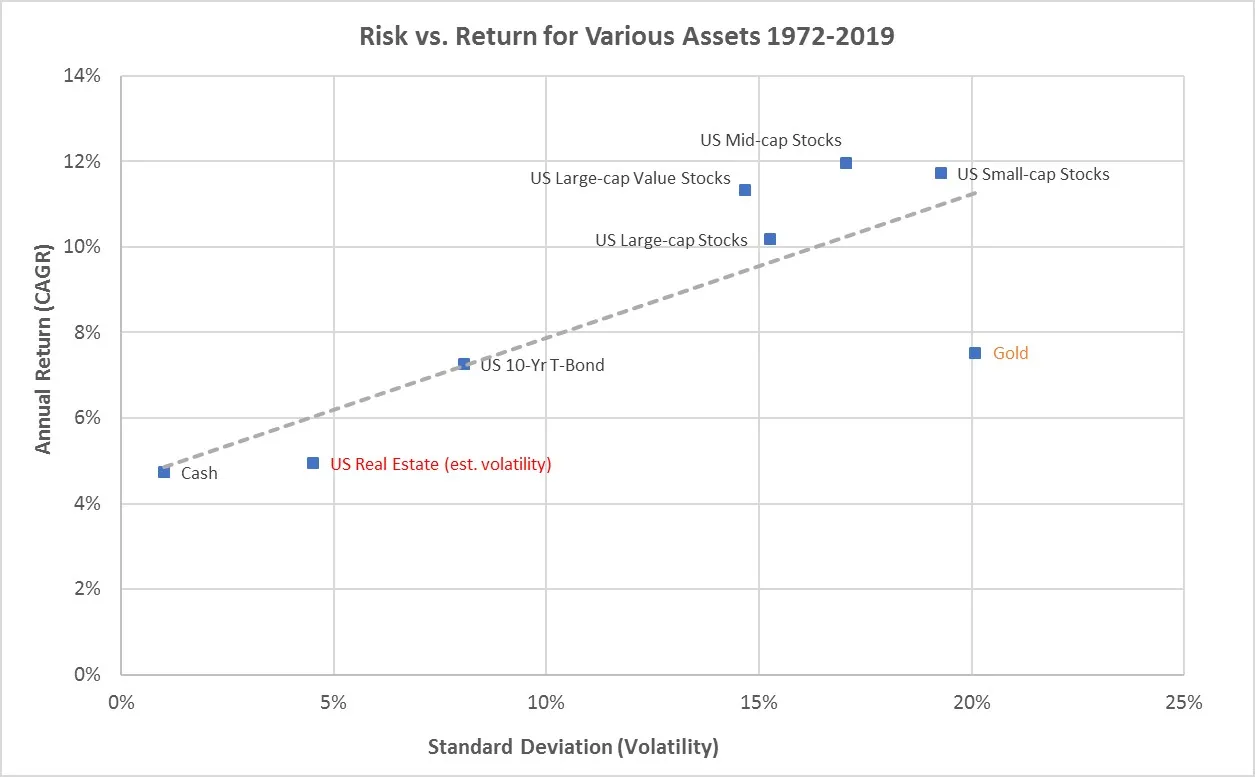

Traditionally, actual property has appreciated on the fee of inflation plus 1-2% a 12 months. Due to this fact, in the event you promote shares to purchase a home, you are buying and selling a extra risky asset with the next historic return for a much less risky asset with a decrease historic return.

Nonetheless, relying on the downpayment quantity, the returns from actual property could possibly be higher than shares. And in the event you can get pleasure from your funding within the meantime, then what a terrific mixture.

Shopping for a dream home with shares

A dream house got here again in the marketplace a 12 months later asking 7% much less. I’d have purchased the house for its asking value final 12 months if I had the cash. However I didn’t because the bear market decreased the worth of my inventory and bond holdings.

As a consequence of my negotiating expertise and willingness to let the promoting agent characterize me, I will buy the house for 14% lower than final 12 months’s asking value. In consequence, I’m extremely tempted.

I wasn’t anticipating to purchase one other without end house three years after buying my present without end house in June 2020. However right here we’re. The one downside is that this house requires me to promote loads inventory to pay money.

Happily, the inventory market has rebounded in 2023, so I truly do not thoughts promoting a variety of inventory at present valuations. I may promote some losers to offset capital positive aspects.

4) Promoting shares to pay for emergency bills

Hopefully, everybody has a minimum of six months of dwelling bills saved up always. In that case, most emergency bills could be paid for utilizing the emergency fund plus month-to-month money circulate.

Nonetheless, if the emergency expense prices greater than your emergency fund’s worth, then promoting shares to pay for the shortfall is smart.

Though there is no such thing as a appreciation potential paying for an emergency expense, paying for an emergency is a necessity. The cash spent may save a life, pay for a deductible for insurance coverage protection to pay out, or stop issues from getting worse.

5) Promoting shares to fund your retirement

Promoting shares to pay for retirement is normally the principle purpose why we’re inspired to put money into shares within the first place. Nonetheless, after a lifetime of investing in shares, it is usually tough to decumulate. As an alternative, it feels a lot better to put money into dividend-paying shares and attempt to reside off the dividend as a substitute of the principal.

In retirement, we are going to hopefully obtain revenue within the type of Social Safety advantages, pension, passive funding revenue, and/or distributions from our tax-advantaged accounts. The extra revenue sources for retirement the higher.

Nonetheless, if we solely have Social Safety advantages and our 401(okay) or IRA to pay for retirement, then promoting shares stands out as the solely manner. You possibly can’t take your shares with you, so that you may as effectively promote shares to fund the remaining years of your life.

