The 1098-E type is what you obtain for tax season for those who paid greater than $600 in scholar mortgage curiosity final 12 months.

Individuals receiving their 1098-E Scholar Mortgage Curiosity Assertion can qualify to deduct scholar mortgage curiosity. You probably have vital scholar mortgage debt, this might yield up to a couple hundred {dollars} in financial savings for you.

Right this moment, we break down what the 1098-E is, and the way it impacts your taxes so to probably declare the scholar mortgage curiosity deduction.

Who Qualifies To Take The Scholar Mortgage Curiosity Deduction?

To take the scholar mortgage curiosity deduction, you will need to pay not less than $600 in scholar mortgage curiosity. You possibly can solely deduct as much as a most of $2,500 in curiosity paid.

The scholar mortgage curiosity deduction is an adjustment of your gross earnings. So for those who paid $2,500 in scholar mortgage curiosity, and also you earned $60,000, you’ll solely pay taxes on $57,500.

For the needs of the deduction, it doesn’t matter whether or not your loans are federal loans or non-public scholar loans. Each qualify for the deduction.

The scholar mortgage curiosity deduction goes to the one that is legally required to pay the scholar loans. Meaning, in case your mother and father took out loans for you, they get the deduction. That is even true for those who make the funds for the loans.

Married debtors should choose to file taxes as married submitting collectively in the event that they need to qualify for the deduction.

The scholar mortgage curiosity deduction can also be affected by your earnings. It’s a deduction with a “part out interval” which suggests as your earnings grows, you’ll have a decrease deduction.

The desk beneath reveals how your earnings impacts your capacity to take a deduction for 2023 (once you file in 2024):

|

Deduction Relative to Earnings |

|

|---|---|

|

Lower than $75,000- Full Deduction $75,000-$89,000- Partial Deduction Greater than $90,000- No deduction |

|

|

Incomes lower than $150,000- Full Deduction $150,000-$180,000- Partial Deduction Greater than $180,000- No deduction |

Because the deduction is predicated on a Modified Adjusted Gross Earnings (MAGI) you’ll want to do a little bit of math to find out your earnings. All of the main tax software program packages will appropriately calculate your scholar mortgage curiosity deduction.

How Do I Know If I Qualify For The Scholar Mortgage Curiosity Deduction?

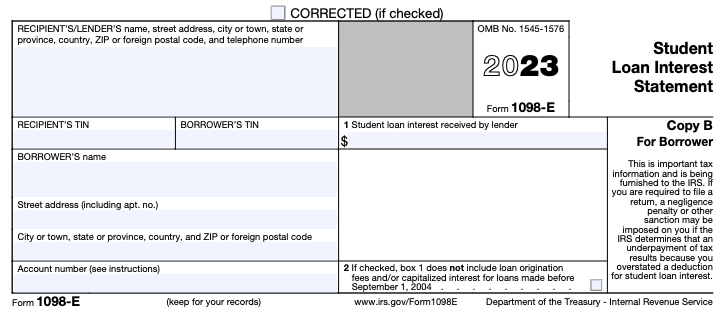

For those who meet or exceed the $600 curiosity requirement, your scholar mortgage servicer ought to mail you a replica of a 1098-E type. Field-1 of the 1098-E type accommodates the overall curiosity you paid in your loans within the earlier 12 months.

Individuals with a number of scholar mortgage servicers might not routinely obtain their 1098-E varieties in the event that they paid lower than $600 in curiosity per servicer. In these instances, name your mortgage supplier for extra data and to ask them to subject you the shape. When you don’t want the shape to finish your taxes, it’s loads simpler than making an attempt to determine the quantity of curiosity you paid by yourself.

Affect Of The Scholar Mortgage Pause

The scholar mortgage cost paused resulted in August of 2023. For a lot of debtors, the primary funds have been due in October 2023. The results of that is that many debtors may not have PAID $600 in curiosity in 2023 since they’d have solely made funds in October, November, and December.

Furtermore, roughly one-third of debtors have been positioned on administrative forbearance due to scholar mortgage servicer failures. These debtors wouldn’t have been required to make funds, and their rate of interest was 0%.

The top result’s that many debtors is not going to have paid sufficient curiosity to say the scholar mortgage curiosity deduction for 2023. Nevertheless, that will change in 2024.

How To Use The 1098-E Kind?

The 1098-E type is a really fundamental type that accommodates your private data and the quantity of curiosity you paid to the lender. For those who obtain a number of 1098-E varieties, you will have so as to add the quantities in Field-1 of the varieties to find out your whole quantity of curiosity paid.

Bear in mind, you possibly can deduct as much as a most of $2500.

For those who’re utilizing a tax software program to do your taxes, the software program will routinely calculate your deductions. Nevertheless, for those who’re hand submitting your taxes, you’ll have to enter your whole curiosity paid in your type 1040.

Because the scholar mortgage curiosity deduction is an above the road deduction, you don’t want to fret about a whole itemization schedule.

Have you ever ever claimed the scholar mortgage rate of interest deduction?