This system wants more cash, however not as a result of it will increase the deficit.

The Harmony Coalition, one in all quite a lot of federal price range watchdog teams, has been driving me loopy of late. The repeated message is that our deficits are too excessive, and subsequently we’ve got to do one thing about Social Safety and Medicare. They try to buttress their arguments by sending alongside op-eds written by like-minded specialists. And so they reiterated their place with the Congressional Funds Workplace’s (CBO) launch of its 2023 Lengthy-Time period Funds Outlook.

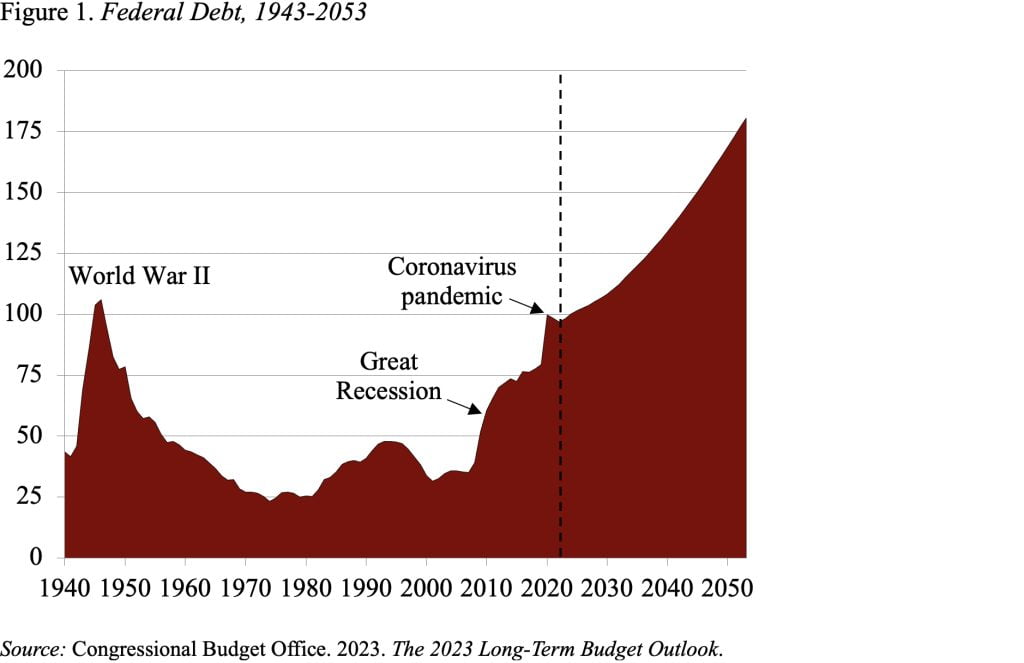

The CBO headlines are certainly alarming. The company initiatives that annual federal deficits will improve steadily between now and 2053 (see Determine 1), at which era debt held by the general public will attain 181 p.c of GDP – an all-time excessive.

Whereas we clearly have to do one thing, it’s not clear to me why Social Safety or Medicare needs to be on the chopping block. Let’s concentrate on Social Safety.

