Sure, mounted revenue was hit by rising rates of interest, but it surely’s a small share of plan portfolios.

My colleagues JP Aubry and Yimeng Yin simply launched an replace on state and native pension plans. Their evaluation in contrast 2023 to 2019 – the yr earlier than all of the craziness started. Consider the bizarre occasions which have occurred in the previous couple of years: 1) the onset of COVID; 2) the next COVID stimulus; 3) declining rates of interest; 4) rising inflation; after which 5) rising rates of interest.

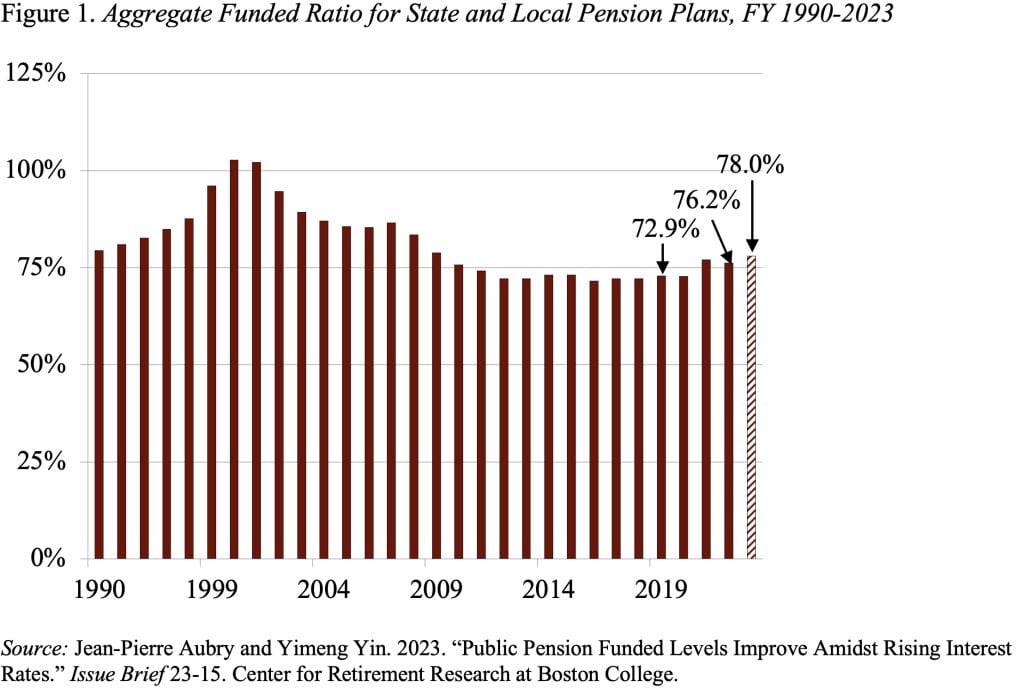

Regardless of the volatility of asset values over this era, the 2023 funded standing of state and native pension plans is about 78 p.c, which is 5 share factors larger than in 2019 (see Determine 1). In fact, the numbers for 2023 are estimates primarily based on plan-by-plan projections, however these projections have a wonderful observe document.

