Most is because of change in this system’s 75-year horizon.

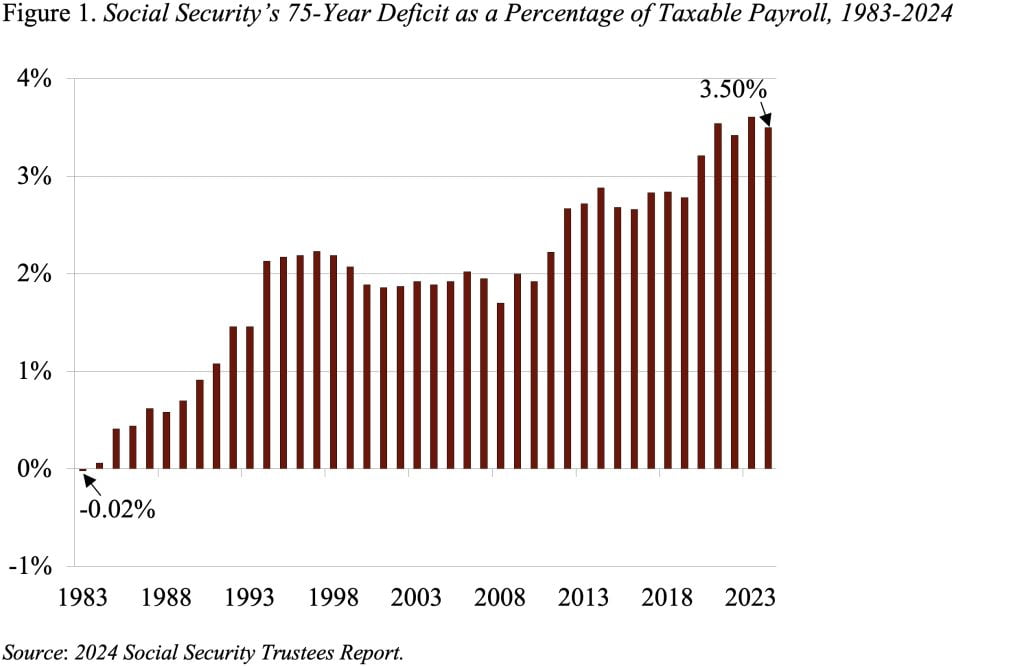

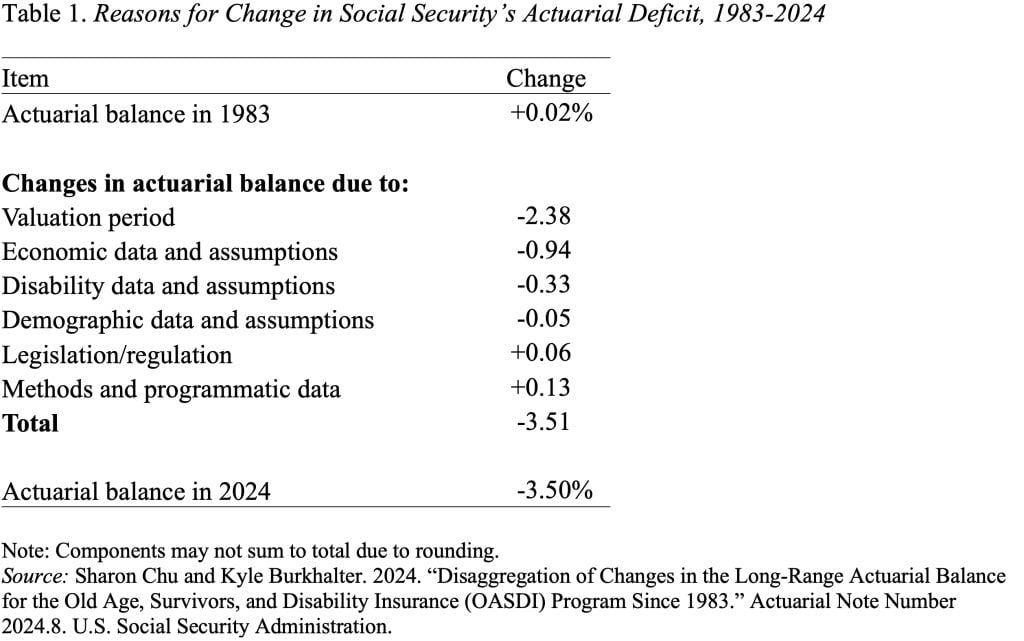

The 2024 Social Safety Trustees Report confirmed a 75-year deficit of three.50 p.c of taxable payrolls in comparison with a surplus of .02 p.c in 1983. Whereas the rise within the deficit during the last 41 years is giant, two-thirds of the rise was completely predictable in 1983 and far of the rest is because of an unanticipated growth exterior this system’s purview.

