The transient’s key findings are:

- Late Boomers have much less retirement wealth than earlier cohorts, together with surprisingly low 401(okay) belongings.

- To clarify this drop, the evaluation explored each altering demographics and labor market experiences.

- The outcomes present that a part of the drop is because of a decline within the share of Late Boomers who’re White, married, and have faculty levels.

- The principle issue, although, is that Late Boomers noticed a weakening within the hyperlink between work and wealth as a result of Nice Recession.

- The Nice Recession story is a bit of excellent information for youthful cohorts, as a number of the downward stress on their wealth holdings ought to abate.

Introduction

Late Boomers have surprisingly low ranges of retirement wealth in comparison with earlier cohorts. A decline in some wealth parts had been anticipated because of the rise in Social Safety’s Full Retirement Age and the shift from outlined profit to outlined contribution plans. However growing 401(okay)/IRA balances had been predicted to offset the hole, since Late Boomers had been the primary technology the place staff may have spent their entire profession coated by a 401(okay) plan. That didn’t occur: retirement wealth dropped throughout all however the high quintile. Why do Late Boomers have so little wealth? And what do the patterns indicate for Early Gen Xers and subsequent cohorts?

This transient, which relies on a current paper, makes an attempt to reply these questions utilizing the Well being and Retirement Examine (HRS) to take a look at precise patterns of wealth accumulation by cohort and the Survey of Client Funds (SCF) to collect insights on the expertise of Late Boomers over their work life. The HRS additionally serves as the premise for a decomposition train to judge the position of the varied components that depressed Late Boomer wealth.

The dialogue proceeds as follows. The primary part paperwork the decline in wealth for Late Boomers and explores whether or not variation by race and ethnicity may need contributed. The second part seems at an alternate issue that may clarify the drop in Late Boomers’ wealth – particularly, their labor market expertise within the Nice Recession. The third part makes use of a decomposition method to kind out the relative contribution of shifting demographics versus labor-market expertise in explaining the drop in wealth. The outcomes present that two components had been at play – a shift within the inhabitants in the direction of lower-wealth households and, extra importantly, a weakening of the hyperlink between work and wealth accumulation. The ultimate part concludes that to the extent that the decline in wealth is a Nice Recession story, a number of the downward stress on wealth holdings ought to abate – potential items information for youthful cohorts.

Wealth Holdings of Late Boomers

The info for calculating retirement wealth come from the HRS, a biennial longitudinal survey of American households over age 50. The measure contains wealth from three sources: 1) Social Safety; 2) outlined profit plans; and three) outlined contribution plans, similar to 401(okay)s and IRAs. The evaluation covers 5 beginning cohorts and, so as to evaluate the latest cohort to the others, the main target is on households at ages 51-56.

Social Safety wealth is the same as the anticipated current worth of advantages at age 62, discounted again to the age on the survey yr and pro-rated (primarily based on earnings) to facilitate a comparability to different wealth that the family has gathered by ages 51-56. Projected revenue from outlined profit plans can also be reworked right into a wealth measure, like Social Safety, by calculating the anticipated current worth of lifetime advantages. Outlined contribution wealth is just the self-reported account balances.