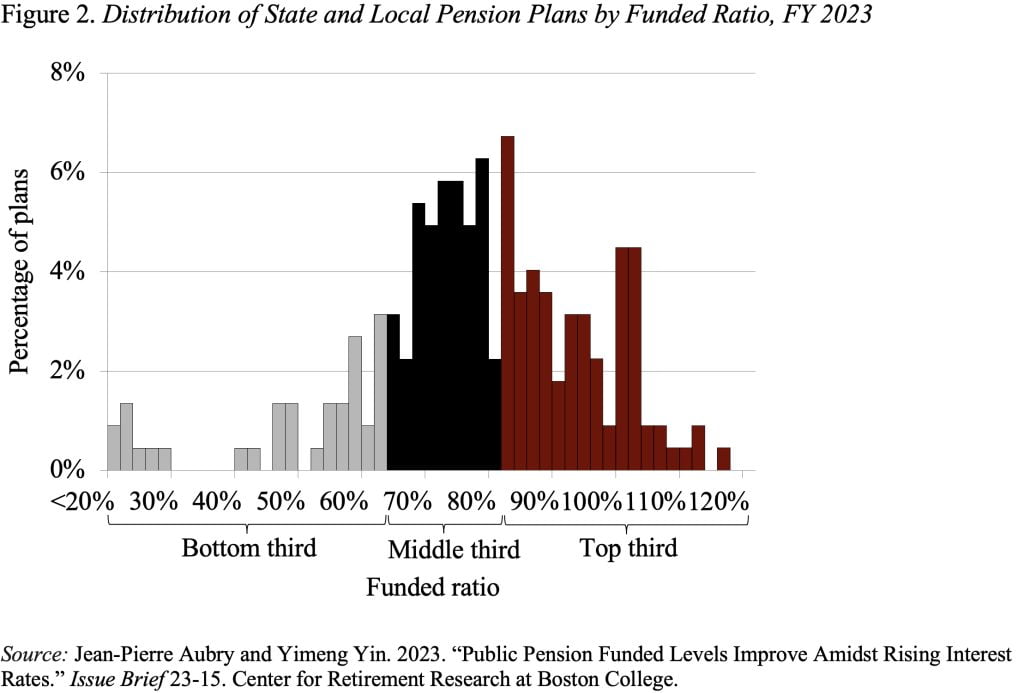

Whereas the mixture funded ratio offers a helpful measure of the general public pension panorama at massive, it can also obscure variations in funding on the plan stage. Determine 2 separates the plans into thirds primarily based on their present actuarial funded standing. The common 2023 funded ratio for every group was 57.6 p.c for the underside third, 79.5 p.c for the center third, and 91.1 p.c for the highest third.

