The dreaded bank card reconciliation needn’t be such a giant deal if we bite-size it.

NB: That is an article from

That’s what this piece is all about: How and why it is best to steadiness your lodge bank cards every day. That’s proper – every single day – and I imply it’s essential to know the playing cards are balanced to 3 separate and related factors.

Subscribe to our weekly e-newsletter and keep updated

Initially, simply to correctly date myself and reminisce just a bit, I can keep in mind mailing off the backs of the cardboard imprints every day.

I used to be working on the entrance desk, and we’d separate the imprints by sort and run a tape to steadiness to our entrance workplace Micros posting terminal. OMG, are you able to think about? Then they went within the mail, and I assume somebody downstairs in accounting picked up the quantity for that day after which waited for the fee and the financial institution assertion that additionally arrived within the mail in all probability two weeks later. Look how far now we have come! So to talk.

That guide course of was eradicated by the arrival of the swiping terminal and as we speak it’s often a handheld or separate gadget that gathers the cardboard knowledge or it’d even be interfaced along with your property administration system or level of sale system.

This card knowledge you’ve simply collected is compiled with all different comparable swipes and on the finish of the day they’re “batched up” and transmitted to the bank card processors. Then the info is distributed to the financial institution, and in flip again to you as money (much less the commissions) deposited on to your checking account. All this passing round creates plenty of alternatives for errors.

To steadiness these card transactions, it’s essential to “compartmentalize” the totals at every level of the journey.

The primary cease is the PMS or POS relying on which system you might be working with. The tip-of-day course of could have the revenue auditor balancing your complete income, tax and settlements, plus or minus the modifications within the ledgers.

As soon as that is accomplished, be certain the numbers you’ve on the terminals you might be utilizing – these gadgets and their “every day batch complete” – are equal to the penny the identical quantity because the PMS/POS. They often do, however not at all times. If they don’t match up cease proper there, discover out why and right the errors.

Now you might be able to transmit your batch and there’s yet another essential step to make sure you steadiness: be certain the identical quantity hits your checking account a number of days later. When it arrives in your checking account it will be much less the bank card fee, so it’s essential to acknowledge this and account for the distinction.

In the long run, you’ve a three-way match much less the commissions. PMS/POS, then on to the terminal batch worth and at last the checking account. It might sound simple however there are some frequent points that make it nearly not possible except you do that every day. Issues like timing – the processors are separate out of your financial institution – and issues don’t at all times line up the best way they had been despatched. There will also be playing cards which can be rejected and alter backs that get included with the transmission totals, to not point out the commissions that get deducted often every day – however not at all times!

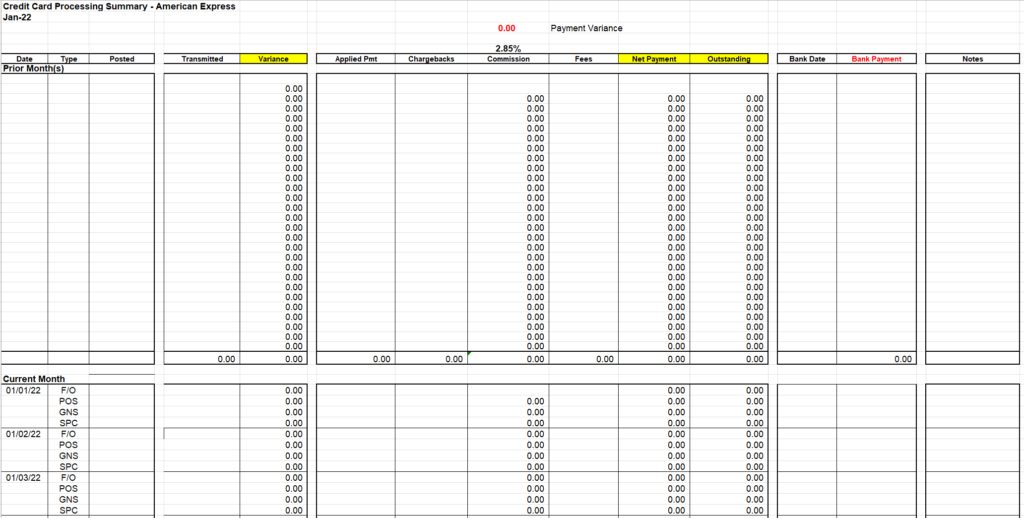

Feels like a headache and you haven’t even began but! So, right here is the answer and once more I can’t stress this sufficient the primary, second and last ingredient within the formulation is “every day.” Here’s what your spreadsheet ought to appear to be:

Word on the backside of the sheet there’s an space to enter the separate quantities from the PMS, POS, then the golf operation and at last the spa. More often than not these are all separate batches. Very often the ultimate funds from the financial institution are lumped collectively so having a course of the place you’ll be able to determine the quantity at every step of the journey is essential.

Some last notes

- Do that every day

- Seize separate totals from every system that has its personal termina

- Be certain that every card sort is right, e.g., a Visa could also be posted as a MasterCard

- Instantly analysis and code any chargebacks or every day variances

- Seize the proper fee and guide it individually

- Comply with the transaction through to the checking account

You will have a separate tab in your spreadsheet for every card sort together with debit playing cards.

It might sound daunting and that’s as a result of most individuals do it month-to-month or possibly weekly.

Don’t make this error, do it every single day. This manner you’ll be able to keep on high of it.