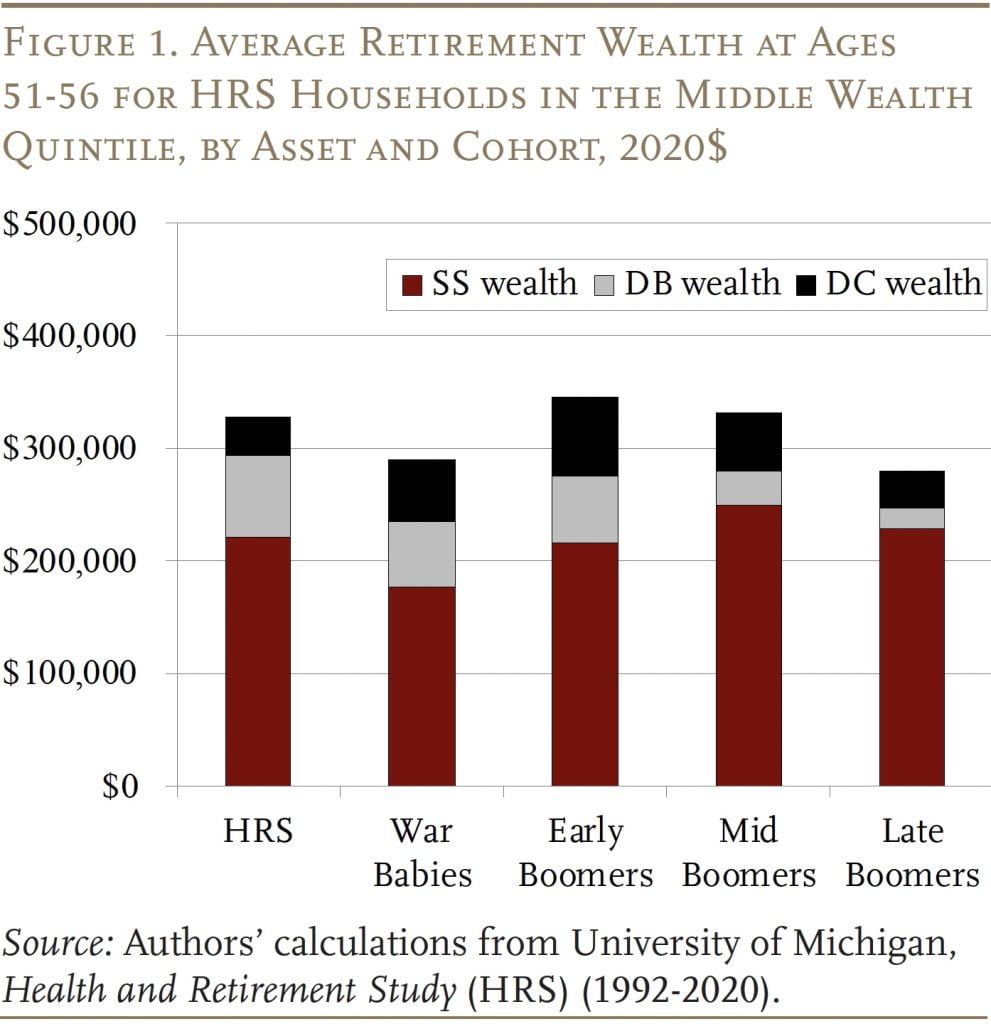

The outcomes for the center wealth quintile present that the sample of wealth holdings throughout cohorts is mostly as anticipated (see Determine 1). Outlined profit wealth declines, Social Safety wealth stays roughly fixed (because the cuts as a result of improve within the Full Retirement Age are offset by the affect of upper wages), and outlined contribution wealth will increase. That sample, nevertheless, involves an abrupt halt with the Late Boomers, when outlined contribution wealth drops sharply.

