Too many retirees of coloration are within the financially precarious state between outright poverty and barely getting by.

Far bigger shares of the nation’s Latino, Black, Asian, and Native American retirees are financially insecure than Whites, in line with a brand new report confirming the now-familiar racial disparities that face each staff and retirees on this nation.

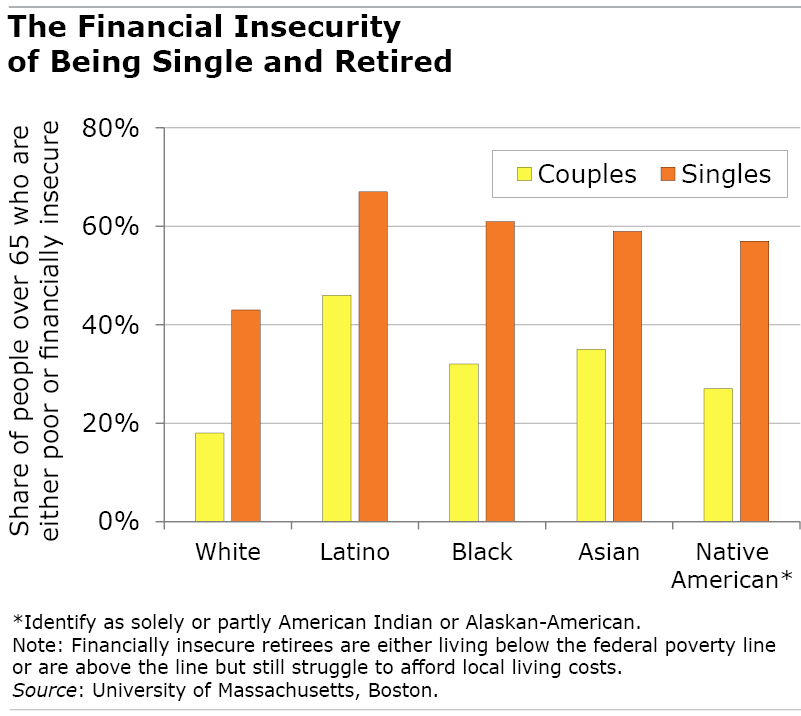

However what additionally stands out in this report, produced by The Gerontology Institute on the College of Massachusetts, Boston, is the gaping disparity between retired single folks and married {couples}.

First, contemplate older White Individuals. They’re in the most effective place financially. But about two in 5 single White retirees are financially insecure, whereas just one in 5 {couples} is. Single Latino retirees are a lot worse off – two out of three are financially insecure, in contrast with underneath half of Latino {couples}.

The institute defines Individuals over 65 as being financially insecure – a complete of 12 million folks – if they’re both beneath the federal poverty degree or, if they don’t seem to be poor, would not have sufficient retirement revenue to afford the price of dwelling of their space.

Extra folks of coloration fall into this hole as a result of they earn much less throughout their working years, and the monetary disparity carries into their retirement.

Though Social Safety advantages change a bigger proportion of low-income staff’ earnings after they’re retired, it’s nonetheless tough to avoid wasting in the event that they’re simply scraping by. They usually might not have entry to an employer 401(okay) that might enhance their probabilities of saving even small quantities. If a employee is an immigrant missing authorized residency, she or he wouldn’t qualify for Social Safety advantages later.

The distinction between the retirement lifestyle for single and married folks of coloration additionally “is de facto essential,” stated Jan Mutchler, the institute’s director, who pointed to a few causes.

First, housing prices are much less of a burden if two persons are capable of pool their Social Safety and different sources of retirement revenue and cut up housing prices similar to lease, utilities, or property taxes.

A second, associated issue within the single-couples disparity is that extra retired girls, who tended to have had much less revenue after they had been working, are single: 33 p.c of ladies over 65 reside alone and usually tend to be supporting themselves on one supply of revenue. Males over 65 usually tend to be in two-person households – solely 20 p.c dwell alone.

“The intersection of race and gender is of particular concern, as financial insecurity is very prevalent amongst single girls of coloration,” the report concluded.

Some fascinating geographic patterns emerged from the institute’s estimates for every state. New York is the place Asian inequality stands out. Retired Latinos in Massachusetts are worse off than in different states. Amongst Black retirees, the very best fee of insecurity might be present in Mississippi. And the very best charges for White {couples} might be present in two very completely different states: Mississippi and Vermont.

“Individuals of coloration [are] at greater threat of getting into later life with few monetary sources, little wealth, and little or no pension revenue, compounding different challenges confronted in previous age,” the report concluded.

Squared Away author Kim Blanton invitations you to observe us on Twitter @SquaredAwayBC. To remain present on our weblog, please be a part of our free electronic mail checklist. You’ll obtain only one electronic mail every week – with hyperlinks to the 2 new posts for that week – while you enroll right here. This weblog is supported by the Middle for Retirement Analysis at Boston School.