January 26, 2023

Center Class Will get the Most from Medicare

This can be a reality of retirement life: older Individuals haven’t paid as a lot into Medicare and Medicaid as authorities spends on their healthcare and nursing house stays.

This can be a reality of retirement life: older Individuals haven’t paid as a lot into Medicare and Medicaid as authorities spends on their healthcare and nursing house stays.

However it’s middle-class retirees who get essentially the most out of the system, based on a new examine.

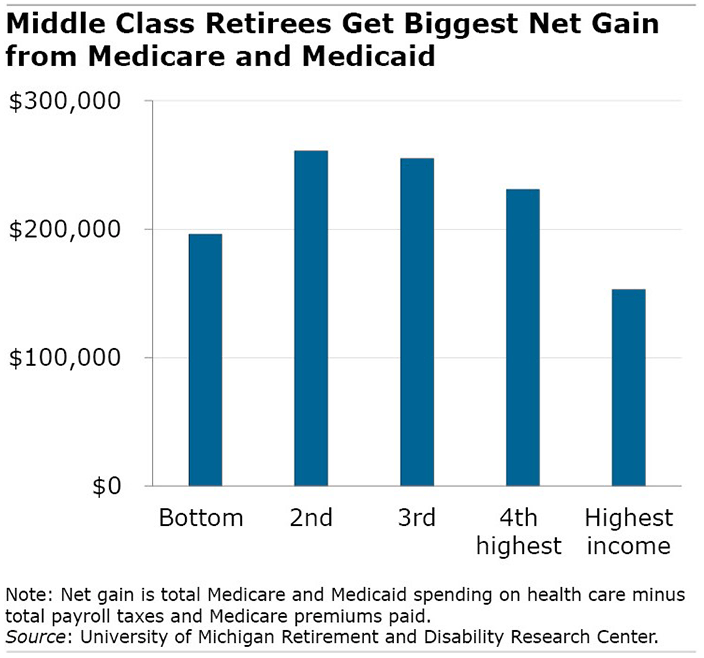

Center-income households obtain about $230,000 to $260,000 extra in Medicare and Medicaid advantages, on common, throughout their retirement years than the whole quantity they’ve paid in. Their contributions encompass the Medicare payroll and earnings taxes deducted from staff’ paychecks, the portion of their federal and state earnings taxes dedicated to Medicare and Medicaid, and the Medicare Half B and D premiums they’re paying in retirement.

The web good thing about the packages to the center class dwarfs the $153,000 in common web advantages for retired households within the prime fifth of the lifetime earnings distribution, and it additionally exceeds the $196,000 achieve for the underside fifth.

The center class is outlined because the second, third, and fourth of the 5 earnings teams the researchers analyzed on this examine. The annual knowledge used to calculate the well being spending and fee estimates for this evaluation are adjusted for inflation.

Individuals over 65 obtain a 3rd of all of the medical care supplied on this nation. This new analysis, funded by the U.S. Social Safety Administration, makes use of authorities administrative knowledge to match the advantages of Medicare and its smaller companion program, Medicaid, for every earnings group.

Individuals over 65 obtain a 3rd of all of the medical care supplied on this nation. This new analysis, funded by the U.S. Social Safety Administration, makes use of authorities administrative knowledge to match the advantages of Medicare and its smaller companion program, Medicaid, for every earnings group.

There are two causes the center class will get essentially the most from the system. First, though the highest earners stay the longest and obtain essentially the most medical care, the center class lives virtually as lengthy and finally ends up receiving a major quantity of care.

Second, the taxes the center class pays to fund Medicare and Medicaid are lower than is paid by the highest earners. Center-income staff and retirees have a decrease marginal tax price for the portion of their federal and state earnings taxes that go towards retiree medical care. And since their earnings are decrease, they pay much less in whole for the Medicare payroll tax, which offers the identical well being advantages for everybody however is a hard and fast share of a employee’s earnings. The much less somebody earns, the much less they pay for his or her future medical care.

Low-income retirees would possibly at first look appear to be the most important beneficiaries, since they’ve paid the least in taxes over their careers and are way more more likely to want the means-tested Medicaid program to cowl the medical care that Medicare doesn’t cowl, together with costly nursing houses. Nonetheless, low-income retirees get lower than the center earnings group from this system as a result of they’ve the shortest life span. Though they are typically in poorer well being, they don’t require as a lot well being care general as different retirees.

The researchers estimated the lifetime web advantages utilizing surveys of staff who turned 65 someday between 1999 and 2004. They paired the surveys with authorities knowledge on earnings to estimate the whole taxes paid by staff in every earnings group. Individually, they estimated the federal government subsidies of retirees’ medical care beneath Medicare Elements A, B, and D and Medicaid, which is a joint federal-state program.

The evaluation is sophisticated however the researchers’ message is obvious. “The biggest beneficiaries of Medicare and Medicaid are these in the midst of the earnings distribution.”

To learn this examine, authored by Karolos Arapakis, Eric French, John Bailey Jones, and Jeremy McCauley, see “How Redistributive are Public Well being Care Schemes? Proof from Medicare and Medicaid in Outdated Age.”

The analysis reported herein was derived in complete or partially from analysis actions carried out pursuant to a grant from the U.S. Social Safety Administration (SSA) funded as a part of the Retirement and Incapacity Analysis Consortium. The opinions and conclusions expressed are solely these of the authors and don’t symbolize the opinions or coverage of SSA, any company of the federal authorities, or Boston School. Neither the US Authorities nor any company thereof, nor any of their workers, make any guarantee, categorical or implied, or assumes any authorized legal responsibility or accountability for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any particular business product, course of or service by commerce identify, trademark, producer, or in any other case doesn’t essentially represent or indicate endorsement, suggestion or favoring by the US Authorities or any company thereof.