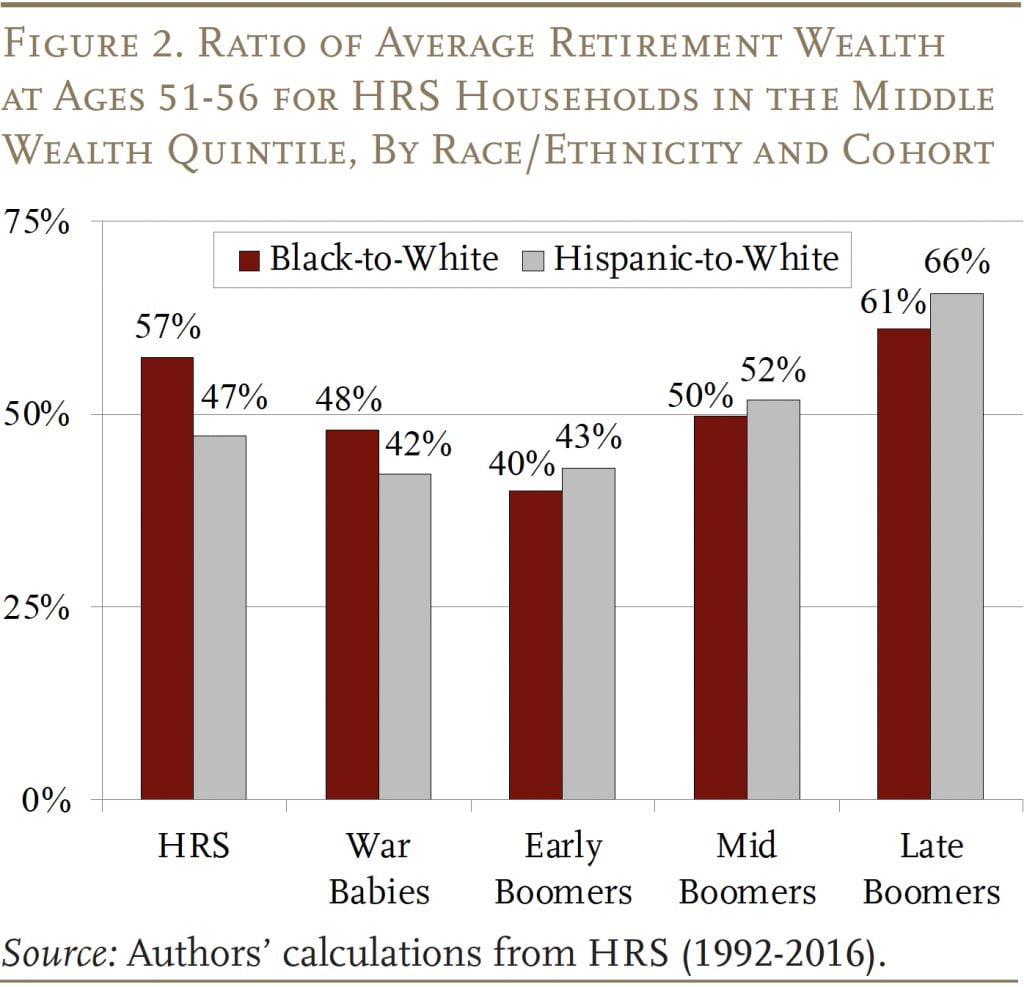

One doable clarification for the decline in retirement wealth of Late Boomers might be shifting demographics. Certainly, Black and Hispanic households within the center quintile maintain solely a fraction of the wealth of their White counterparts. Curiously, nevertheless, Late Boomers in these historically deprived teams haven’t skilled the identical decline in retirement wealth as Whites. With their Social Safety wealth holding regular and modest modifications elsewhere, retirement wealth for Black and Hispanic households relative to White households really rose from Mid Boomers to Late Boomers (see Determine 2).

The truth that the decline in wealth from Mid Boomers to Late Boomers was not pushed by a worsening scenario for Black and Hispanic households doesn’t imply that the racial composition of the inhabitants isn’t related to the decline in wealth from one cohort to the opposite. Particularly, since Black and Hispanic households nonetheless have much less wealth than their White counterparts, to the extent that non-White households improve as a share of the full, common cohort wealth will decline. The decomposition process described within the closing part makes an attempt to kind out how a lot of the decline could be attributed to demographics versus different components. The most definitely different issue is the labor market expertise of Late Boomers.

Labor Market Expertise of Late Boomers

Whereas the HRS knowledge are wonderful for retirement wealth for households ages 50 and older, they supply restricted data on what occurred to the varied cohorts earlier in life. For that, the evaluation turns to the SCF, which incorporates households of all ages, to discover whether or not the labor market expertise of Late Boomers would possibly assist clarify their low wealth holdings. The SCF, which has been carried out each three years since 1983, asks households about their revenue, wealth, and pension protection. Though the SCF doesn’t observe the identical households over time, it’s doable to assemble “artificial” cohorts from these triennial SCF surveys to get an image of employment, earnings, and wealth tendencies throughout the lifecycle.