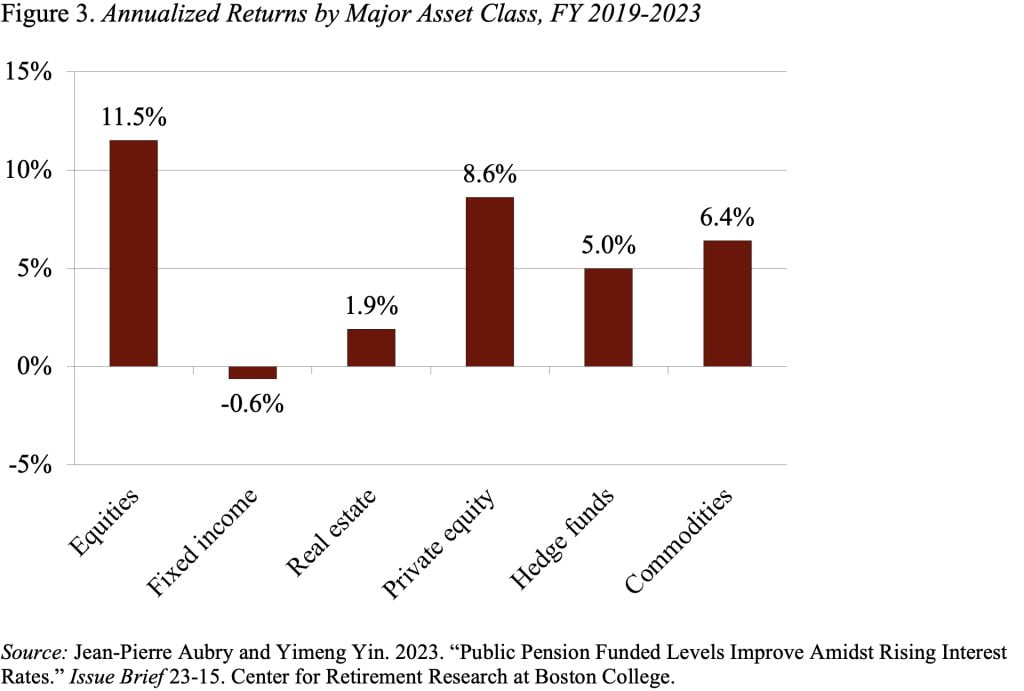

The most important motive for the advance in plans’ funded standing is that, regardless of the turbulence within the economic system, complete annualized returns, which embody curiosity and dividends, have risen noticeably for nearly all main asset class indices over the 2019-2023 interval (see Determine 3). The exception over this quick and unstable interval is fixed-income property, which have declined in worth.

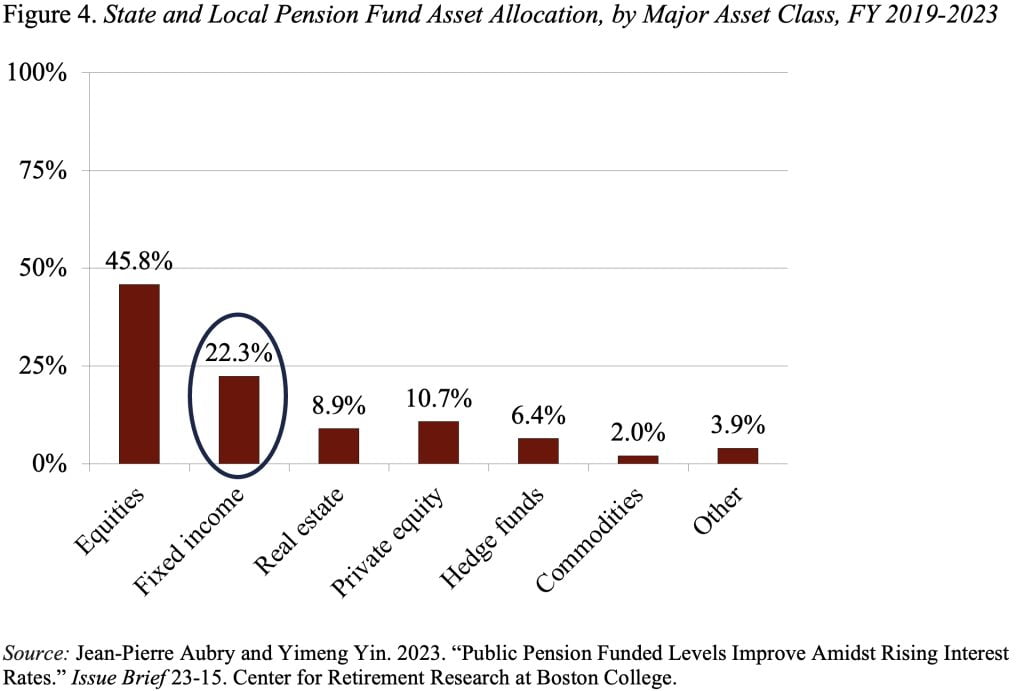

The impact of mounted revenue’s decline on general portfolio efficiency has been modest as a result of, since 2019, mounted revenue has averaged solely about 20 p.c of pension fund property (see Determine 4).

So, issues are trying somewhat higher for state and native pensions. Sure, the funded ratios are biased upward as a result of plans use the assumed return on their portfolios – roughly 7 p.c – to low cost promised advantages. That mentioned, traits are necessary, and the pattern is sweet.

Furthermore, annual state and native profit funds as a share of the economic system are approaching their peak for 2 causes. First, most pension plans don’t absolutely index retiree advantages for inflation, which lowers the true worth of advantages over time. Second, the profit reductions for brand spanking new hires – launched within the wake of the Nice Recession – have began to have an effect.

With liabilities in verify and stable asset efficiency, possibly we are able to all loosen up a bit about the way forward for the state and native pension system.