First, the predictable a part of the story. The explanations for the rise in Social Safety’s 75-year deficit during the last 41 years are proven in Desk 1. Main the record is advancing the valuation interval. Every time the 75-year interval strikes ahead one yr – for instance, from 1983-2057 to 1984-2058 – it picks up a yr with a big detrimental stability. The cumulative impact of including these detrimental balances during the last 41 years has been to extend the 75-year deficit by 2.38 p.c of taxable payrolls. That’s, greater than two-thirds of the 41-year change within the deficit is attributable to easily shifting the valuation interval ahead.

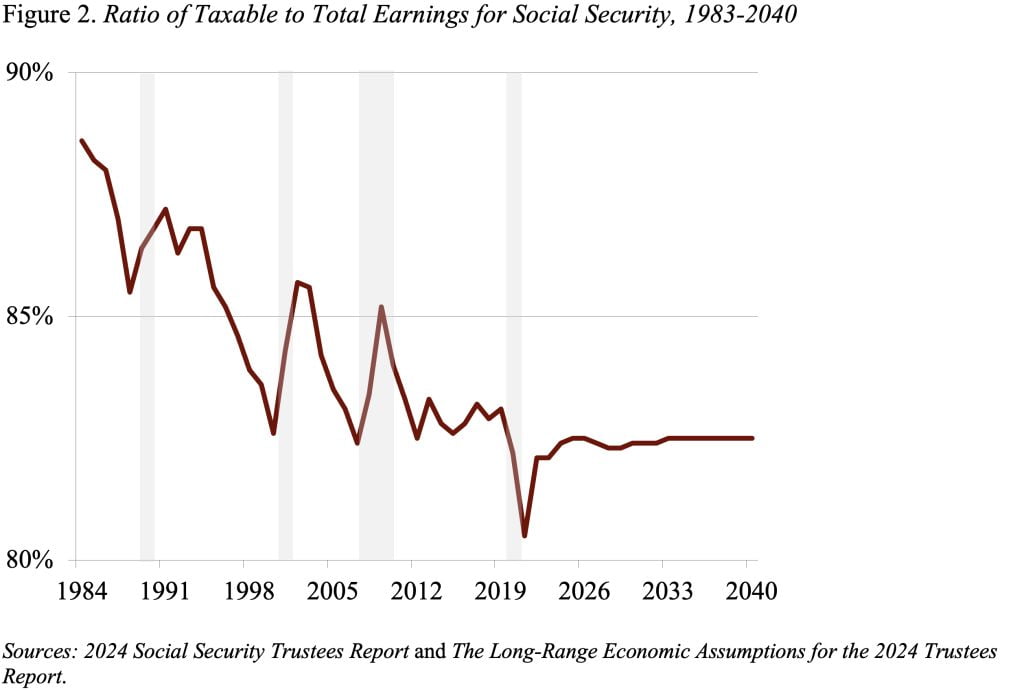

The truth that a lot of the rise within the deficit is because of a mechanical situation – not a change in prices or revenues – ought to give us confidence within the accuracy and stability of the actuaries’ projections. Furthermore, a lot of the remaining one-third of the deficit enhance is because of a largely unanticipated growth – particularly, the rise in earnings inequality, which has led to an enormous decline within the ratio of taxable earnings to lined earnings.

Let me clarify. Solely earnings under Social Safety’s contribution and advantages base of $168,600 in 2024 are topic to this system’s payroll taxes and depend in direction of advantages. The fraction of whole earnings under this threshold is the taxable ratio. As inequality has elevated, the share of earnings topic to tax has declined from nearly 90 p.c in 1983 to 82 p.c immediately (see Determine 2).

A decline within the taxable ratio raises Social Safety prices for 2 causes. To grasp the consequences of each channels, assume that common wage development for employees general is fixed, however that the expansion shifts to the higher finish of the revenue distribution.

The primary channel is thru the progressivity of the Social Safety profit method – that’s, Social Safety offers greater advantages relative to earnings for low earners than for top earners. Consequently, an increase within the share of lined earnings above the taxable cap means comparatively decrease earnings development for employees of modest means. This slower earnings development means much less tax income for Social Safety, however – due to the progressive profit method – future advantages don’t decline by a commensurate quantity.

A second channel by which rising earnings inequality erodes Social Safety’s funds is thru the Common Wage Index (AWI). The AWI relies on all lined earnings, each under and above the taxable most. An increase within the AWI that’s pushed by development in earnings above the taxable most generates no extra tax income. However such an increase does enhance advantages as a result of the AWI is used to inflate employees’ prior earnings when calculating their profit ranges.

Whereas the actuaries in 1983 knew that Social Safety prices would enhance over time because of the getting older of the inhabitants and so they knew the 75-year deficit would rise because the valuation interval moved ahead, they’d not deliberate on the rise in earnings inequality. However now that too is constructed into the projections.