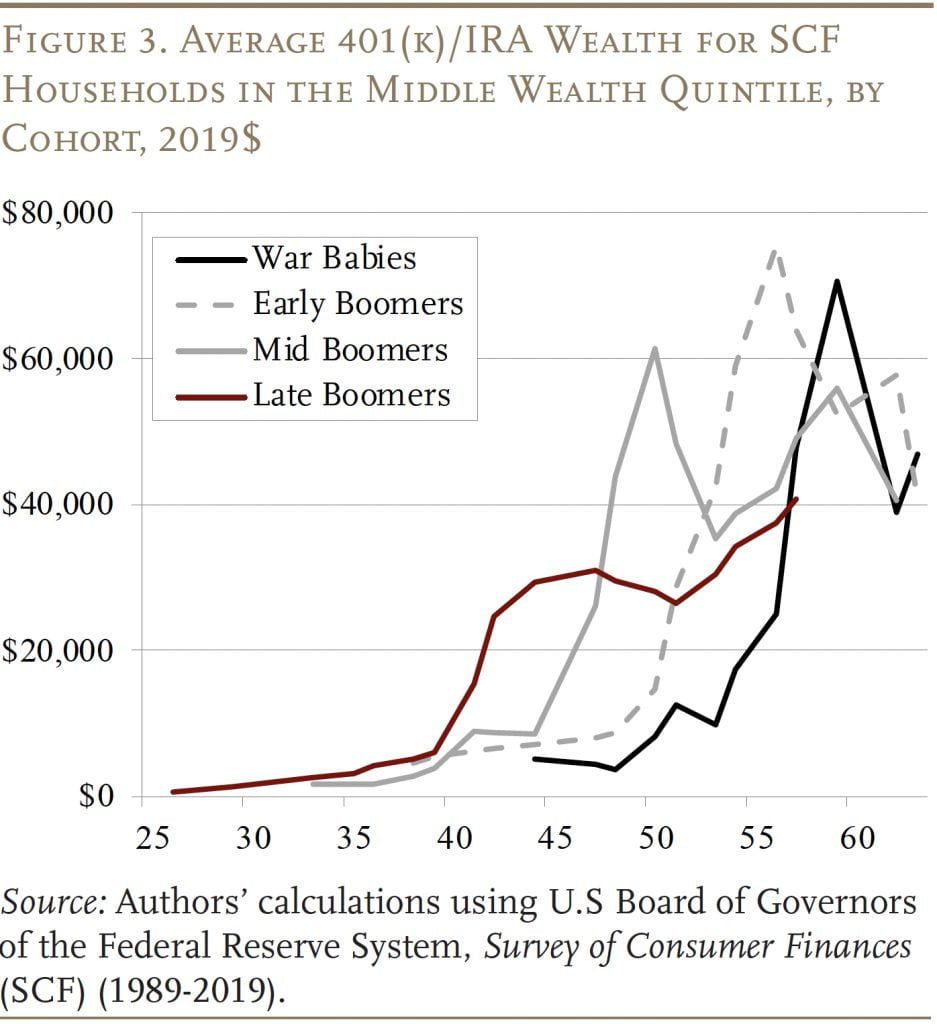

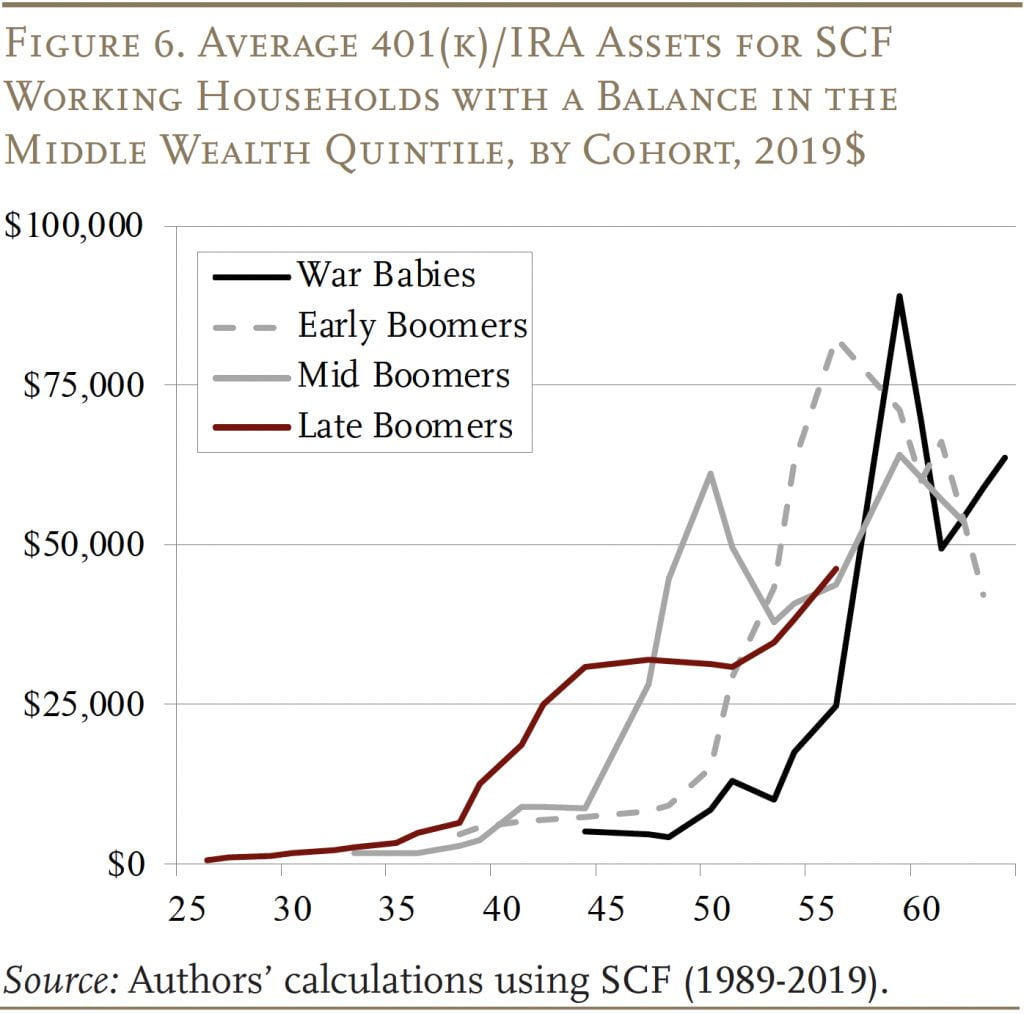

The outcomes present that Late Boomers weren’t all the time behind in non-public retirement financial savings. In truth, till their mid-40s, Late Boomers held extra 401(okay)/IRA belongings than earlier cohorts on the similar age (see Determine 3). Thereafter, nevertheless, that sample modified abruptly; development ceased and common belongings really dropped. Whereas their balances did begin to develop once more as they moved into their 50s, their holdings remained considerably under these of earlier cohorts.

