The CAPE Ratio assesses a inventory’s value in comparison with its common earnings over the previous 10 years, adjusted for inflation. A excessive CAPE Ratio means that shares is perhaps overvalued relative to historic earnings, indicating potential draw back dangers.

The image isn’t as clear-cut because it appears, nevertheless. One of many major drawbacks of equal weighting, as critics level out, is the extra drag on efficiency from its methodology.

Take the Invesco S&P 500 Equal Weight ETF (RSP) for example. It has a 21% turnover and a 0.20% expense ratio. The Canadian-listed model is the Invesco S&P 500 Equal Weight Index ETF (EQL, EQL.F). In distinction, SPY maintains a mere 2% turnover and a decrease expense ratio of 0.0945%.

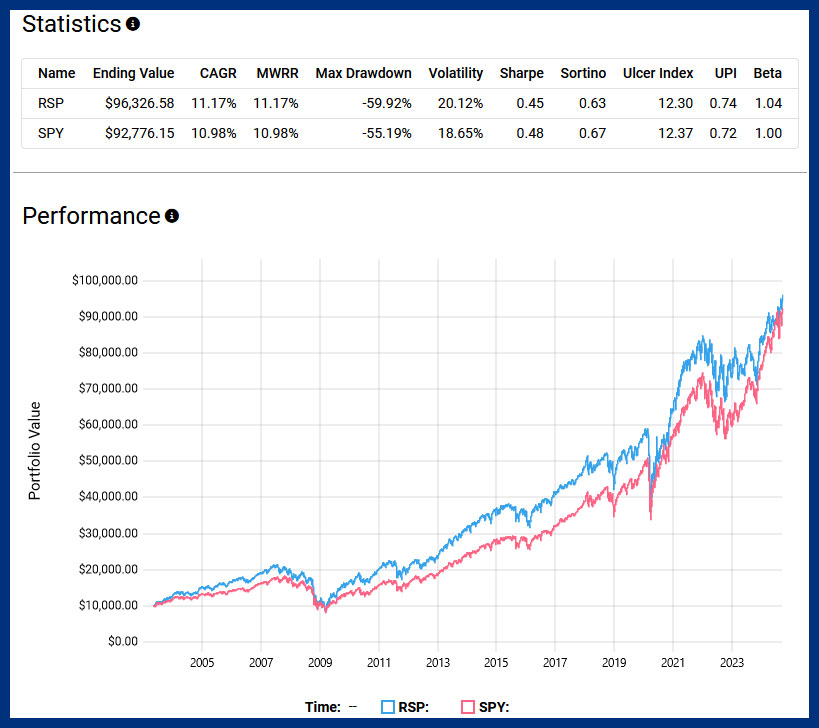

Whereas it’s true that RSP outperformed SPY in whole returns since its inception in April 2003, the victory isn’t as clear-cut because it may appear. The danger-adjusted return of RSP, indicated by a Sharpe ratio of 0.45, is barely decrease than SPY’s 0.48. What does that imply? It might recommend that RSP took on greater volatility for less than marginally higher returns. Furthermore, RSP skilled a deeper most drawdown than SPY. A most drawdown measures the biggest single drop from peak to trough throughout a specified interval, indicating a better historic threat of losses for buyers.

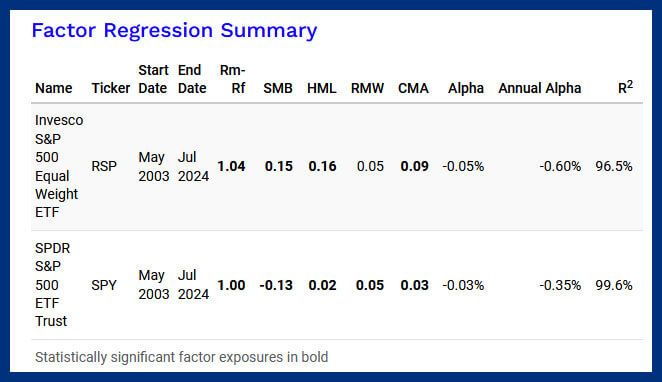

Additional evaluation by way of issue regression reveals that almost all of RSP’s outperformance might be attributed to the scale. Basically, RSP’s equal-weighted methodology has inadvertently skewed its publicity in direction of smaller and extra undervalued corporations, which traditionally have contributed to outperformance.

This raises a important level: If the purpose is to spend money on these sorts of corporations, wouldn’t it’s extra simple and environment friendly to focus on them immediately based mostly on elementary metrics somewhat than adopting a blanket equal-weighting method to the complete S&P 500?

I discover myself siding with cap weighting now. The first attraction is simplicity. Market-cap methods require fewer selections concerning rebalancing or reconstitution, which in flip retains sources of friction like turnover and costs significantly decrease—leading to fewer headwinds to efficiency.

In an excellent frictionless world, the attraction of equal weighting is obvious. Nevertheless, the truth of quarterly rebalancing and better charges related to equal-weight ETFs has not traditionally yielded higher risk-adjusted returns over the past twenty years.