At present we’ll talk about the important thing variations between a mortgage co-borrower and a mortgage co-signer.

Whereas the 2 phrases sound fairly comparable, and are generally used interchangeably, there are essential distinctions that you ought to be conscious of it contemplating both.

In both case, the presence of a further borrower or co-signer is probably going there that will help you extra simply qualify for a house mortgage.

As an alternative of relying in your earnings, belongings, and credit score alone, you possibly can enlist assist out of your partner or a member of the family.

This will likely help you qualify for a bigger mortgage quantity, snag a decrease rate of interest, and even win a bidding battle by way of a stronger provide.

What Is a Mortgage Co-Borrower?

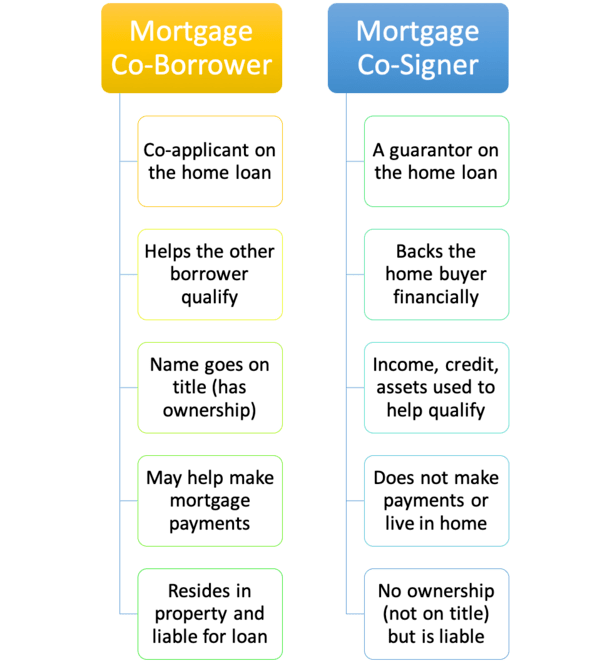

A mortgage co-borrower is a person who applies for a house mortgage alongside the primary borrower.

Sometimes, this could be a partner that will even be dwelling within the topic property. To that finish, they share monetary accountability and possession, and are each listed on title.

For instance, a married couple could determine to buy a house. They apply collectively as co-borrowers.

Doing so permits them to pool collectively their earnings, belongings, and credit score historical past. Ideally, it makes them collectively stronger within the eyes of the lender and the house vendor.

This might imply the distinction between an accredited or rejected loa software, and even a successful vs. shedding bid on a property.

Simply think about a house vendor who’s deciding between two competing bids with their actual property agent.

Do they go along with the borrower simply scraping by financially, or the married couple with two good jobs, two regular incomes, strong pooled belongings, deep credit score historical past, and so on.

Talking of that earnings, two incomes may permit you afford extra dwelling.

What Is a Mortgage Co-Signer?

A mortgage co-signer is a person who acts as a guarantor on a house mortgage and takes accountability for paying it again ought to the borrower fail to take action.

In that sense, the co-signer acts as a kind of security web, and never an lively participant.

This implies they don’t make month-to-month funds, nor do they reside within the topic property.

Maybe extra importantly, they don’t have possession curiosity within the property. Nonetheless, they share legal responsibility together with the borrower(s).

To be blunt, they get all of the potential dangerous with none of the nice, i.e. possession.

However the entire level of a co-signer is to assist another person, so it’s not about them. A standard instance is a mother or father co-signing for a kid to assist them purchase a house.

Each their earnings and credit score historical past can come into play to assist their baby get accredited for a mortgage.

For the document, somebody with possession curiosity within the property can’t be a co-signer. This consists of the house vendor, an actual property agent, or dwelling builder. That will be a battle of curiosity.

Mortgage Co-Borrower vs. Mortgage Co-Signer

What Is the Credit score Rating Influence for Co-Debtors and Co-Signers?

As a co-signer, you might be answerable for the mortgage for your entire time period, or till it’s paid off by way of refinance or sale.

This implies it’ll be in your credit score report and any destructive exercise (late funds, foreclosures) associated to the mortgage will carry over to you.

There are additionally credit score inquiries, although these normally have a minimal impression.

Nonetheless, it’s attainable the on-time mortgage funds will help you credit score over time, per Experian.

The opposite subject is it might restrict your borrowing capability if you happen to’re on the hook for the mortgage, even if you happen to don’t pay it.

Its presence may make it tougher to safe your individual new strains of credit score or loans, together with your individual mortgage, if needed, on account of DTI constraints.

In case you’re a co-borrower on a mortgage, credit score impression would be the similar as if you happen to had been a solo borrower. There will probably be credit score inquiries when making use of for a mortgage.

And the mortgage will go in your credit score report if/when accredited, and cost historical past will probably be reported over time.

On-time funds can enhance your rating, whereas missed funds can sink your rating.

What A few Non-Occupant Co-Borrower?

You might also come throughout the time period “non-occupant co-borrower,” which because the identify implies is a person on the mortgage who doesn’t occupy the property.