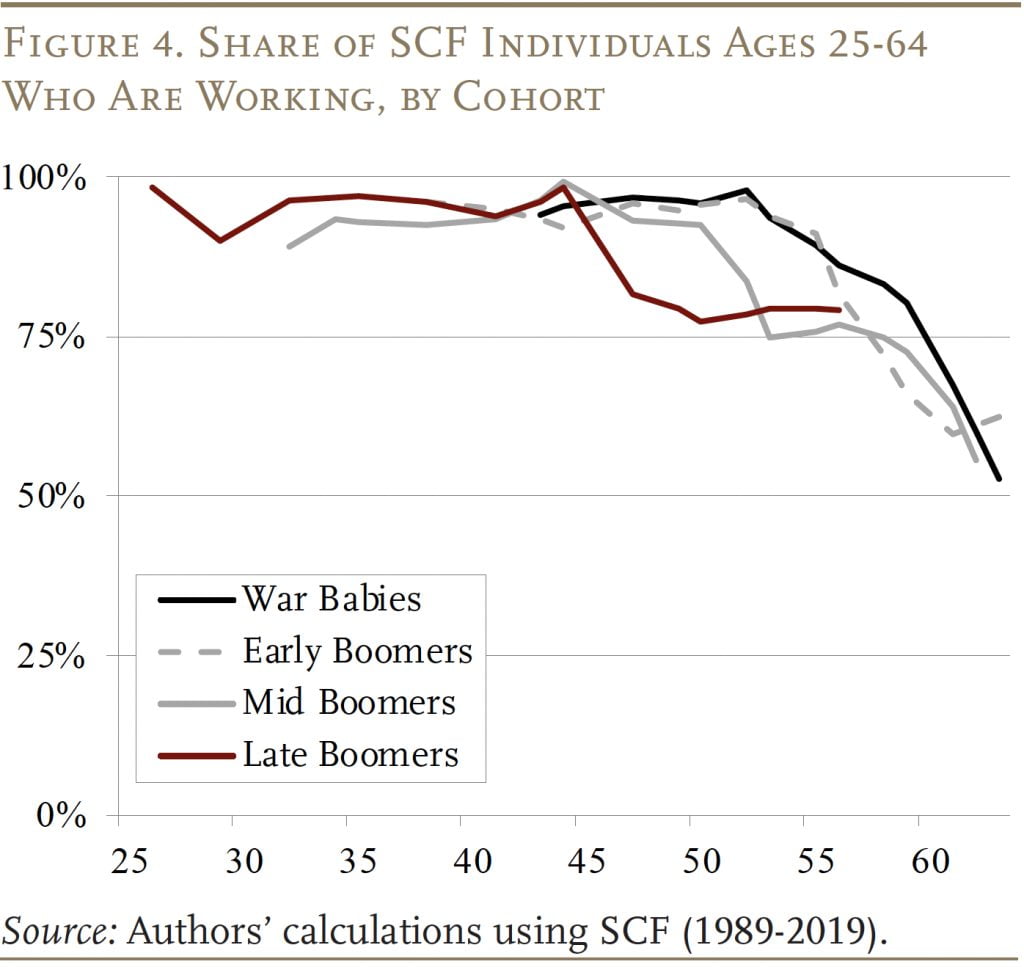

Curiously, the Late Boomers had been of their 40s throughout the Nice Recession, and this financial calamity seems to have hit them significantly arduous. Their employment fee – that’s, the proportion of people working – dropped sharply (see Determine 4). Extra importantly, the proportion of the cohort working didn’t rebound because the financial system recovered. Thus, one clarification for the low stage of retirement belongings is just that many Late Boomers ended up completely unemployed, unable to contribute to their 401(okay)s, and sure having to empty gathered retirement belongings to help themselves. However a better have a look at those that had been employed means that the injury went past the unemployed.