The tax penalties of promoting shares in retirement could be important. Therefore, it’s greatest to have a mix of a Roth IRA and 401(okay), if accessible. Roth IRAs don’t require withdrawals till after the dying of the proprietor; nonetheless, beneficiaries of a Roth IRA are topic to the RMD guidelines.

Will be tough to promote inventory in the event you retire early

After I left work in 2012 I ready to promote some shares to pay for retirement. Nonetheless, I could not as a result of I used to be solely 34. Promoting inventory then felt like I used to be short-changing my future wealth. We have been solely a few years out of the world monetary disaster and I felt there was a variety of upside.

As an alternative of promoting shares, I ended up making supplemental revenue doing issues I used to be interested in or loved, e.g. consulting for startups, writing on-line. The pattern continues as we speak.

However I’ve to think about that when we’re previous 65 years outdated, promoting shares to pay for retirement is less complicated. We’re extra conscious of our mortality as we age. Additional, by then, it is simpler to mannequin our monetary wants given we’ve got fewer years to plan forward.

Promote The Losers Or The Winners?

In case you are an energetic investor, one dilemma you may discover when promoting shares to purchase one thing is which shares to promote first?

Normally, winners are likely to carry on profitable whereas losers are likely to carry on dropping. Turnaround tales are uncommon, however they do occur. Though, all corporations have life cycles.

Given losers are likely to carry on dropping, it might be greatest to promote your losers first. This manner, you’ll not should pay capital positive aspects tax. As an alternative, you may get to deduct as much as $3,000 in investments losses for the 12 months. Or you may deduct as much as the whole inventory loss you probably have an equal capital achieve that 12 months. Verify the newest tax loss guidelines.

If the sale of your losers cannot cowl what you wish to purchase, then you definately’ll should promote some winners. Ideally, you promote sufficient winners with sufficient capital positive aspects to offset your capital losses. This manner, you may pay zero or minimal capital positive aspects tax.

When you’re speaking about promoting inventory in an index fund, just like the S&P 500, then you don’t have any different selection. Everytime you promote inventory within the S&P 500 to purchase one thing, settle for that ~76% of the time you’ll miss out on future positive aspects over the next 12 months.

This potential alternative price is without doubt one of the predominant explanation why prodigious traders discover it so tough to ever promote.

Plan As Far Forward As Potential

Danger management and tax legal responsibility administration are the 2 predominant causes to plan forward earlier than promoting shares to pay for one thing.

The farther sooner or later your expense, equivalent to 18 years to your new child’s faculty tuition, the extra aggressively you may put money into shares. The nearer your youngster will get to varsity age, the extra the goal date fund will shift its asset allocation in direction of bonds and away from shares .

As for purchasing a home, there’s much more threat investing your down fee or all-cash fee largely in shares. Given the median house value in America is round $420,000, you may need a minimum of a $84,000 down fee plus a $42,000 buffer in case you are following my 30/30/3-5 house shopping for information.

When you make investments 100% of the $126,000 in shares and a 35% bear market hits, you will not be capable to comfortably afford to purchase your goal $420,000 house anymore. If you wish to pay $5 million money to your dream house and also you make lower than $1 million a 12 months, then you may’t afford to speculate nearly all of your dream house fund in shares.

I wrote a put up on easy methods to make investments your down fee in the event you plan to purchase a home inside varied time frames. The nearer you might be to purchasing your home, the much less your down fee ought to be invested in shares.

Often Promote Shares To Stay Your Greatest Life

In my 20s, I by no means thought-about promoting shares to pay for something. I used to be dedicated to saving and investing as a lot as potential for retirement. After experiencing pretend retirement for over eleven years, I am OK with promoting shares to pay for issues. At 46, sadly, my life is half over.

In my view, one of the simplest ways to “decumulate” is to improve properties.

I put decumulate in quotes as a result of shopping for a pleasant home at a terrific value may also act as an funding. The cash does not simply go to zero. Quite the opposite, the asset shift may respect as the house could respect over time. However I’m not shopping for the house to earn a living. I’m shopping for the house to improve our life-style.

There’s actually no level saving aggressively and investing properly if we do not often take income and spend.

When you’re in your 40s and past, in case your shares have appreciated to the purpose it will possibly purchase you a dream house, pay for a secure automotive, or purchase no matter your coronary heart needs, I say go for it. You’ve already been investing for 20 plus years.

Replenish Your Inventory Publicity, Create New Wealth Targets

When you promote shares to purchase one thing, assessment your new internet value composition. After reviewing your internet value breakdown, create a brand new internet value purpose and composition goal.

In my case, if I promote shares to purchase a brand new home, I’ll begin dollar-cost averaging again into the inventory market with my month-to-month money circulate. My predominant purpose can be to spice up my internet value in order that my new house turns into lower than 20% of my internet value.

And possibly I will get fortunate with this home buy. There is a ~24% likelihood I may promote shares earlier than one other correction hits. There’s additionally an opportunity I purchase this home earlier than costs begin ticking up when mortgage charges decline once more. Or the alternative may occur.

No one is aware of for certain. However what I do know is that life goes on. Delaying gratification by investing ought to solely go to date.

Reader Questions and Options

Do you usually promote shares to pay for issues? What have you ever bought lately together with your inventory sale proceeds? Do you wish to promote your winners first or your losers? What strategy do you are taking to make sure you’re monetizing the worth of your inventory holdings?

Enroll with Empower, the most effective free device that will help you grow to be a greater investor. With Empower, you may monitor your investments, see your asset allocation, and X-ray your portfolios for extreme charges. When you hyperlink up $100K+ in investable property, you may get a free portfolio assessment and free customized plan with considered one of its monetary advisors.

For extra nuanced private finance content material, be part of 60,000+ others and join the free Monetary Samurai publication and posts by way of e-mail. Monetary Samurai is without doubt one of the largest independently-owned private finance websites that began in 2009.