Supply: The Faculty Investor

Why Does It Seem That BlackRock Owns All the things?

This query is about ETFs.

There’s been loads of rumors and conspiracy theories floating round that BlackRock (NYSE: BLK), a big funding agency, owns a big a part of the world we all know. However someway, it is all carried out in a shadowy manner. And BlackRock usually will get lumped in with different corporations like Vanguard, State Road, and others.

Whereas these corporations won’t have kitchen desk identify recognition, the rationale their identify exhibits up on firm possession stories so typically is for a easy purpose: these corporations all handle mutual funds and ETFs that personal these corporations’ shares.

BlackRock manages a staggering $10.47 trillion in belongings as of Q1 2024. With that a lot in belongings, does BlackRock actually personal all the things? The brief reply isn’t any. However let’s dive into why and the place this conspiracy is coming from.

BlackRock Owns All the things Conspiracy

There are a lot of movies throughout social media which are sharing how, if you have a look at each firm within the inventory market, BlackRock appears to come back up as one of many largest house owners.

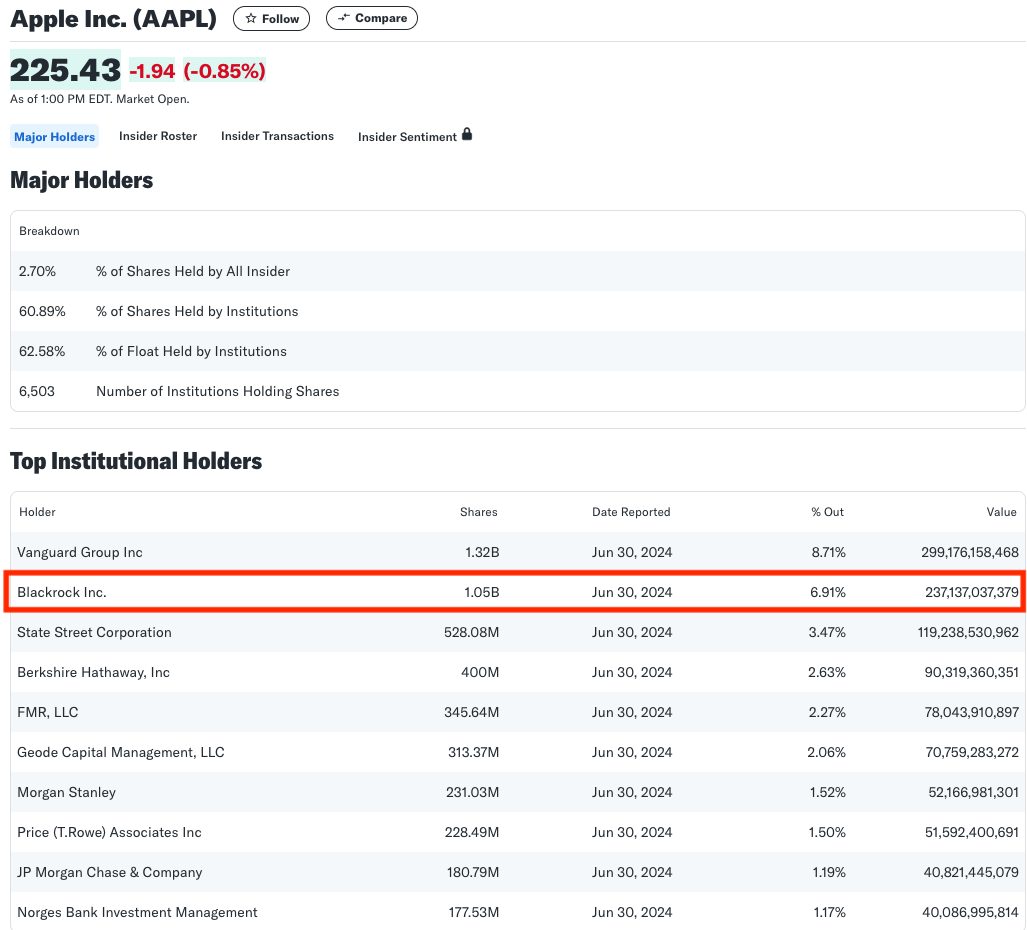

For instance, for those who have a look at the Apple (NSQ: AAPL) possession report, you will see that BlackRock is the second-largest proprietor of Apple Inventory, proudly owning 6.91% of the complete firm, price $237 billion.

Apple Possession Report as of June 30, 2024. Supply: Yahoo! Finance

These stories have been highlighted in movies, like this one which has over 5.5 million views on TikTok:

Debunking The Fantasy

At its core, BlackRock is tasked with managing wealth on behalf of institutional buyers, governments, and people. Regardless of the huge dimension of its steadiness sheet, direct fairness investments made by BlackRock itself make up a comparatively small portion of its operations. As a substitute, its funds maintain vital stakes in massive firms, however these investments are tied to the purchasers who personal the funds.

For instance, BlackRock’s iShares S&P 500 ETF is the third-largest ETF on the earth by belongings. This single ETF makes up about 5% of BlackRock’s whole belongings.

Largest ETFs within the World as of Sept. 25, 2024. Supply: VettaFI

Nonetheless, as an asset supervisor, BlackRock would not “personal” the underlying belongings. The shareholders of the ETFs do. BlackRock is solely a steward for his or her shopper’s investments. They don’t seem to be the true house owners of the belongings.

And if you begin trying on the possession stories of those ETFs, the image adjustments fairly a bit. The possession of those ETFs (and mutual funds) may be very unfold out amongst smaller funding advisors, retirement accounts, and people.

As a result of, on the finish of the day, every proprietor of the ETF really owns their tiny fraction of the underlying investments.

Even in non-publicly traded investments, like actual property, BlackRock is solely the custodian for his or her buyers – whether or not buying actual property, issuing or shopping for debt, and extra.

So, on the finish of the day, no, BlackRock doesn’t personal all the things. Nonetheless, since BlackRock is a big asset supervisor and supervisor of big ETFs (which are required to put money into the underlying index of shares), their identify exhibits up as an proprietor throughout many of the publicly traded corporations on the earth.