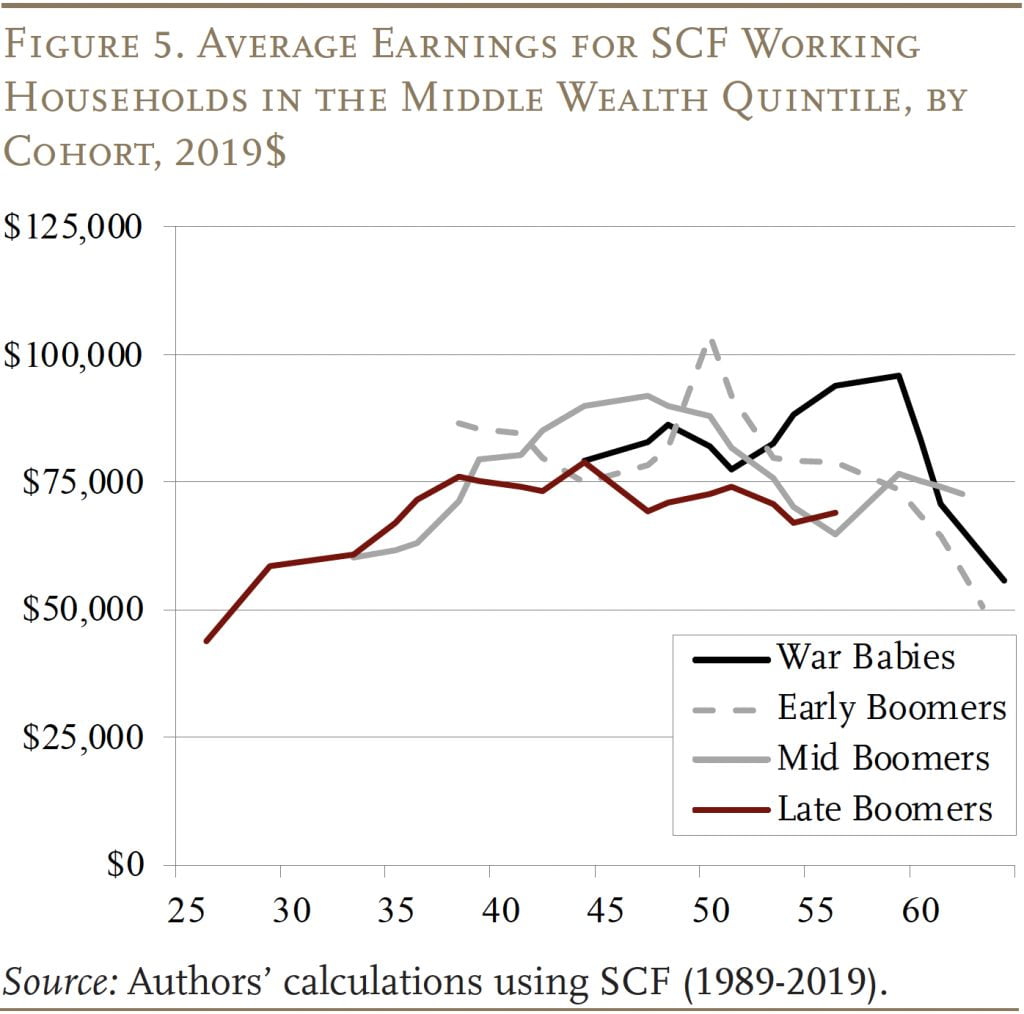

Even amongst working households, the Nice Recession seems to have taken a higher toll on Late Boomers than on earlier cohorts. When Late Boomers reached their 40s, their common earnings flattened out after which declined repeatedly thereafter, leaving them of their 50s with earnings usually effectively under these of Early and Mid Boomers (see Determine 5).

The Late Boomers’ decrease earnings had been accompanied by a decline within the share of those households collaborating in a 401(okay) plan; and even for these working households who had been collaborating, the trajectory of their 401(okay)/IRA balances modified dramatically after the Nice Recession. Whereas earlier than the financial collapse their balances exceeded these of earlier cohorts, afterwards they flattened and remained largely under these of different Boomers (see Determine 6).

Briefly, the decline in 401(okay)/IRA balances for the Late Boomers displays not solely the unemployment brought on by the Nice Recession but in addition the deterioration of labor market outcomes for individuals who stayed employed. The last word query is, how a lot of the deterioration within the retirement wealth of Late Boomers was because of their worse labor market expertise versus the shifting demographics described earlier?

Decomposing Decline from Mid to Late Boomer Wealth

The device for assessing the significance of varied components in explaining the drop in wealth from Mid Boomers to Late Boomers is a Oaxaca-Blinder decomposition evaluation. The evaluation begins by estimating an peculiar least squares regression for every cohort that hyperlinks wealth to demographic and financial variables.

Wealth = ƒ(demographic traits, financial expertise)

The demographics embody race/ethnicity, marital standing, variety of youngsters, and training. Due to knowledge constraints, the one financial variable included is share of family years labored when the top was ages 42-49 – the age of Late Boomers at first of the Nice Recession. To make sure a big sufficient pattern measurement, the equations are estimated for the center three quintiles of the wealth distribution.

