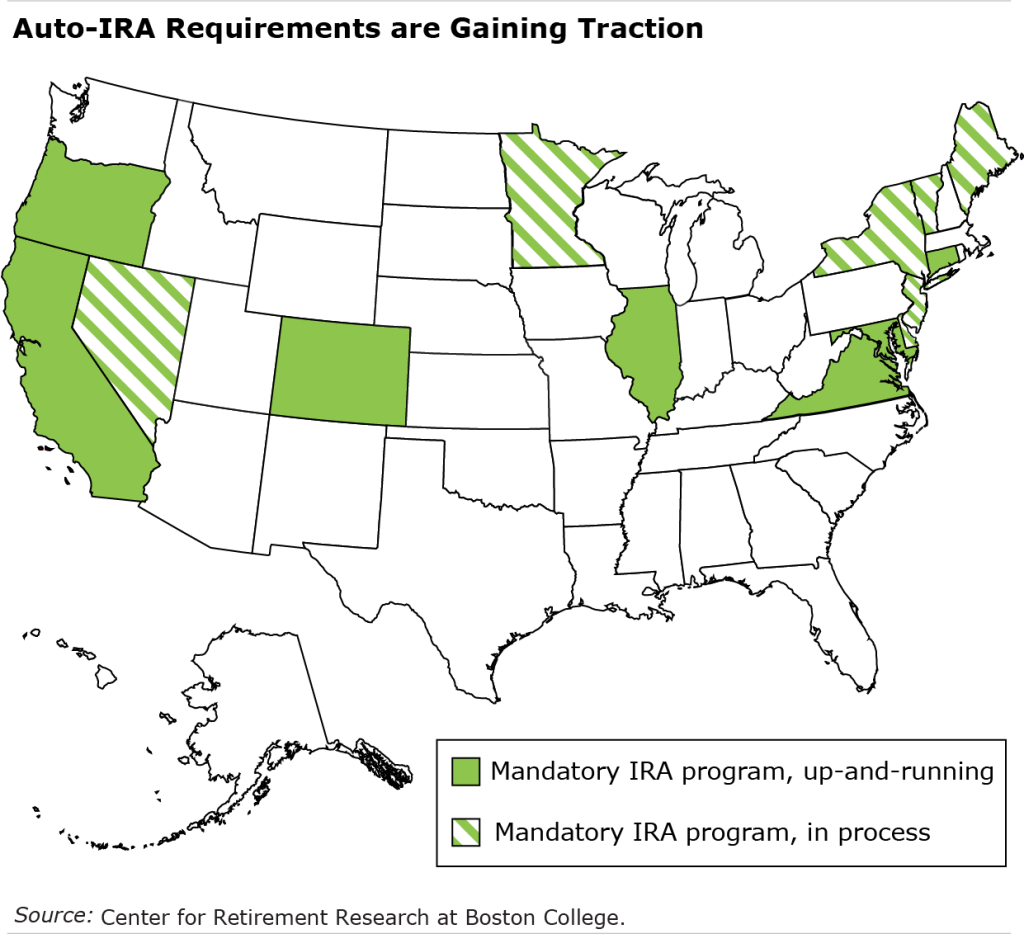

Seven states now require employers that don’t have retirement plans to mechanically enroll their staff in an IRA, and others have handed laws to create comparable packages.

The aim is to get extra individuals to save lots of for retirement at a time monetary safety in previous age more and more depends upon it. Pensions are quickly disappearing. However solely about half of working persons are presently saving sufficient to keep up their way of life after they retire.

A serious offender within the financial savings shortfall is that staff don’t persistently have entry to a retirement plan by their jobs. The share of staff with employer plans has barely budged in many years.

Details about how employers may react to the state IRA mandates continues to be rising. For instance, some employers that already had financial savings plans in place may shut them down and enroll staff within the state-created IRA as an alternative. Alternatively, the mandates is likely to be a catalyst for companies that had been interested by beginning a plan to lastly achieve this.

Researchers on the FDIC, the World Financial institution, Brown College and George Mason College used U.S. Census surveys on state residents’ conduct and the retirement plan reviews that employers file with the federal authorities to investigate the oblique influence of auto-IRAs within the three states which have had the packages up and working the longest: California, Oregon and Illinois.

They discovered constructive proof on either side – from the employee surveys and firm reviews – that extra employers are providing their very own plans in states with obligatory auto-IRAs, giving workers an opportunity to save lots of for the long run.

The packages in California, Oregon and Illinois have elevated by 3 % the chance that the residents in these states work for a agency that provides its personal retirement plan and by 33 % the chance people are saving in these employer plans.

The tendencies within the three states can’t be stretched to use to the handful of states which have established or are pursuing voluntary retirement financial savings plan packages. However the early ends in California, Oregon, and Illinois are promising, and auto-IRAs could also be an efficient strategy to develop participation in employer-based financial savings plans.

Getting staff to save lots of is, the researchers conclude, “a perform of each employer and employee selections.” And, on this examine at the least, it’s additionally a perform of necessities that employers both enroll their workers within the state’s program or arrange one on their very own.

Squared Away author Kim Blanton invitations you to observe us on Twitter @SquaredAwayBC. To remain present on our weblog, please be part of our free e mail record. You’ll obtain only one e mail every week – with hyperlinks to the 2 new posts for that week – while you enroll right here. This weblog is supported by the Heart for Retirement Analysis at Boston Faculty