On prime of that, this particular person could or could not have possession curiosity within the topic property, per Fannie Mae.

This differs from a co-signer, who doesn’t have possession curiosity as indicated on title.

However each should signal the mortgage or deed of belief, and may have joint legal responsibility together with the borrower.

On FHA loans, a non-occupying co-borrower is permitted so long as they’re a member of the family with a principal residence in america.

If not a member of the family, or for 2-4 unit properties, a 25% down cost is required (max 75% LTV).

Both manner, the non-occupant co-borrower takes title to the property, not like a co-signer who doesn’t.

Notice that co-signers or non-occupant co-borrowers aren’t permitted on USDA loans.

And for VA loans, a co-signer should be a partner or lively responsibility/veteran who resides within the property.

Most lenders don’t permit non-occupying co-borrowers on VA loans, although a “joint mortgage” could also be an choice.

When To not Use a Co-Borrower for a Mortgage

Consider it or not, there are occasions when utilizing a co-borrower may do extra hurt than good.

The commonest instance is when the possible co-borrower has poor credit score, and even marginal credit score.

As a result of mortgage lenders usually take into account all debtors’ credit score scores after which take the decrease of the 2 mid-scores, you gained’t need to add somebody with questionable credit score (until you completely need to).

For instance, say you’ve got a 780 FICO rating and your partner has a 680 FICO rating. You propose to use collectively as a result of they’re your partner.

However then you definately discover out that the mortgage lender will qualify you on the 680 rating. That pushes your mortgage fee manner up.

On this case, you could not need to use the co-borrower until you want them for earnings functions.

They will nonetheless be on title and get possession within the property with out being on the mortgage.

How a Co-Borrower’s Larger Credit score Rating Can Make You Eligible for a Mortgage

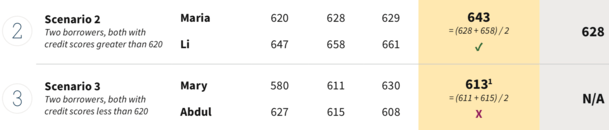

Just lately, Fannie Mae instituted a brand new technique for figuring out eligibility when there’s a co-borrower.

They take the median rating of every borrower and mix them, then divide by two (the common).

For instance, think about borrower 1 has scores of 600, 616, and 635. They’d usually use the 616 rating and inform the borrower it’s not adequate for financing.

Now suppose there’s a co-borrower (borrower 2) with FICO scores of 760, 770, and 780.

Fannie Mae will now mix the 2 median scores (770+616) and divide by two. That will end in a mean median credit score rating of 693.

This enables borrower 1 to adjust to Fannie/Freddie’s minimal 620 credit score rating requirement (for conforming loans).

Notice that that is only for qualifying, and provided that there’s a co-borrower. And it doesn’t apply to RefiNow loans or manually underwritten loans.

Moreover, pricing (and mortgage insurance coverage if relevant) remains to be decided by the consultant credit score rating (616).

So collectively you qualify, however the mortgage fee is perhaps steep based mostly on the decrease credit score rating used for pricing.

Notice that not all lenders could permit a borrower to have a sub-620 credit score rating, no matter these tips (lender overlays).

Methods to Take away a Mortgage Co-Borrower or Co-Signer

Whereas it may be good to have a mortgage co-borrower or co-signer early on, they might need out sooner or later.

There are a selection of the reason why, presumably a divorce, presumably to release their very own credit score.

Luckily, it may be achieved comparatively simply by way of a conventional mortgage refinance.

The caveat is that you simply’d must qualify for the brand new dwelling mortgage with out them. Moreover, you’d need mortgage charges to be favorable at the moment as effectively.

In spite of everything, you gained’t need to commerce in a low-rate mortgage for a high-rate mortgage merely to take away a borrower or co-signer.

A standard situation is perhaps a younger dwelling purchaser who wanted monetary help early on, however is now flying solo.

They might refinance and alleviate the attainable stress/monetary burden of the co-signer and at last stand on their very own.

Options to Utilizing a Co-Borrower/Co-Signer

In case you’re unable to discover a keen co-borrower or co-signer to go on the mortgage with you, there is perhaps alternate options.

First, decide what the difficulty is, whether or not it’s a low credit score rating, restricted earnings, or an absence of belongings.

These with low credit score scores could need to take into account bettering their scores earlier than making use of. Except for making it simpler to get accredited, you possibly can qualify for a a lot decrease rate of interest.

These missing earnings/belongings can look into choices that require little to no down cost.

For instance, each VA loans and USDA loans don’t require a down cost.

There may be additionally Fannie Mae HomeReady and Freddie Mac House Doable, each of which require simply 3% down and permit boarder earnings (roommate) to qualify.

Or inquire about grants and down cost help by way of an area lender or state housing company.

There are a lot of mortgages that require little or no down and subsequent to nothing by way of belongings/reserves.

You might also take into account reducing your most buy worth if these points persist.

An alternative choice is utilizing reward funds to decrease your LTV ratio and mortgage quantity, thereby making it simpler to qualify for a mortgage.