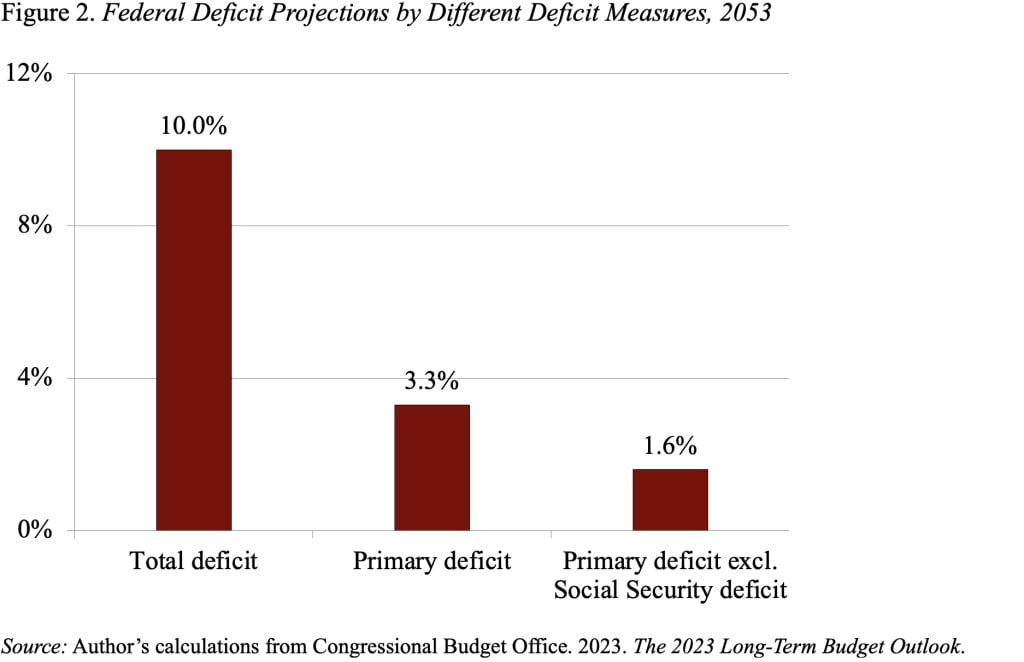

First, Social Safety doesn’t contribute one iota to the deficit, since, by legislation, it might solely pay advantages from its belief funds. As soon as the belief funds go to zero within the early 2030s, Social Safety pays solely these advantages coated by incoming revenues – primarily payroll taxes. The CBO projections, nevertheless, assume that Social Safety continues to pay scheduled advantages though it doesn’t have the cash to take action. Limiting Social Safety’s outlays to its approved ranges (about 75 p.c of scheduled advantages) cuts the 2053 major federal deficit (the deficit excluding curiosity funds) in half (see Determine 2).

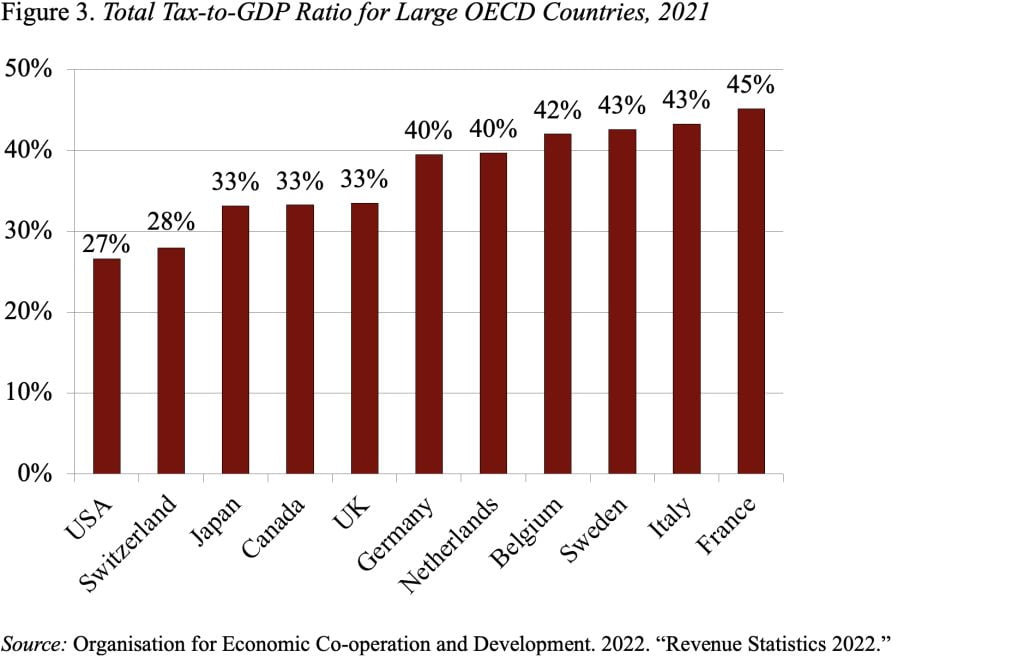

Don’t get me fallacious; I would like Social Safety to proceed to pay scheduled advantages. They’re the life blood of retirement earnings for all however the nicely paid. However paying scheduled advantages requires extra revenues. If the complete burden had been on the present payroll tax, the speed must go up by about 2 share factors for each the employer and the worker. However a number of different payroll tax choices additionally exist, and, for my part, a robust case may be made for an infusion of basic revenues. People are dramatically undertaxed in comparison with different giant OECD international locations (see Determine 3).

Sorry to maintain happening, however the op-ed the Harmony Coalition forwarded was additionally annoying. The authors had been two earlier congressional staffers who ought to have identified higher. However inside a couple of quick paragraphs, they put forth three defective arguments.

- First, they contend that Social Safety was instituted when life expectancy was about 65 and now it’s within the excessive 70s. Since advantages began at 65 and the common particular person was useless, prices will need to have been actually low certainly! The error is life expectancy at beginning, which certainly has gone up by 14 years – primarily because of a discount in toddler mortality The related numbers are life expectancy at 65, which has gone up 6 years.

- Second, they assert that Social Safety will probably be bancrupt within the early 2030s. In response to the Merriam-Webster dictionary, bancrupt is outlined as: 1) unable to pay money owed as they fall due; or 2) having liabilities in extra of belongings. Neither applies to Social Safety as a result of it has no liabilities in extra of revenues and subsequently pays all money owed as they arrive due.

- Third, they finish their pitch for reducing Social Safety with a suggestion to extend this system’s Full Retirement Age, arguing that it’s honest “to inform all 20-year-olds that they need to not all count on to retire at 65.” How might they’ve missed the truth that the Full Retirement Age has moved from 65 to 67?

The underside line – Social Safety does want consideration, however for program – not price range – causes. Future retirees will want the extent of safety that Social Safety at the moment gives. There isn’t any manna from heaven. Revenues have to be raised. Happily, our taxes relative to GDP are actually low in comparison with different OECD international locations, so we’re well-positioned to lift the required revenues.