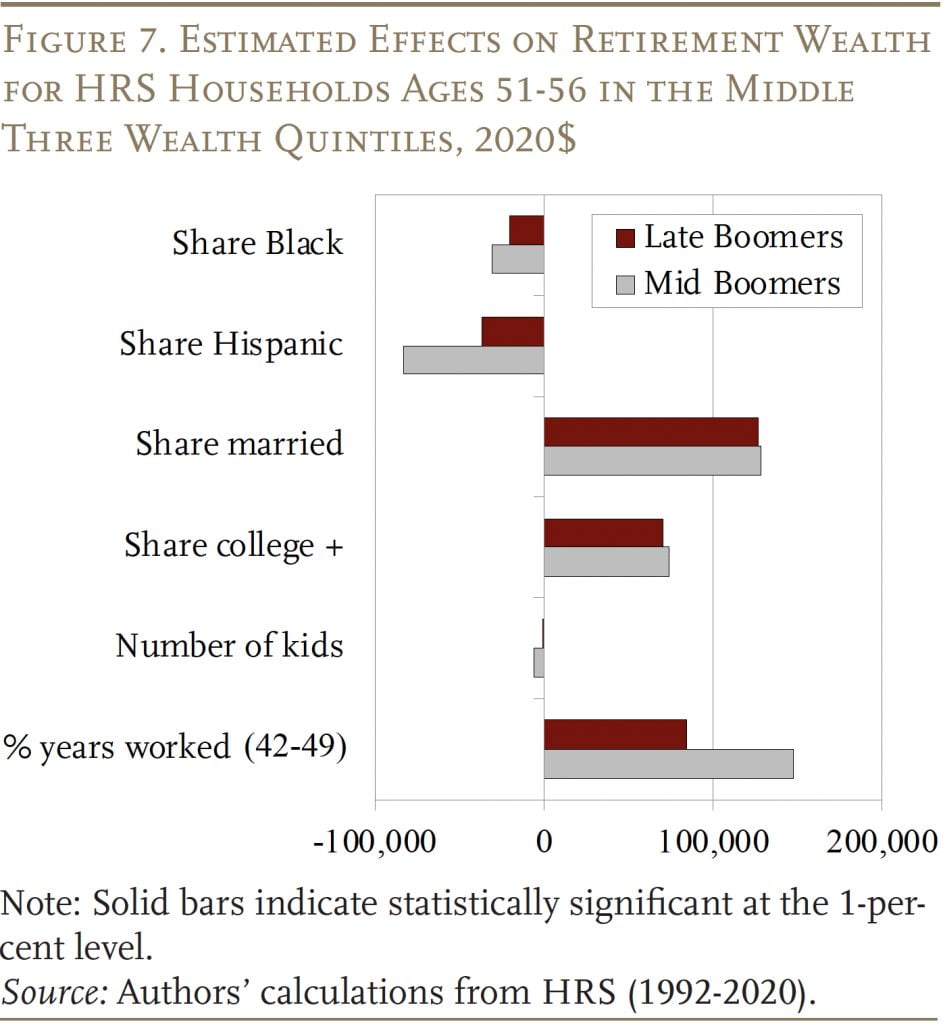

The outcomes of those regressions for Mid Boomers and Late Boomers are proven in Determine 7. The coefficients of the demographic variables – Black family, Hispanic family, married, faculty or increased, and variety of youngsters – enter the equations with the anticipated indicators and are statistically vital. The financial variable – share of family years labored when the top was ages 42-49 – additionally has a statistically vital optimistic relationship with wealth accumulation.

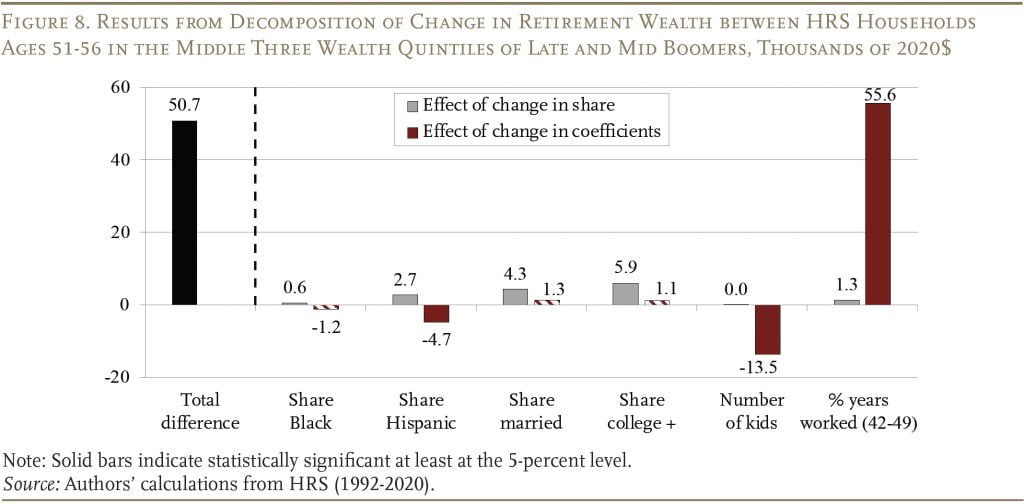

These equations represent the premise for the decomposition. Step one is to estimate Late Boomer wealth and Mid Boomer wealth primarily based on the regression outcomes, by multiplying the imply worth for every variable by the coefficient. This calculation exhibits retirement wealth for Mid Boomers is $350,400 and for Late Boomers $299,700 – a distinction of $50,700. (the black bar in Determine 8). The problem is to clarify the explanations for this distinction by trying on the affect of the shift in shares of households in every group after which the affect of shifting coefficients.

The primary a part of the decomposition holds fixed the coefficients and predicts what would have occurred if solely the shares had modified. The outcomes, proven within the grey bars, point out that the upper share of Black households amongst Late Boomers in comparison with Mid Boomers is liable for $600 of the full decline in retirement wealth for Late Boomers. For Hispanic households, the comparable quantity is $2,700. Late Boomers additionally noticed a drop within the share of households that had been married and people headed by faculty graduates – these components account for $4,300 and $5,900, respectively, of the decline of their retirement wealth. Because the variety of youngsters didn’t change very a lot between cohorts, this variable didn’t have a statistically vital coefficient. On the financial facet, as famous above, Late Boomers labored lower than Mid Boomers once they had been ages 42-49; this discount in work ends in $1,300 {dollars} much less in retirement wealth. In all, the change within the demographic traits and work exercise between Mid to Late Boomers explains $14,800 of the decline in retirement wealth, or 29 p.c of the full decline.

The second a part of the decomposition assumes that the shares of every variable are fastened on the Mid-Boomer stage and predicts what would have occurred to retirement wealth if the coefficients modified. The outcomes, proven within the purple bars, point out that an important think about the entire evaluation is the change within the coefficient for the proportion of family years labored amongst these with a head ages 42-49. Particularly, this hyperlink between work and wealth accumulation declined considerably for Late Boomers, in comparison with Mid Boomers, lowering their retirement wealth by $55,600 extra.

Two different smaller results had been additionally evident. The primary pertained to the share of households with a Hispanic head. The outcomes point out that the wealth accumulation prospects for Hispanic households improved between these two cohorts, leading to a rise in wealth for Late Boomer households of $4,700. The second is the variety of youngsters. The outcomes present that the destructive impact of youngsters on wealth was diminished for Late Boomers, making their retirement wealth $13,500 increased in comparison with Center Boomers. One doable clarification for this anomalous consequence could also be that scholar loans grew to become a socially acceptable solution to pay for school, permitting dad and mom to avoid wasting extra for retirement.

The underside line for these outcomes is twofold. First, the decomposition evaluation brings house the truth that one can’t have a look at the tendencies in common wealth by households with out contemplating the demographics. And so long as non-White households earn much less, inherit much less, and due to this fact accumulate much less belongings than White households, any improve of their share of the full inhabitants will convey down any measure of common wealth. Equally, even when whole wealth had been growing, the shift from married to single-person households would produce a decline in common family wealth. And if the proportion of households with a school diploma declines, so will wealth accumulation. All these issues occurred between the Mid Boomers and the Late Boomers.

Second, the weakened hyperlink between work and wealth is absolutely in step with the “artificial” cohort evaluation from the SCF, mentioned earlier, which confirmed that even Late Boomers who had a job after the Nice Recession earned much less, had been much less more likely to take part in a 401(okay) plan, and gathered fewer belongings in these plans. Work, for these center quintiles of Late Boomers, merely didn’t produce the increase to wealth accumulation that it had for earlier cohorts, and this altering relationship was the one most essential issue. A Nice Recession story is sweet information for future cohorts.

Conclusion

Late Boomers have considerably much less wealth than earlier cohorts. The query is why. A Oaxaca-Blinder decomposition suggests two components had been at play – a change within the composition of households and a weakening for Late Boomers of the hyperlink between work and wealth accumulation.

This isn’t a story of the deteriorating standing of Black and Hispanic households; certainly, the wealth of non-White households has elevated relative to their White counterparts. However Black and Hispanic households have much less wealth than White households, so once they improve as a share of the full inhabitants, common cohort wealth will decline. Equally, a decline within the share of households married or with a school diploma will convey down the typical. These altering demographics, together with a decline in work exercise, accounted for 29 p.c of the full decline.

The remainder was attributable to shifting coefficients – an important of which was the weakened hyperlink between work and wealth. This discovering is probably excellent news for the wealth holdings of future generations. Whereas the demographic/training shifts will proceed to convey down the typical, these components weren’t the most important supply of the decline. The large change was the weakening of the hyperlink between work and wealth accumulation for the Late Boomers who had been of their 40s throughout the Nice Recession and by no means recovered. To the extent that the decline in wealth is a Nice Recession story, a number of the downward stress on wealth holdings ought to abate.

References

Chen, Anqi, Alicia H. Munnell, and Laura D. Quinby. 2023. “Why Do Late Boomers Have So Little Retirement Wealth and How Will Early Gen-Xers Fare?” Working Paper 2023-6. Chestnut Hill, MA: Middle for Retirement Analysis at Boston Faculty.

Well being and Retirement Examine. 1992-2022. “RAND HRS Longitudinal File 2018 V2 Public Use Dataset.” Produced and Distributed by the College of Michigan with funding from the Nationwide Institute on Getting older (Grant Quantity NIA U01AG009740). Ann Arbor, MI.

U.S. Board of Governors of the Federal Reserve System. Survey of Client Funds, 1989-2019. Washington, DC.